GO plc maintains elevated dividend to shareholders

The annual reporting season for local companies with a December financial year-end comes to a close in ten days’ time. At the end of March, GO plc and its two major subsidiaries published their annual financial statements.

The recent announcement by GO plc was eagerly awaited by the market mainly from a dividend perspective following the surprise announcement in August 2021 of the declaration of a net interim dividend of €0.07 per share. This was the first time since 2007 that GO distributed an interim dividend to shareholders.

On 30 March 2022, GO announced that its directors are recommending the payment of a final net dividend of €0.09 per share which brings the total net dividend for the 2021 financial year unchanged at €0.16 per share.

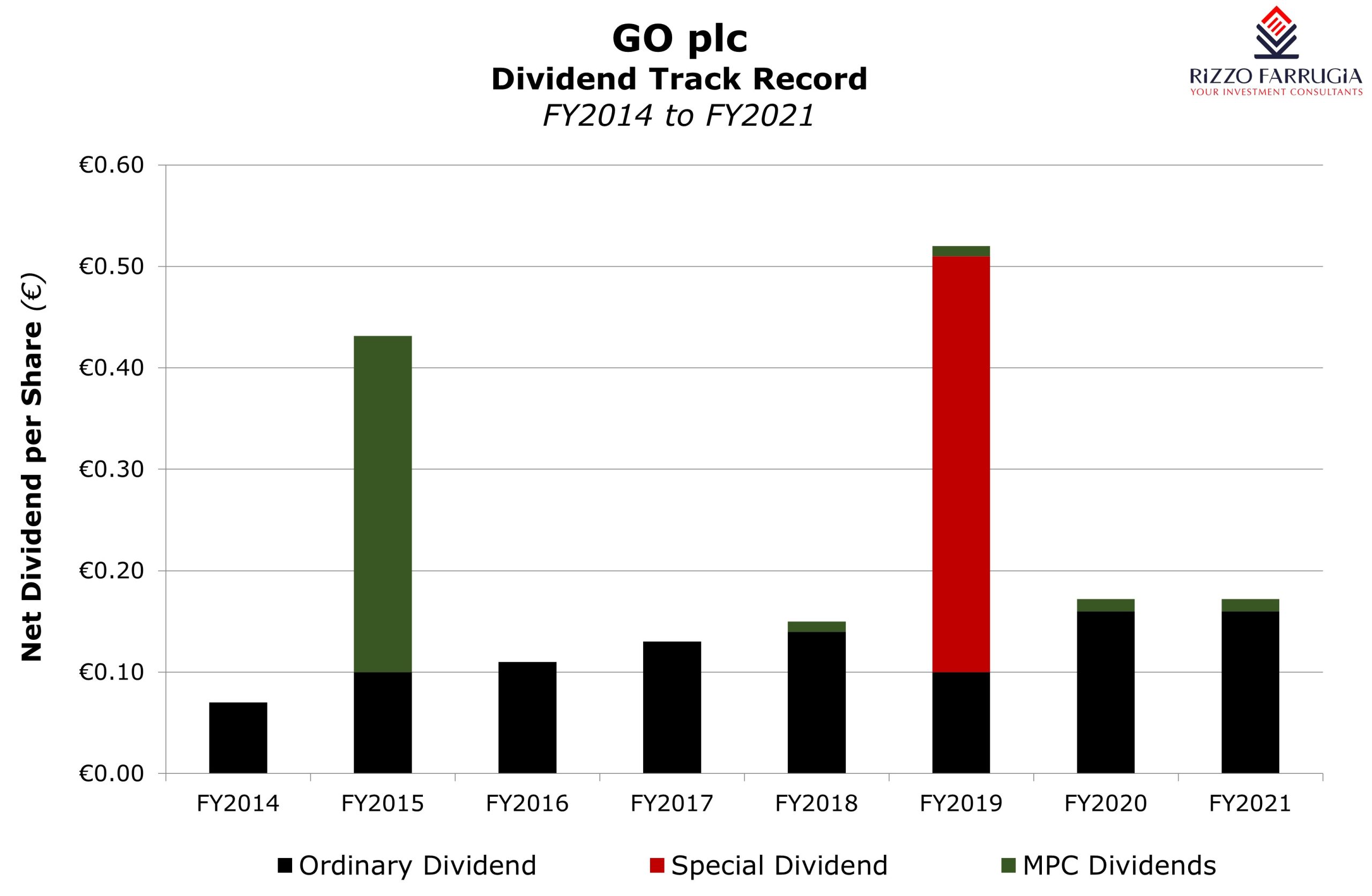

GO’s dividend track record in recent years must be viewed in the context of the uncertainty surrounding the COVID-19 pandemic as well as the large one-off distributions to shareholders following two major corporate actions.

In October 2015, GO declared a net interim dividend of €0.3313 per share by way of a distribution ‘in kind’ of the entire shareholding in Malta Properties Company plc to GO’s shareholders pro rata to the number of shares held at the time. In May 2019, GO shareholders received a special net interim dividend of €0.41 per share amounting to a cash distribution of €41.5 million following the capital gains generated by GO from the sale of a 49% shareholding in BMIT Technologies plc through an IPO in January 2019. The decision in 2020 to reduce the annual dividend from €0.14 per share to €0.10 per share was driven by the significant uncertainties at the start of the COVID-19 pandemic in early 2020 as well as the sizeable cash distribution of €41.5 million just 12 months earlier.

In total between 2015 and 2022, GO plc shareholders would have received overall cash dividends amounting to €1.38 per share net of tax (amounting to €140 million) apart from the ‘in kind’ distribution of €0.3313 per share related to the spin-off of Malta Properties Company. In addition to the annual cash dividends distributed by MPC over the years, the value of this distribution has increased to over €0.50 per share as per the latest market price of MPC shares. Thus, if one had to work out the total returns that GO shareholders received over the past 7 years when also including the appreciation in the share prices of both GO plc and MPC, the aggregate return would amount to over €260 million (equivalent to €2.58 per share) which represents almost 81% of GO’s market cap today. In other words, an investor who would have bought GO plc shares at €2.55 per share at the end of 2014 has already got back the initial capital invested, partly through capital appreciation and partly through dividends.

When reviewing the elevated dividend by GO plc over the past two financial years at €0.16 per share annually, one needs to analyse the cash flow generated by the group and not compare this solely to the reported earnings per share. In fact, although the total dividend of €0.16 per share in respect of the 2021 financial year may appear aggressive from an earnings perspective, it is important to highlight that during 2021 GO generated free cash flow of €0.172 per share. Moreover, one must also mention that this free cash flow generation took place despite the enormous amounts required for capital expenditure of the various parts of the group.

The annual financial statements of the GO Group show record revenues of €193.7 million (+4.6%) in 2021 with growth registered across all three operating segments. In Malta, revenues increased by 0.9% to €116.2 million largely on the back of higher demand for broadband and mobile services which offset the subdued income generated from roaming volumes and related revenues.

Meanwhile, revenues from BMIT increased by 5.5% to a record of €25.3 million on the back of the double-digit growth registered in the provision of cloud services (+13.4%) and managed services (+33.3%), as well the resale of hardware and software (+23.5%). The three other principal service activities of the company – namely, connectivity, power, and colocation – in aggregate registered a stable performance.

Revenues generated by the Cypriot company Cablenet Communication Systems plc increased by almost 14% to €53.5 million as the company continued with its path towards becoming a full-scale quad-play telecom operator following the successful penetration into the mobile market. During 2021, Cablenet increased its total number of mobile subscribers to 46,200 compared to 23,600 as at the end of 2020, thus increasing its market share to 3.5%. Revenues from mobile services alone more than doubled in 2021 to €4.4 million. Excluding revenues from mobile services, Cablenet’s revenues grew by over 8%. In the broadband segment, the total number of subscribers increased by 6.6% to 85,400 compared to 80,100 as at the end of 2020. Moreover, Sports TV customers also increased at a strong pace (+19%) as the company extended the broadcasting agreements covering a number of football clubs.

Despite the increase in revenues, EBITDA when adjusted for a number of one-time items (namely voluntary retirement costs and movement in provisions for pensions) dropped by 2.4% to €73.8 million as the Group continued to invest heavily in its infrastructural capabilities particularly in the continued roll out of the fibre network in Malta and Cyprus. Indeed, the GO Group invested close to €50 million in 2021 as it aims to complete its True Fibre programme in Malta over the next three years and reach a coverage of approximately 80% of total households in Cyprus. In a recent meeting with financial analysts, the CEO of Cablenet revealed that the company expects its profitability and cash flow generation to improve at a steady pace in the near term as it achieves more scale in the mobile and Sports TV segment.

The ability of the GO group to sustain its current generous dividend policy must also be seen in the context of its financial position. Following the successful €60 million bond issue in 2021, the Group ended the year with a net debt position of €134.5 million when including lease liabilities amounting to €33.9 million and football rights liabilities of €12.8 million. Despite the increase in net indebtedness and the drop in adjusted EBITDA over 2020, the adjusted net debt to EBITDA of the Group stood at just 1.8 times which shows the extent of GO’s financial strength when analysed from the perspective of its cash earnings.

When the Group moves past the current high levels of investments required over the coming years related to the completion of the roll out of True Fibre and the transition to the new technology hub in Zejtun, the accounting profits recorded by GO would likely show a better view of the Group’s underlying profitability. This should also reinforce the ability of the group to continue to reward shareholders with attractive and sustainable dividends to shareholders.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.