Easing of bond market issuance as yields rise

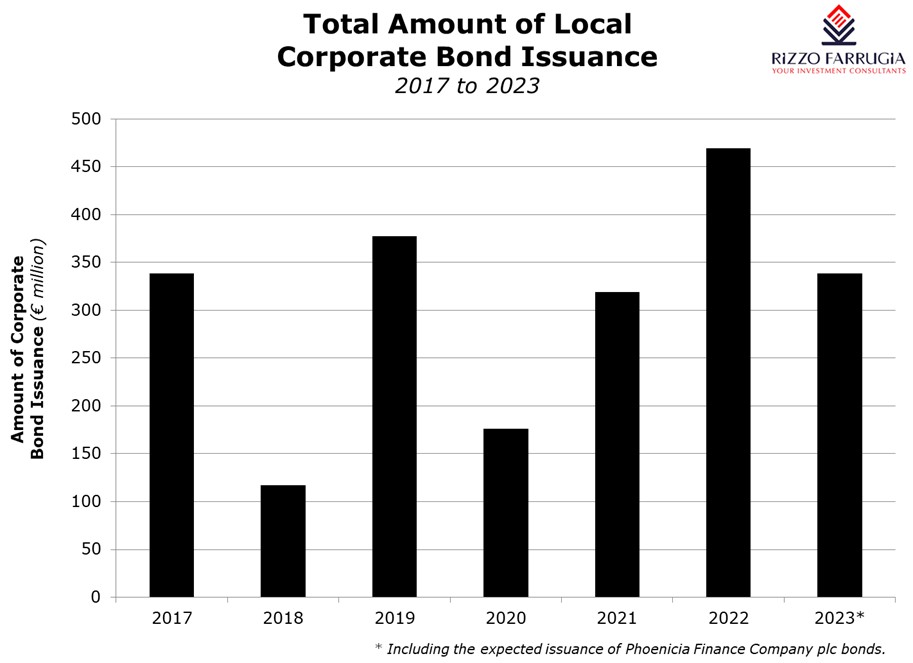

The amount of corporate bonds issued on the Regulated Main Market of the Malta Stock Exchange declined during 2023 from the record issuance of circa €470 million during 2022.

This ought to have been expected as a result of the steep rise in interest rates by the European Central Bank during the first half of the year with the deposit facility climbing from 2% at the end of 2022 (it had been at minus 0.5% until July 2022) to 3.5% by the end of June 2023. In fact, total corporate bond issuance during the first half of 2023 was of only €101.6 million with a notable pick-up during the past 6 months arising from sizeable bond issues by APS Bank plc, AX Group plc and International Hotel Investments plc with another large bond issue expected to be imminently launched by Phoenicia Finance Company plc.

While there were 20 bond issues approved by the MFSA during 2022, these declined to 12 this year assuming the Phoenicia bond is approved by year-end. Half of these issuers (APS Bank, AX Group, IHI, JD Capital, MIH and Phoenicia) already had bonds previously listed on the Regulated Main Market. Five issuers (Bonnici Bros. Properties plc, Juel Group plc, ClearFlowPlus plc, Plan Group plc and GPH Malta Finance plc) are new additions to the corporate bond market in 2023. Meanwhile, AST Group plc can also be classified as a newcomer to the Regulated Main Market of the Malta Stock Exchange although the company had previously issued debt via Prospects MTF.

Among the newcomers, it is worth highlighting that the ClearFlowPlus bond promoted by the Water Services Corporation was the first (and so far only) security admitted to the Green Bond List. Although the MFSA had approved the Malta Stock Exchange bye-laws for the green bond market in February 2021, the only listing to date remains a Government-controlled entity. In view of the increased importance of sustainable finance, various fiscal incentives are clearly required to instigate privately-owned companies to consider the benefits of utilising the green bond market for their financing requirements following the weak appetite evident so far in this important area.

The size of Malta’s corporate bond market has now reached almost €2.6 billion. The 6 largest issuers with total bonds in issue of at least €100 million account for 46% of the overall market totalling €1.2 billion. The Corinthia Group (incorporating International Hotel Investments plc, CPHCL Finance plc and Mediterranean Investment Holdings plc) remains the largest issuer with total bond issuance of €400 million followed by the Hili Ventures Group (incorporating 1923 Investments plc, Hili Finance Company plc, Premier Capital plc and Hili Properties plc) with total bond issuance of €308 million.

Bank of Valletta plc is the third largest issuer with total bond issuance of €161.6 million. However, it is worth highlighting the issuance by BOV of €350 million callable senior non-preferred notes on the Irish Stock Exchange in early December 2022 with just over half this sizeable amount allocated to investors based in Malta. As such, the actual amount of debt issuance by Malta’s largest bank is much larger than the figure indicated above when taking this amount into consideration. The three other notable issuers in Malta are AX Group plc (incorporating AX Real Estate plc), APS Bank plc and the GO Group (incorporating its subsidiary Cablenet Communications Systems plc).

An important development that emerged during the year was the issuance of a number of debt instruments which are not listed on the MSE. Details of these ‘unlisted bonds’ were publicised since all these companies already had instruments listed on the Regulated Main Market of the MSE. There were 5 issues of unlisted bonds in 2023 totalling just below €21 million excluding the most recent announcement by JD Capital plc of another imminent bond of €5 million.

Since these companies issued the details of their private offerings through the MSE site as a company announcement, many investors questioned the rationale for carrying out issues of such unlisted bonds by highlighting the fact that one of the main benefits of the corporate bond market is the transferability of the bonds before maturity date via the secondary market of the MSE. Moreover, these announcements ought to have attracted the attention of a number of investors due to the interest rates of above 7% from each of the last three issuers namely Endo Finance plc, Von der Heyden Group and JD Capital plc.

One of the primary determinants of the size of new issuance next year will be the interest rate environment. Interest rate cuts by the major central banks during the course of 2024 could instigate additional corporate bond issuance during the year. In fact, bond yields have already declined significantly over recent weeks in anticipation of this possible monetary policy easing as from Q2 2024.

Corporate bond issuance is also dependent on the amounts of bonds maturing in any calendar year. Three issuers with bond maturities in 2024 (AX Group, IHI and Mariner Finance) have already refinanced their upcoming redemptions and will therefore repay the outstanding amounts of the old bonds which amount to just under €40 million. Meanwhile, other notable bond redemptions during 2024 are those of Tumas Investments plc (€25 million in July), Hal Mann Vella Group plc (€30 million in November) and 1923 Investments plc (€36 million in December). The decisions by each of these companies on their method of refinancing or repayments to bondholders would be expected well in advance of the actual maturity date.

Although the corporate bond market has grown remarkably over recent years with over €1.6 billion in issuance since 2019, there is a clear opportunity to accelerate this growth in future years given the sheer amount of liquidity across the financial system. Many retail and high net worth investors continue to seek fixed income securities for their investment portfolios since deposit rates at Malta’s two largest banks remain close to zero. This excessive amount of idle liquidity within the financial system could be very beneficial given the sizeable investments required in the area of sustainable finance apart from the elevated funding requirements by the Government of Malta to fund its ongoing budget deficit and the annual MGS redemptions in the coming years.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.