Equity markets plunge in Q1

Most investors have probably had an overdose of articles and reports hitting their screens explaining the dismal performance of equity markets over recent weeks. However, when deciding about the topic for this week’s article, I thought it would still be important to try to provide a brief overview of the more important events that led to the fastest bear market in history.

International equity markets had a positive start to the New Year continuing on their bull market phase which had started in March 2009. In fact, US equities rallied strongly in the first half of January with the S&P 500 hitting a new record high in the middle of the month after the US and China signed ‘phase one’ of a trade deal. In the second half of January, however, mounting fears over the spread of the coronavirus in China and beyond erased the gains with the main indices in the US ending the month flat.

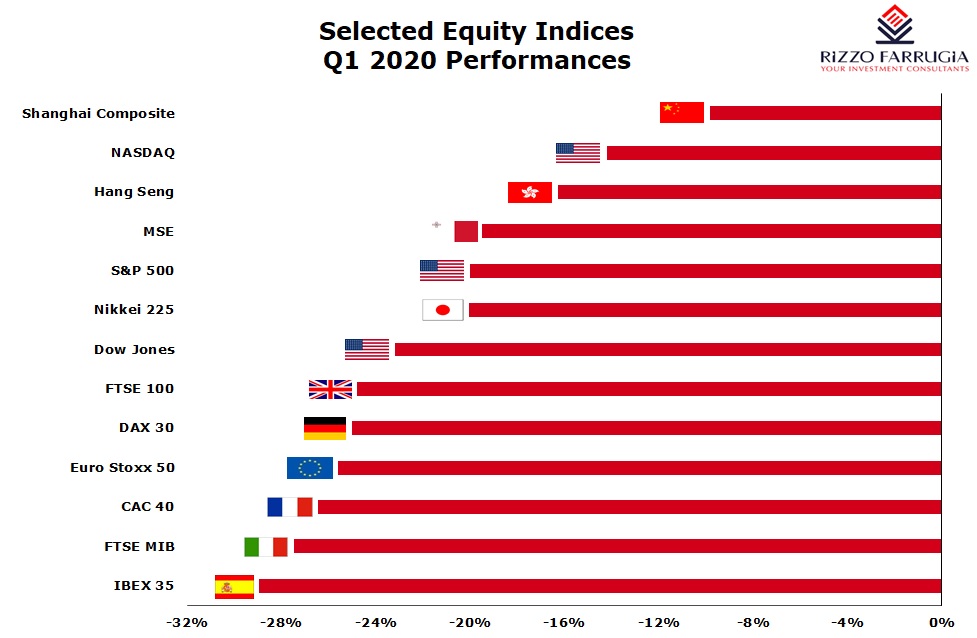

The S&P 500 Index touched a fresh record high in early February following robust economic data and President Trump’s acquittal in the final impeachment vote. However, as many of the world’s biggest economies went into lockdown as a result of the ‘Covid-19’ outbreak, investor confidence was shattered and the S&P 500 index in the US suffered its quickest fall into a bear market on record. The index took just 16 days to slump from all-time highs to bear market territory (a drop of 20%) easily surpassing the previous record of the quickest fall into a bear market that was set in 1929 at 44 days. The S&P 500 index ended the quarter with a decline of 20% – the weakest quarter since the financial crisis.

Apart from the concerns regarding the spread of the ‘Covid-19’, another determining factor was the sharp decline in the oil price to its lowest level in 18 years. Oil was impacted by the dual shock of the largest drop in demand in history as the coronavirus cut consumption and a surge in supply following the start of a price war between Saudi Arabia and Russia.

Volatility across most equity markets was very high in the latter part of the quarter. However, as governments and central banks put together significant packages to offset some of the large negative economic effects of the virus, investor sentiment improved and equity markets recovered from their lows. In fact, US equities advanced by almost 18% from their lowest levels of the year on 23 March 2020. Despite the recovery, the Dow Jones Industrial Average shed 23.2% throughout Q1 – its steepest first quarter decline on record.

The House of Representatives in the US approved a USD2.2 trillion stimulus bill to offset the economic destruction of the ‘Covid-19’ pandemic which was signed into law by President Donald Trump. The Federal Reserve cut US interest rates to close to zero and later unveiled a variety of programs to combat the impact of the coronavirus including a ‘Commercial Paper Funding Facility’, a ‘Primary Dealer Credit Facility’, a ‘Money Market Mutual Fund Liquidity Facility’, a ‘Primary Market Corporate Credit Facility’, a ‘Secondary Market Corporate Credit Facility’ and a ‘Term Asset-Backed Securities Loan Facility’. In particular, , and for the first time ever, the Fed also intervened in the corporate bond market through the ‘Secondary Market Corporate Credit Facility’ which essentially is a mechanism for the purchase in the secondary market of corporate bonds issued by investment grade US companies and US-listed exchange-traded funds whose investment objective is to provide a broad exposure to the market for US investment grade corporate bonds.

In Europe, the European Central Bank continued to ramp up its response with President Christine Lagarde stating that there are “no limits” to its commitment to the euro. The pan-European STOXX 600 index registered its worst quarter since 2002 with a decline of 23%. The worst performing markets were Italy and Spain as both countries suffered the highest number of deaths from the pandemic.

In the UK, the FTSE 100 dropped by almost 25% – its worst quarter since the 1980’s. Ironically, the Chinese Shanghai composite was the best performing index with a decline of only 9.8%.

In Malta, a total of 16 equities suffered double digit declines with International Hotel Investments plc ranking as the weakest performer with a drop of just over 35%. The benchmark MSE Equity Price Index ended the quarter with a decline of just under 20%. The share price of Malta International Airport plc dropped by 28% in Q1 after it had registered a drop of just over 49% before staging a remarkable recovery from the low of €3.50 on 23 March 2020 (coinciding with the low in US stocks).

In the quarterly market reviews published in the past, I generally concluded by giving a brief outlook on expected developments in the following months. This time, it is naturally too hard to do the same given the extraordinary circumstances we are facing and the huge amount of uncertainty on when some form of ‘normality’ returns and certain businesses can restart operations. The second quarter of the year is generally an exciting time for the Maltese investing public as the annual reporting season reaches a climax with companies publishing their financial statements and most declaring dividends. Moreover, it is also a time when Annual General Meetings take place, giving investors an opportunity to gain a deeper understanding on the business strategy of a company and also give space for some social gathering while nibbling on the famous Maltese ‘pastizzi’. Unfortunately, this year’s annual reporting season is clouded and overshadowed with the ongoing impact of the ‘Covid-19’ and irrespective of the successful financial performance of several companies in 2019, the focus is very much on the manner in which the virus is affecting a company’s current performance and the near-term outlook. Similar to developments overseas, many companies are postponing their dividends in order to retain as much cash as possible given the uncertainties on when certain business lines can resume. Annual General Meetings have also been postponed due to restrictions by health authorities. For the first time ever, some Maltese companies may need to resort to organising their annual shareholder meetings remotely causing added hurdles for those investors who are less IT savvy.

Many people are understandably very anxious due to the impact of the ‘Covid-19’ on their daily lives and the concerns about contracting the virus especially those classified as most vulnerable. The dismal performance of equity markets, the uncertainty being created by the very challenging times and the postponement of dividend payments, which are important sources of income for many investors, adds to the overall level of anxiety being faced. It is therefore natural that this leads to panic selling at times. However, while listening in to a conference call recently organised by an experienced international fund manager, it was argued that recessions are the best times for long-term investors as in such times markets tend to overreact bringing about good opportunities.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.