Euro stages strong recovery against US Dollar

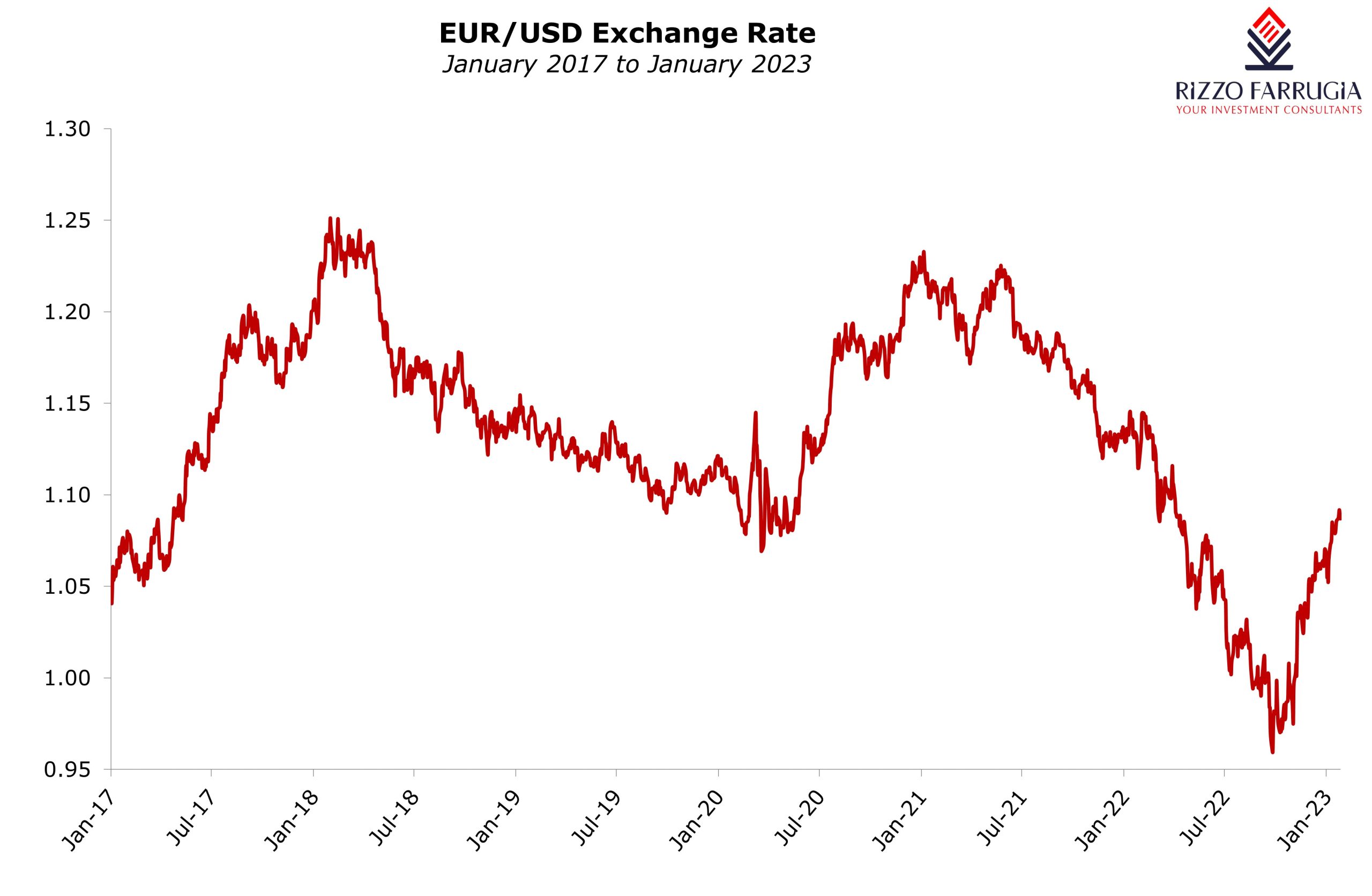

One of the main highlights across financial markets last year was the extent of the strength of the US Dollar against most currencies. For Maltese investors with investments across the global capital markets, the EUR vs USD exchange rate is an important currency to monitor since this impacts the overall performance of an investment portfolio with direct exposure to the US stockmarket.

During the course of 2022, the US Dollar gained 5.5% against the EUR to a year-end value of USD1.07. The US Dollar had appreciated to a level below USD0.96 at the end of September 2022 as the spike in inflation rates to multi-decade highs forced the Federal Reserve to embark on the most aggressive monetary policy tightening in its history. In fact, the Federal Reserve raised rates by 75 basis points four times in 2022, 50 basis points twice and 25 once (in March 2022). In total, the Federal Funds rate shot up from 0.125% at the start of the year to 4.375%.

On its part, the European Central Bank (ECB) began its current rate hike cycle in July 2022 when it increased rates by 50 basis points bringing rates out of negative territory for the first time since 2014. It then followed with 75 basis points hikes in both September and October and a further 50 basis point rate rise in December. The speed of the current rate hike cycle in the eurozone is the fastest since the ECB came into existence in 1999.

The delayed action by the ECB compared to the Fed was one of the reasons for the strong appreciation of the US Dollar against the euro. This was also amplified by the shutdown of the key gas pipeline Nordstream 1 over the summer which fuelled fears that the euro region would struggle to replace Russian energy sources and led to a surge in gas prices.

However, the very mild weather conditions between October and December resulted in low energy usage by both households and factories thereby reducing the risk of energy rationing. Furthermore, the extra fiscal support from various European governments to counteract the energy crisis coupled with the reopening of the world’s second-largest economy (China) led many investment banks to change their stance on the eurozone prospects. It was widely reported over recent weeks that the US major investment bank Goldman Sachs no longer expects a recession across the euro zone in 2023 as they lifted their GDP forecast for the single-currency region to +0.6% from their previous forecast of -0.1%.

Likewise, last week Deutsche Bank revised its forecast for European growth upwards, from expectations of a contraction of 0.5% in 2023 to a 0.5% expansion.

Essentially, a stronger eurozone economy could potentially allow the ECB to raise interest rates more aggressively as it tackles inflation. In fact, many financial analysts and economists expect the ECB to lift rates to 3% shortly following another two hikes of 50 basis points each in the upcoming meetings in February (today) and March. Meanwhile, the Federal Reserve is widely expected to slow the pace or pause rate hikes as there are clear signs that inflation is easing in the US. This would remove a key tailwind for the US Dollar that was very evident during most of 2022.

As a result of the more optimistic prospects for the eurozone economy as well as the decline in inflation rates in the US and Europe coupled with remarks by many members within the ECB that it will continue to hike rates during the course of 2023, the value of the euro continued its rapid recovery from the multi-decade lows last year.

The euro touched a 9-month high of above USD1.09 early last week representing a recovery of more than 14% from its multi-year low of below the USD0.96 level reached in September 2022. The euro is therefore at its strongest level against the US Dollar since May 2022.

The ECB, which was the laggard in raising rates to contain inflation last year, has become the most hawkish of the banks, warning investors that its tightening measures will continue in the months ahead.

This week, the world’s three biggest central banks will deliver their first interest rate decisions of the year. The monetary policy decisions being announced by the Federal Reserve, the ECB and the Bank of England could provide further clues on the future direction of interest rates and currency movements.

Most market commentators believe that the Federal Reserve will opt for a quarter-point rise thereby lifting the Fed Funds rate to a range between 4.50% and 4.75% amid signs that inflation is coming down in line with expectations. A rate hike of just 25 basis points would be the smallest since March last year and a step back from the large hikes the Federal Reserve was forced into during 2022.

Meanwhile, the ECB is expected to opt for a 50-basis point rise today. In recent weeks, the President of the ECB Christine Lagarde has repeatedly warned that investors are underestimating the bank’s appetite to control inflation.

As to the future trajectory of the EUR vs USD exchange rate, the US Dollar is likely to decline further if we continue to see a combination of improving economic conditions in the rest of the world, and a continued decline in inflation in the US that would allow the Federal Reserve to slow its pace of rate rises without unduly undermining growth. This would be favourable for those investors who intend to add on to their exposure to the US financial market following the very positive start to the year for US equities.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.