Farsons: Evident signs of post-pandemic recovery

On 29 September 2021, Simonds Farsons Cisk plc published its results for the six-month period ended 31 July 2021 effectively bringing to an end the interim reporting season.

The financial results published by Farsons two weeks ago cover the period when several restrictions for social activities in Malta were still in place. Moreover, additional requirements were imposed in July for travellers to Malta following the sharp increase in COVID-19 cases in early July which negatively impacted tourism arrivals. Notwithstanding these extraordinary challenges, Farsons still reported a notable rebound in business across all its three segments, namely ‘Brewing, Production and Sale of Branded Beers and Beverages’, ‘Importation, Wholesale and Retail of Food and Beverages’, and ‘Franchised Food Retailing’.

It is fair to mention that during the comparative period (i.e. between 1 February 2020 and 31 July 2020) there were also several highly restrictive measures imposed by the health authorities at the start of the pandemic which greatly impacted the performance of the Farsons Group as well as virtually all other companies dependent on tourism and social activities within the local economy. As such, during the first half of the 2020/21 financial year ended on 31 January 2021, the Farsons Group only had six weeks of what would be regarded as “normal” trading as the airport was closed between 21 March and 1 July 2020 together with restaurants, bars and night clubs. All mass events were also cancelled which therefore left a marked impact on all business segments of the Farsons Group at the start of the pandemic. In view of this very bleak comparative period, it is also worth measuring the rebound in business activity over the past six months against the pre-COVID environment during the first half of the 2019/20 financial year, i.e. between 1 February 2019 and 31 July 2019.

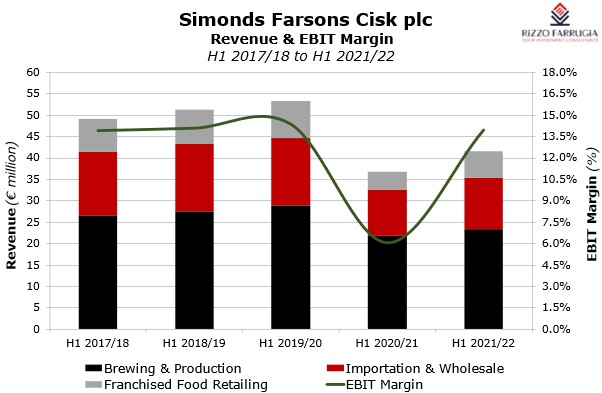

Overall group revenues increased by just over 13% during H1 2021/22 to €41.6 million but still represents a decline of almost 22% from the record turnover (at interim stage) of €53.3 million achieved in the first half of the 2019/20 financial year.

The main business segment of the group, namely the ‘Brewing, Production and Sale of Branded Beers and Beverages’ experienced a 7.1% increase in revenues (or +€1.55 million) to €23.4 million. However, this is still 18.9% lower than the turnover generated in the first half of FY2019/20. Sales within the ‘Importation, Wholesale and Retail of Food and Beverages’ arm climbed by 11.1% (or +€1.2 million) to just under €12 million (24% lower than the corresponding period pre-pandemic) while the revenue generated from the ‘Franchised Food Retailing’ business rebounded by 50% (or +€2.09 million) from last year to €6.28 million (27.6% lower than the record of €8.67 million achieved in H1 2019/20).

As a result of the evident recovery in business performance over the past six months, the profitability and margins also improved considerably from the weak figures last year and also compare relatively well to the pre-COVID business period.

The group’s operating profit (‘EBIT’) more than doubled during the past 6 months to €5.8 million compared to €2.22 million in H1 2020/21 with the EBIT margin climbing to 13.9% (compared to 6% in H1 2020/21) which is only 50 basis points lower than the record (at interim stage) of 14.4% posted in the first half of the 2019/20 financial year. The biggest contributor to the rebound in profitability was the ‘Brewing, Production and Sale of Branded Beers and Beverages’ (the largest business segment) with an EBIT of €3.52 million compared to €1.91 million in H1 2020/21. Meanwhile, the ‘Importation, Wholesale, and Retail of Food and Beverages’ arm recorded an EBIT of €1.39 million (+€1.11 million) and the ‘Franchised Food Retailing’ business generated an EBIT of €0.89 million compared to just €0.04 million in H1 2020/21.

Farsons reported a pre-tax profit of €5.2 million (compared to €1.6 million in H1 2020/21) and a net profit of €4.88 million (compared to €1.6 million in H1 2020/21). During the first half of the 2019/20 financial year, Farsons had generated record profitability of €6.92 million pre-tax and €6.4 million after tax.

As with several companies locally, and also in line with many companies internationally that were impacted sharply by the pandemic, Farsons had halted dividend distributions to shareholders in early 2020 in order to preserve cash resources until such time as further clarity on the effects of the pandemic became more evident.

At the time of the publication of the 2020/21 Annual Report in May 2021, Farsons had noted that the declaration of an interim dividend for the current financial year will be considered once the interim financial results are published as the group would have a better indication of the performance of its business during the important summer season. On 29 September 2021, Farsons resumed its dividend distributions as it declared a €1.5 million interim dividend which will be paid on 20 October 2021. More importantly however is the statement of confidence made by the Directors that should business conditions continue to improve, another interim dividend may be declared before the end of the 2021 calendar year.

This would not be surprising giving the overall strength of the balance sheet of the Farsons Group and the indications that the group is well placed to achieve the financial targets published in the Financial Analysis Summary in July 2021 with revenues of €91.7 million; EBITDA of €19.3 million and a pre-tax profit of almost €10 million. As reported in last week’s article, the group has a very strong debt to asset ratio which is projected to amount to 0.20 times during the current financial year to 31 January 2022 with total debt of €38.9 million and total assets of just under €197 million. Moreover, the projected net debt to EBITDA multiple for the current financial year of only 1.22 times indicates that the group can repay its projected net debt of €23.6 million in under one-and-a-half years of operating profits which is indeed an enviable credit metric even by international standards.

Prior to the pandemic, the Farsons Group adopted a fairly conservative dividend policy with a payout ratio in the region of circa 26% with €4 million in dividends distributed in respect of the financial year to 31 January 2019. Although the group has considerable continuous requirements for ongoing capital expenditure related to its operations, product development and export initiatives which remains an important area of focus for the long-term growth ambitions of the group, in my view, a more aggressive dividend payout can be considered favourably in due course on the back of its robust financial position and strong market presence. This would definitely be well-received by the investing public.

Although the interim results published by Farsons cover the period until July, there are evident signs of the economic recovery materialising from the sharp setback suffered during the initial stages of the pandemic when highly restrictive measures were in force. In fact, Farsons reported that it “is cautiously optimistic that the gradual recovery of the food and beverage market for the local and tourism sectors currently being experienced will be sustained”. This is corroborated by the traffic results published by Malta International Airport plc with significant growth registered during the months of August and September compared to the June and July figures albeit they are still well-below the corresponding figures registered prior to the start of the pandemic in early 2020.

As the economic recovery continues to gather momentum in the weeks and months ahead, it would be expected that other companies follow the procedure of Farsons and restart dividend distributions to shareholders. This would be a very important development for retail investor sentiment especially at a time when new investment opportunities are being made available across both the bond market as well as the equity market.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.