Hospitality sector: assessing financial soundness

Operators within the hospitality sector were one of the most negatively impacted businesses as a result of the lockdown measures imposed by the COVID-19 restrictions as tourism to Malta shrunk considerably leading to little revenue generation for most hotels since the start of the pandemic.

Today’s article aims to shed light on the financial soundness of those companies within the hospitality sector whose bonds are listed on the Regulated Main Market of the Malta Stock Exchange.

Among the seven companies within the hospitality sector, five have a financial year ending in December while the financial year-end of AX Group plc is in October and SD Holdings Ltd (as guarantor of the bonds of SD Finance plc) in March. The timing of the financial year-end is an important determinant when looking at the most recent financial statements of each of these companies due to the huge impact of the pandemic and the severe restrictions that took place since the start of COVID-19. For example, the latest audited financial statements of SD Holdings Ltd are for the financial year from 1 April 2019 to 30 March 2020 – a period which was very limitedly impacted by COVID-19.

Another important observation is that some of the companies are not entirely dependent on the hospitality sector with property development activities being important determinants in the overall performance and cash flows of the wider group specifically in the context of AX Group plc and Spinola Development Company Ltd (as guarantor to Tumas Investments plc).

Furthermore, while International Hotel Investments plc (Corinthia Group) has a diversified portfolio of hotels across various jurisdictions and not totally dependent on a specific tourism market, all other companies are totally dependent on their properties in Malta.

As explained in one of my articles last year regarding the strength of bond issuers across the hospitality sector and also other sectors, in view of the huge negative impact from an operational aspect due to COVID-19, any credit metrics based on the EBITDA generation such as the interest cover and the net debt to EBITDA multiple are not good benchmarks to determine the strength of an issuer in the prevailing circumstances.

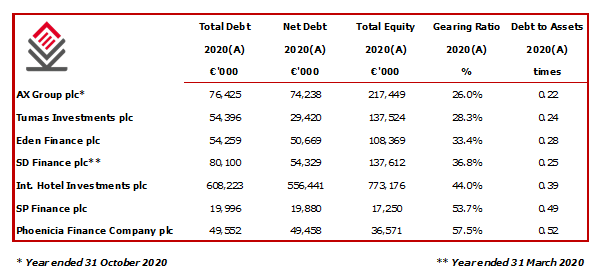

As such, in order to measure the credit worthiness of an issuer of bonds, the gearing ratio (calculated as total debt divided by total debt plus equity) is an important metric to monitor since it shows the overall financial leverage of the company and could help investors gauge whether shareholder support or additional borrowing would be required for these companies to honour their obligations until their performances begin to improve once tourism numbers start to recover gradually.

The two companies showing the highest level of indebtedness across the hospitality sector are the Phoenicia Group and SP Finance plc which is the parent company and financing arm of the Sea Pebbles Group. The Phoenicia Group had total debt of over €49 million at the end of 2020 and total equity of €36.6 million translating into a gearing ratio of 57.5%.

Sea Pebbles Limited which is the Guarantor of the €12 million in bonds issued by SP Finance plc had total debt of €20 million and equity of €17.3 million giving a gearing ratio of 53.7%. Incidentally, Phoenicia and Sea Pebbles are also the smallest companies among the 7 operators in the hospitality sector with their equity well below €50 million. Meanwhile, the total equity of the other operators is above €100 million each and International Hotel Investments plc by far the largest at above €700 million.

AX Group plc has the lowest level of indebtedness with a gearing ratio of 26% as at 31 October 2020. The total debt of the AX Group amounted to €76.4 million and equity amounted to €217.4 million.

The second lowest gearing ratio is of Spinola Development Company Ltd (as guarantor to Tumas Investments plc) at 28.3% with total debt of €54.4 million and equity of €137.5 million. However, in this case it is worth highlighting that the net debt is of only €29.4 million given the high level of cash retained at the year-end following the final payment of the sale of the building known as the Crystal Ship (adjacent to the Portomaso Business Tower).

In absolute terms, International Hotel Investments plc has the highest amount of debt at €608 million but it is also the largest company as indicated above with total equity of €773.2 million giving a gearing ratio of 44%. Despite the very challenging conditions brought about by the pandemic, the overall indebtedness of IHI increased by only €1.61 million during 2020. IHI has ownership interests across a total of 13 properties in 8 countries.

The other two hospitality operators, Eden Leisure Group Ltd and SD Holdings Ltd, have relatively low gearing levels. The total debt of Eden Leisure Group as guarantors to the €40 million bonds in issue by Eden Finance plc amounted to €54.3 million with total equity of €108.4 million giving a gearing ratio of 33.4%. Meanwhile, total debt of SD Holdings Ltd as at 31 March 2020 was of €80.1 million mainly made up of the €65 million in bonds that are due to mature in 2027. The total equity of SD Holdings amounted to €137.6 million giving a gearing ratio of 36.8%.

The total amount of bonds in issue by these seven operators in the hospitality sector amount to €452 million (when also including the €40 million bonds issued by Corinthia Finance plc) representing 24% of the overall amount of bonds in issue across the Regulated Main Market of the Malta Stock Exchange. It is worth nothing that the large majority of the bonds in issue by these companies within the hospitality sector are not due to mature for a number of years. However, International Hotel Investments plc has a €20 million bond up for redemption on 21 December 2021 and another €10 million due in November 2023.

As Malta’s vaccination drive accelerated considerably in recent weeks placing the country among those with the highest levels of vaccinations on a global level (in terms of the percentage of population), there is cautious optimism among many operators within the tourism sector for the upcoming summer season also possibly amid hopes that Malta will be added to the UK’s ‘green list’ in the weeks ahead.

Given the importance of the upcoming summer season to all these companies mentioned in today’s article, it would seem reasonable for each of them to provide more regular updates to the market in the months ahead for the benefit of all bondholders and the wider investing public. Moreover, a more regular flow of communication by these companies would also help sentiment across other sectors given the huge ripple effect that tourism has on the overall performance of the local economy.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.