Farsons adapting to the new norm

Last week Simonds Farsons Cisk plc published its 2019/20 Annual Report following the publication of their financial statements on 27 May 2020 and ahead of their Annual General Meeting which has yet to be re-scheduled due to the pandemic.

Instead of the customary presentation of the Annual Report to all financial analysts at their head office, in view of COVID-19, Chairman Louis Farrugia, CEO Normal Aquilina and CFO Annemarie Tabone conducted this year’s presentation virtually.

The presentation provided a detailed overview behind the 2019/20 financial performance showing a 3.7% growth in revenue to €103.5 million, a decline of 8.7% in adjusted EBITDA to €21.2 million and a drop of 22% in profits after tax to €11.9 million which the CEO nonetheless described as a “satisfactory performance” following the strong rate of profitability growth over a long number of years. The CFO attributed the decline in profits mainly to the impact of IFRS 9 related to impairment provisions and a higher tax charge since no increase in the deferred tax asset was recorded during the 2019/20 financial year in relation to investment tax credits. The Directors stated in the Annual Report that it was not appropriate to add to the deferred tax asset due to the lower profits recorded in the 2019/20 financial year and “significantly lower profit expectations for FY 2021”.

Despite the overall positive momentum in the last financial year, the main focus placed by both Chairman Louis Farrugia and CEO Normal Aquilina in their address to financial analysts was understandably on the immediate impact from COVID-19 and how the Farsons Group is responding to the new environment.

The CEO explained that as the strict measures by the health authorities were announced in March, the board of directors and management responded immediately to “implement important operational and cost saving initiatives”. Mr Aquilina explained that these actions included strict cost containment measures including reduced marketing budgets and shorter production runs in order to ensure enhanced cost efficiency. However, the Group never laid off any of its employees but an “immediate freeze was imposed on overtime working and on all new recruitment as well as on the engagement of subcontracted and casual labour”.

Meanwhile, in order to preserve cash resources, certain capital expenditure projects were deferred. Mr Aquilina however explained that the Old Brewhouse Project is continuing and it is projected to be completed as originally planned in 2021.

Despite the significant challenges ahead and the heightened competition faced across all business segments, the CEO highlighted the Group’s determination on looking beyond the pandemic to continue to grow the business in the future. Mr Aquilina claimed that strategically important investments need to be maintained to drive future profitability growth.

Farsons is one of the companies that as a result of its bonds in issue is obliged to publish its financial projections on an annual basis. However, the Group announced on 17 June that it will be delaying the publication of its financial projections to the end of September from the original deadline of the end of July. The CEO explained that the situation is still too fluid given the Group’s very high dependency on tourism and he remarked that July is a critical month given the opening of the airport.

When responding to a number of questions during the virtual presentation, Mr Aquilina also explained that the agreement signed with PepsiCo to become a regional player has been stalled due to COVID-19 which also disrupted exports given the scale of the global pandemic. Last year, Farsons had announced it reached an agreement with PepsiCo to export to certain identified markets since PepsiCo is seeking to utilize the space capacity of certain key partners to increase its presence in certain regions.

Moreover, with respect to the food importation business which still accounts for a small share of the overall Group revenue and profitability, in response to another question, the CEO argued that the food importation sector remains excessively fragmented and opportunities for consolidation may exist.

The lengthy report by the Farsons Directors within the 2019/20 Annual Report concludes by stating that the “next task of the board and management team is to develop a business plan that is appropriately tailoured to the new normal that is expected to emerge”. The report further explains that “potentially, this new normal may well require the adoption of a materially different business model that will need further measures to be implemented”. In view of the high degree of uncertainty as a result of the pandemic and its impact on different economic sectors and individual business to varying degrees, it would be best practice for Farsons and all other companies to issue more regular announcements to the public as highlighted in one of my articles earlier this month.

More specifically, in the case of Farsons, given the dependence on the tourism industry on the overall financial performance for the current financial year to 31 January 2021, following the publication of the July interim financial statements due by the end of September, the company ought to also publish its key performance indicators for the third quarter of their financial year (for the period from August to October) for investors to monitor the Group’s financial performance during the crucial summer period. Moreover, given the possibility of a “materially different business model” that may be required by Farsons, should this be agreed and enacted by the Board and senior management team, it should also be presented to the investing community for investors to gain a better understanding of the new strategy of Farsons.

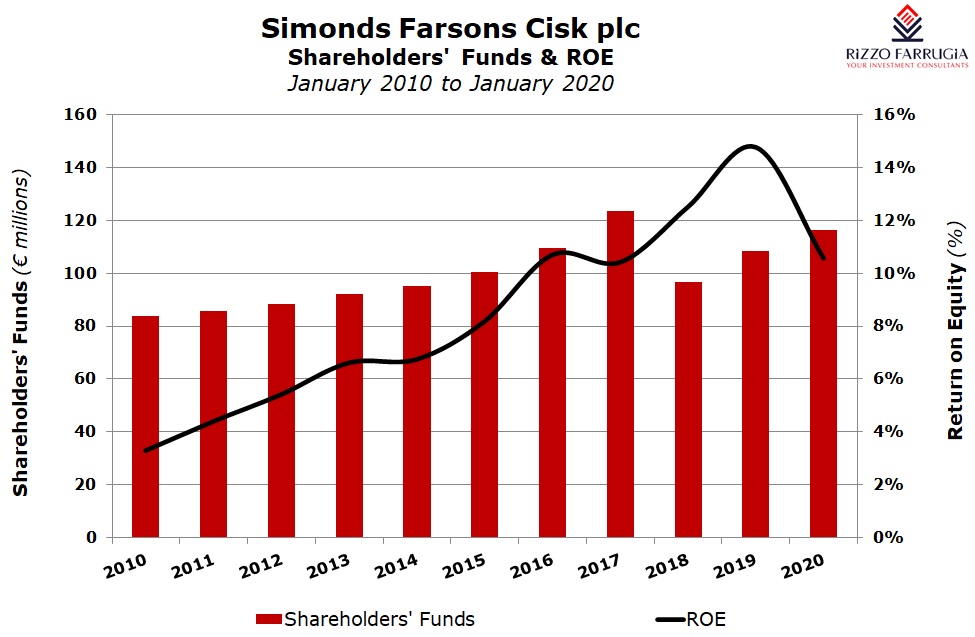

Although the financial forecasts for the current year to 31 January 2021 will only be published in September 2020, it is evident that the financial performance of the Farsons Group will be significantly dented as a result of the pandemic. However, Chairman Louis Farrugia correctly argues in the Annual Report that the Group “entered the COVID-19 crisis from a position of strength, following many years of significant capital investment and record profits being recorded every year for the last ten years”. In fact, as a result of the consistently high level of profits over the past ten years and the prudent dividend distribution, the Group’s equity base expanded significantly with total shareholders’ funds climbing from €84 million in 2010 to €116.2 million as at 31 January 2020 despite the spin-off of Trident Estates plc in late 2017. The Chairman also indicated that despite the particularly challenging year ahead, and assuming a slow recovery when restrictions are completely lifted shortly, given the Group’s financial position, its strong brand portfolio and the measures taken by management, it is forecast that the Group will be able to “sustain its operations in a manner that is cash flow positive into the foreseeable future”.

The pandemic is affecting economic sectors and individual companies to varying degrees. Unfortunately, Farsons is one of a number of companies that is being severely impacted by COVID-19 due to the Group’s dependency on both the tourism industry and a buoyant local economy. While it is still very hard to predict the length of time required for the tourism sector to eventually to return to the record levels of some months ago, the numerous loyal Farsons shareholders should be comforted by the Group’s determination to remain at the forefront of the local food and beverage industry in the years ahead.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.