Farsons invests over €112 million during past decade

The annual reporting season in Malta came to an end two weeks ago with the publication of the January 2023 full-year results of Simonds Farsons Cisk plc and Trident Estates plc. Both companies subsequently delivered a presentation to financial analysts last week providing additional details on last year’s financial performance and the strategy going forward.

In one of my recent articles, I mentioned that we are witnessing a much faster-than-expected return to ‘normality’ across many sectors such as travel, hospitality and retail.

This trend was also very evident in the financial performance of Simonds Farsons Cisk plc which is closely linked to the state of the tourism and leisure sectors as well as the overall performance of the local economy.

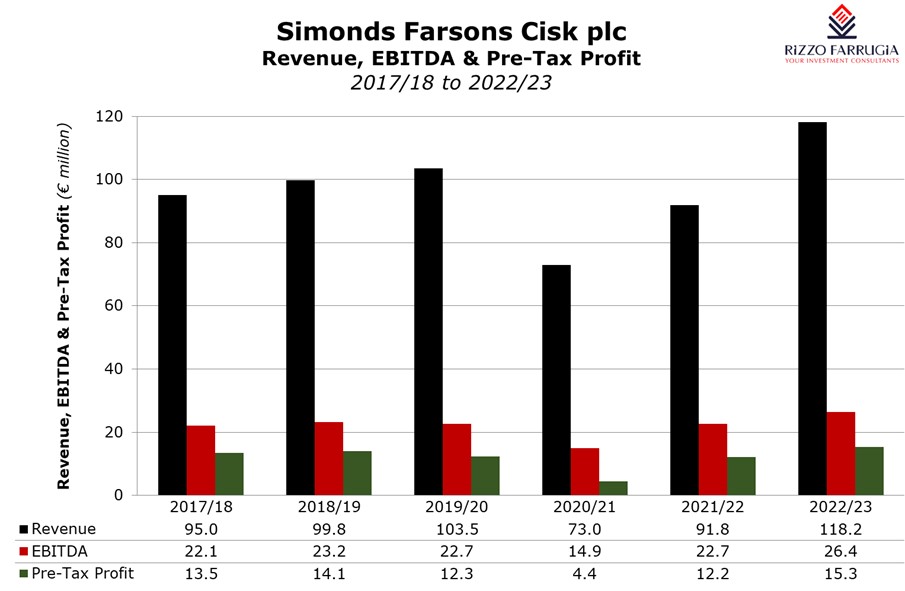

Although the start of the past financial year between 1 February 2022 and 31 January 2023 was still disrupted by a number of COVID-19 restrictions and weak tourism figures, the Farsons Group reported a record performance for FY2022/23. In fact, Group revenues of €118.2 million were 14.2% higher than the previous record of €103.5 million in the 2019/20 financial year prior to the outbreak of the pandemic. Likewise, earnings before interest, tax, depreciation and amortisation (EBITDA) amounted to €26.4 million when compared to the record of €23.2 million in FY2018/19 and the profit before tax of €15.3 million also exceeds the previous record of €14.1 million in FY2018/19.

Due to the obligations for most issuers of bonds across the Regulated Main Market of the Malta Stock Exchange, Farsons publishes its financial forecasts annually. On 22 July 2022, Farsons had announced that during the 2022/23 financial year, it was expected to generate revenue of €115.7 million, EBITDA of €25.6 million and pre-tax profits of €14.2 million. It is always important to compare actual results to forecasts prepared by each of the companies that publish such financial estimates. In the case of Farsons, it is positive to note that the actual performance last year indeed exceeded the company’s forecasts.

With the exception of the 2020/21 financial year which was hugely impacted by the pandemic, the Farsons Group has been reporting healthy levels of profitability over the years and a marked improvement compared to the weak levels of profits prior to 2014. Investors possibly fail to appreciate that the consistently healthy levels of profits over the past few years are partly as a result of the benefits of the consistent investments undertaken. During last week’s meeting, Group CFO Ms Anne Marie Tabone indicated that total capital expenditure amounted to over €112 million over the past decade. Despite this elevated level of capital expenditure, the level of indebtedness of the Group remained on the low side. In fact, as at 31 January 2023, the net debt (excluding lease liabilities) amounted to only €14.8 million compared to just over €34 million prior to the pandemic.

In his intervention to financial analysts last week, CEO Mr Norman Aquilina highlighted the growing importance of the subsidiaries to the Group. Despite the fact that the combined revenue of the subsidiaries exceeded the turnover of the company, the core business of the Group, namely the ‘Brewing, production and sale of branded beers and beverages’ remains the major driver of profitability.

The CEO of Farsons highlighted the “significant opportunities for further growth” across the subsidiaries with a particular emphasis on increasing the market share of the food importation business since the market remains excessively fragmented. In this respect, the Group is embarking on a major investment in a dedicated food distribution centre in Handaq which will significantly increase the warehousing capacity of this business unit. Works are expected to be completed by late 2025 or early 2026.

Apart from the record financial performance and dividend distribution to shareholders in FY2022/23, the major highlight of the recent Annual Report was the comment on the ongoing strategic review of the food business. Farsons stated that this review will also consider the potential structuring of the food operations into a separate listed entity similar to the spin-off that took place some years ago of Trident Estates plc.

In his address to financial analysts last week, Chairman Mr Louis Farrugia explained that following the clear benefits of the spin-off of Trident as a separate company listed on the MSE, a similar strategy is being considered for the food operation. Hopefully this review will be concluded in the near-term to enable the Group to take advantage of the opportunities for consolidation of the food importation business. It is very reassuring to see that some public companies do highlight the overall benefits of being a publicly traded company. Hopefully, this will instigate many more Maltese companies to consider a stock exchange listing thereby providing further depth and choice to investors across the local capital market.

In view of its obligations as a bond issuer, Farsons will be publishing its financial projections for the current financial year through an updated Financial Analysis Summary by mid-July since this must be issued within two months from the publication of its annual financial statements. Given the positive momentum across the local economy and the expectations of a strong year across the tourism sector, it will be interesting to read the Group’s expectations for the current financial year. The 2023/24 financial year promises to be another rewarding year since in the words of the CEO, Farsons is “taking on the future with renewed ambition and confidence in our strategy”.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.