Hili Properties – A diversified commercial property company

Earlier this week, Hili Properties plc obtained regulatory approval and published a prospectus in connection with the issuance of 185,185,185 new shares at a price of €0.27 each for a total value of €50 million.

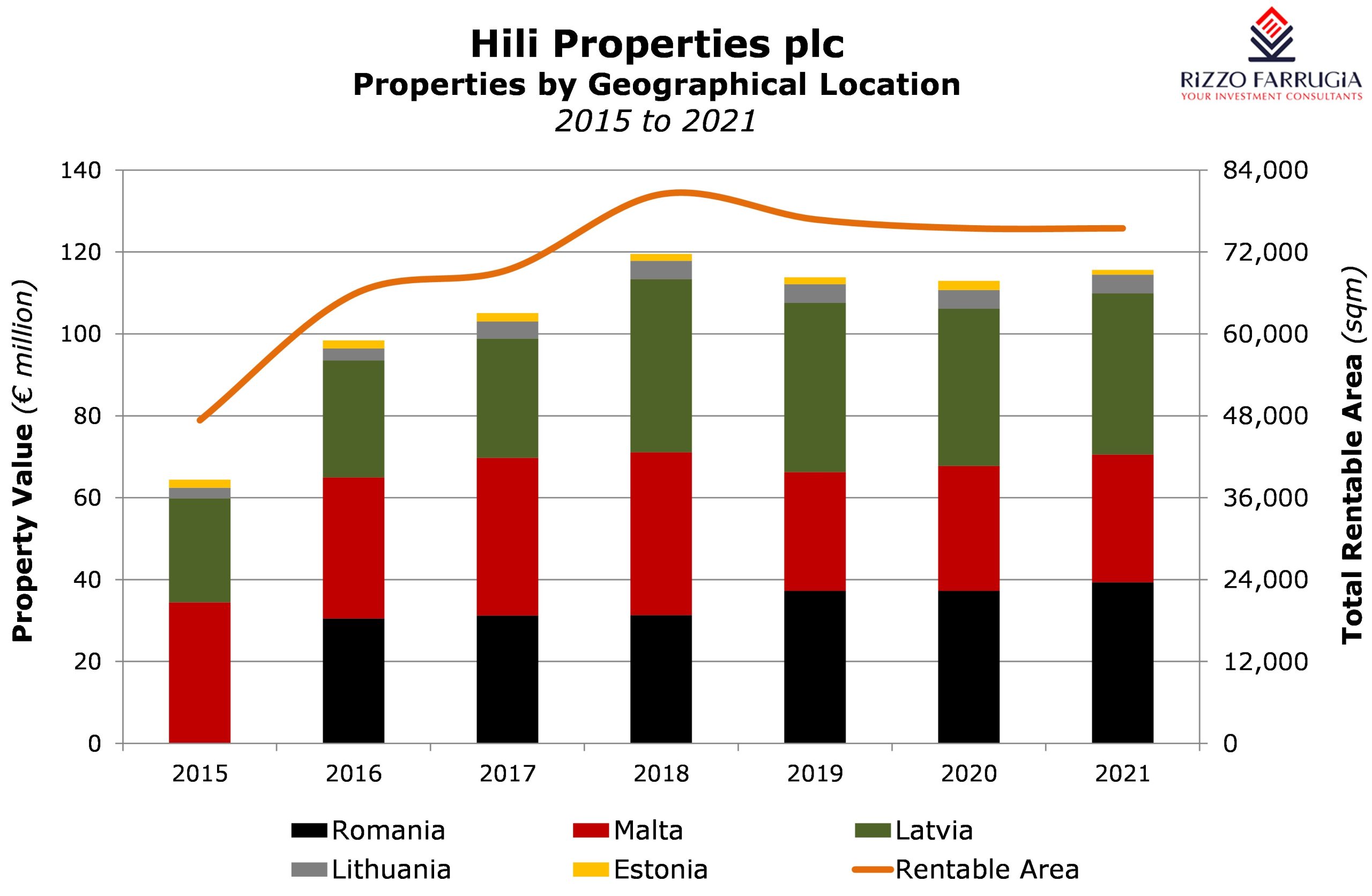

This is the second offering by Hili Properties across the local capital market following the €37 million bond issue in 2015. Hili Properties owns and manages a portfolio of commercial properties in Malta, Romania and the Baltics (namely Estonia, Latvia and Lithuania). The 23 properties currently held by the company have a total value of just over €115 million and are almost entirely fully occupied with a weighted average lease term (WALT) of almost 9 years.

The company has a diversified portfolio of properties not only geographically but also across the type of property. In fact, the company currently owns 6 grocery-anchored shopping centres, 12 restaurants, 2 office buildings, 1 property focused on the healthcare sector and 1 residential property.

With respect to the geographical split, 34% of the value of the portfolio is in properties situated in Latvia (the 6 grocery-anchored shopping centres having the ‘Rimi’ chain as the anchor tenant and 3 McDonald’s restaurants), another 34% is in Romania (the property housing the healthcare operator Regina Maria and 5 McDonald’s restaurants), 27% in Malta (the 2 office buildings, 1 McDonald’s restaurant and the private residence), 4% in Lithuania (2 McDonald’s restaurant) and 1% in Estonia comprising a McDonald’s restaurant.

The 5 largest assets accounting for 64% of the total value of the portfolio are the property housing the healthcare operator in Romania valued at €29.8 million, the office and warehousing complex in Malta (the ‘1923 Building’) valued at €16.9 million, one of the grocery-anchored shopping centres in Latvia valued at €10.9 million, the McDonald’s restaurant and offices in Sliema valued at €8.2 million, and another grocery-anchored shopping centre in Latvia valued at €7.7 million.

Meanwhile, in August 2015, Hili Properties had also agreed with APM Holdings Limited (which is a shareholder of its parent company Hili Ventures Limited) to acquire all the ordinary shares held in Harbour (APM) Investments Limited which is the owner of a parcel of land measuring circa 92,000 sqm in Benghajsa for a total consideration of €25 million. Since then, Hili Properties transferred an aggregate deposit of €24.5 million (in cash and by the issuance of new shares) to APM Holdings Limited. The final deed of sale is expected to be executed by 31 December 2022.

Essentially this means that the company has a €24.5 million asset from which it is not and will not be generating any cashflow for the foreseeable future until such time as a purpose for the land is established (in line with the prevailing planning policies in force at the time). This ultimately adversely impacts the financial metrics of the company since no rental income is being derived. Notwithstanding this, at the meeting with financial analysts earlier this year it was explained that the Benghajsa land remains a priority for the company and professional consultants were engaged in order to derive the best utilisation for the land, including for industrial and/or logistical purposes.

The future strategy of Hili Properties is to grow the size of its property portfolio by pursuing acquisitions of newly-identified assets coupled with property appreciation of existing assets through continuous management and upkeep as well as potential redevelopment opportunities. In fact, apart from the Benghajsa land, the presentation published in conjunction with this Initial Public Offering (IPO) indicates the company plans a major renovation and development of one of its existing grocery-anchored shopping centres in Latvia.

Hili Ventures, which is the parent company of Hili Properties (as well as the parent company of Premier Capital plc and 1923 Investments plc) injected €18.4 million in additional share capital into Hili Properties a few weeks ago ahead of this IPO. Essentially, should this €50 million public offering be fully subscribed, the company would immediately have up to €68 million in additional capital in order to pursue its strategy to continue to expand its property portfolio.

In fact, the company stated that it is already in advanced discussions to acquire one commercial property in Poland and one industrial property in Lithuania, having a combined value in excess of €38 million.

The presentation shows that the property identified in Warsaw (Poland) is a newly reconstructed property with a strong tenant in place having a 9-year lease agreement which may also be extended in due course. The property in Poland currently generates a rental yield of circa 7%. Moreover, the asset in Lithuania would represent the first investment in an industrial property which is also newly built and already has a 20-year lease agreement with a strong international tenant occupying the entire area. This property currently generates a rental yield of circa 6% and it also has potential for expansion in the future.

Hili Properties is also in discussions with prospective buyers to sell three of the grocery-anchored shopping centres which are all situated in Latvia. These have a combined value of €8.3 million.

The financial statements of Hili Properties indicate that during 2020 it generated €8.1 million in rental income which equates to an implied gross rental yield of 7.2%. The company published its financial forecasts until 2024 as part of the IPO documentation showing that revenue is expected to rise to €12.1 million in 2024 with pre-tax profits of €7.4 million. The assumptions indicate that these forecasts are based on the inclusion of additional properties in the coming years with an acquisition in Poland and another one in Lithuania. The assumptions also include the sale of the 3 shopping centres in Latvia.

The adjusted net asset value of the company prior to the IPO amounts to €86.6 million. Based on the issued share capital of 300 million shares prior to the IPO, the net asset value per share equates to €0.289 while the offering price of the new share issue has been established at €0.27 per share.

Hili Properties intends to distribute a net dividend of 4% based on the offering price of €0.27 per share which would represent a dividend payment of €5.2 million per annum assuming all the 185,185,185 new shares are fully subscribed during the upcoming general public offer.

This is the largest ever equity fund raising exercise by a company to be listed on the Malta Stock Exchange as it just surpasses the €49 million IPO of BMIT Technologies plc in January 2019.

The Hili Properties equity issue is a very important development for the capital market not only due to the size of the offering but also since its business prospects are not entirely dependent on the Maltese economy, therefore enabling investors to obtain access to international property via a well-known Maltese company.

Hili Properties is not a development company but an owner of a growing stock of commercial properties leased to various tenants across different economic sectors. As such, this diversification element provides a lot of resilience as was very much evident at the height of the pandemic in 2020 with the company continuing to receive almost all the pre-agreed rental income from the various tenants in line with the long-term lease agreements in place. This is an important observation in view of the stated dividend policy being projected.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.