Farsons’ performance regains pre-pandemic levels

Simonds Farsons Cisk plc published its 2021/22 Annual Report & Financial Statements on 25 May 2022 and held an online presentation for financial analysts last Friday 3 June to provide further details on last year’s financial performance.

The financial year between 1 February 2021 and 31 January 2022 was once again very much disrupted by the COVID-19 restrictions with bars and restaurants closed until May 2021 and additional travel-related and other social restrictions re-imposed in the latter part of the year. Moreover, tourism figures were also subdued throughout summer 2021 in view of the travel restrictions, the low levels of airline capacity to and from Malta as well as continued concerns regarding the pandemic.

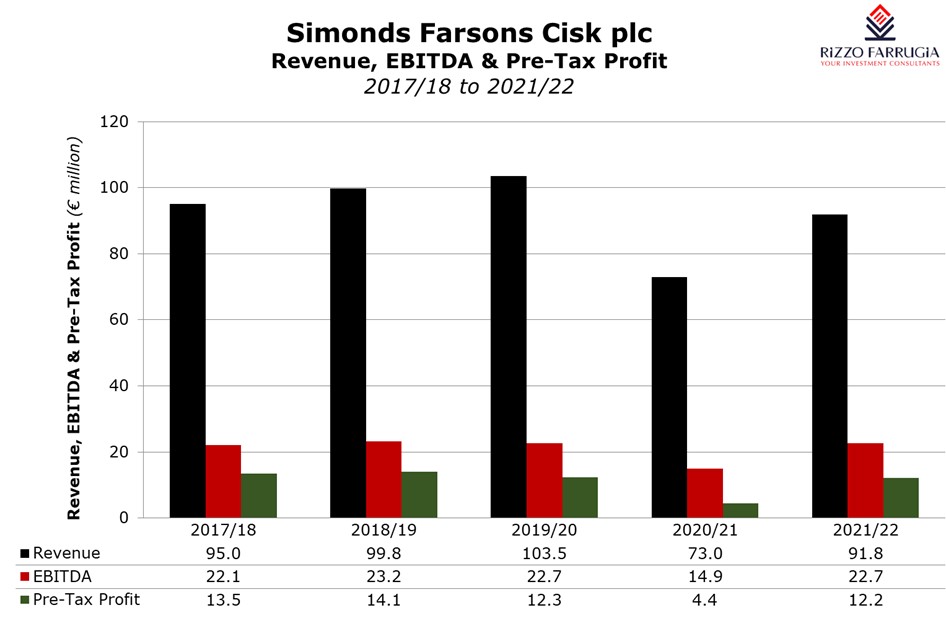

Despite these very challenging conditions, Group revenues rebounded by 25.7% to €91.8 million over the previous year (FY2020/21: €73.0 million). Moreover, when comparing the revenue figure with that of the financial year prior to the outbreak of the pandemic (1 February 2019 to 31 January 2020), the turnover registered last year is only 11.3% below the record figure of €103.5 million in the 2019/2020 financial year. This is an excellent achievement.

While the revenue figure as expected has not yet reached the pre-pandemic level, the Farsons Group performed particularly well from an operational and profitability aspect. In fact, earnings before interest, tax, depreciation and amortisation (EBITDA) amounted to €22.7 million when compared to both the €14.9 million in the previous comparative period and the record of €23.2 million in FY2018/19 prior to the pandemic. Likewise, the profit before tax of €12.2 million during the last financial year represents significant growth over the prior period of €4.4 million and compares very well with the record of €14.1 million in FY2018/19 prior to the pandemic.

Due to the obligations for issuers of bonds across the Regulated Main Market of the Malta Stock Exchange, Farsons publishes its financial forecasts annually. On 21 July 2021, Farsons had announced that during the FY 2021/22 financial year, it was expected to generate revenue of €91.7 million, EBITDA of €19.3 million and pre-tax profits of €9.9 million.

The actual financial results for the financial year ended 31 January 2022 must therefore also be compared to the forecasts published almost mid-way through the financial year. While actual revenue was exactly in line at €91.8 million, the level of EBITDA at €22.7 million is 17.6% higher than the projected figure of €19.3 million and the pre-tax profit of €12.2 million is also well-ahead of expectations.

The main reason provided by the Farsons management for such a strong and resilient performance despite the challenging conditions was that a number of operational and cost saving efficiencies were achieved since the start of the pandemic. This should be very welcome news for shareholders.

The segmental results continue to show that the Group remains very much dependent on its main business unit, i.e. the ‘Brewing, production and sale of branded beers and beverages’ in particular with the CISK brand. During the last financial year, revenue from ‘Brewing, production and sale of branded beers and beverages’ amounted to €49.5 million (representing 54% of total revenues and a segment operating profit of €9.9 million). Sales generated by the ‘Importation, wholesale and retail of food and beverages’ segment amounted to €26.5 million (representing 29% of total revenues and a segment operating profit of €1.9 million) while revenues from the ‘Operation of franchised food retailing establishments’ segment amounted to €15.7 million (representing 17% of total revenues and a segment operating profit of €1.6 million).

At the start of the pandemic just over 2 years’ ago, Farsons had highlighted that its immediate priority was to adapt to the new norm and in fact in the 2019/20 Annual Report it was stated that the “next task of the board and management team is to develop a business plan that is appropriately tailored to the new normal that is expected to emerge”.

The company had also indicated that “potentially, this new normal may well require the adoption of a materially different business model that will need further measures to be implemented”.

Meanwhile, in this year’s Annual Report, CEO Norman Aquilina stated that the Group’s strategic direction is to return to a “growth mindset”. He explained that the Group needs to “formulate a more distinctive food and beverage business, seeking further innovation and accelerating our digitalisation process, better responding to our sustainability responsibilities, ensuring successful business continuity through leadership talent and succession planning”.

The very encouraging financial performance in the last financial year coupled with the strong financial position enables the Group to indeed return to this growth mindset. In fact, the financial strength and flexibility of the Group with net debt of €18.6 million (including lease liabilities) translating into a net debt to EBITDA multiple of only 0.8 times is worth highlighting.

Apart from having the flexibility to continue to invest in its core business, the low level of leverage also enables Farsons to consider adopting a more aggressive dividend policy. Although two interim dividends were distributed in September and December 2021 totalling €3 million and a final dividend of €4 million is being proposed at the upcoming Annual General Meeting, this must be seen in the context of the cash conservation measures adopted during the pandemic where no dividends were distributed. In prior years, the dividend payout ratio was in the region of 30% of profits after tax. In my view, this can be increased due to the low level of leverage, the resilient financial performance of the Group as well as the likelihood that the level of capital expenditure of future years would be below that in the past few years.

High levels of dividends to shareholders could also be considered despite the variety of challenges being faced in the current financial year to 31 January 2023. While on the one hand the performance is expected to be positively impacted by the strong recovery in tourism as well as the return of social activities across the Maltese islands, the Group is also facing continued supply chain disruptions, significant increases in the cost of raw material and imported products together with increases in shipping costs following the onset of the war with Ukraine. As such, the publication of the financial forecasts via the Financial Analysis Summary due by 25 July 2022 is an important event for shareholders of Farsons and also for financial analysts to gauge the overall combined effect of these realities on the financial performance of the Group for this year.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.