Hoteliers expecting strong recovery this year

In recent weeks, numerous companies with a December year-end and whose bonds are listed on the Regulated Main Market of the Malta Stock Exchange were obliged to publish a Financial Analysis Summary detailing their financial forecasts for the current financial year.

Since the operators within the hospitality sector were one of the most negatively impacted businesses as a result of the lockdown measures imposed by the COVID-19 restrictions over the past two years as tourism to Malta shrunk considerably, this article aims to gauge the extent of the expected recovery by these hospitality companies this year.

Although the majority of the main hotel operators in Malta utilised the bond market over the years in order to diversify their sources of funding, many of these companies are also involved in other business activities (mainly property development activities) and this makes it difficult to make a perfect comparison between one company and another. Nonetheless, a comparison of some of the aggregate figures across their financial statements in 2019 and the expectations for this year provides some interesting observations.

The ten companies that are classified within the hospitality sector have an outstanding aggregate amount of €720 million in bonds thereby accounting for circa one-third of the entire Maltese corporate bond market totalling €2.26 billion. The largest issuers within the sector are International Hotel Investments plc (Corinthia Group) accounting for 45% of the bond issuance across the hospitality sector, followed by AX Group as well as SD Holdings Ltd who are guarantors of the bonds of SD Finance plc. In the case of SD Holdings, since the company has a 31 March financial year-end, the forecasts for the current financial year to 31 March 2023 are not yet available as these are normally published in September.

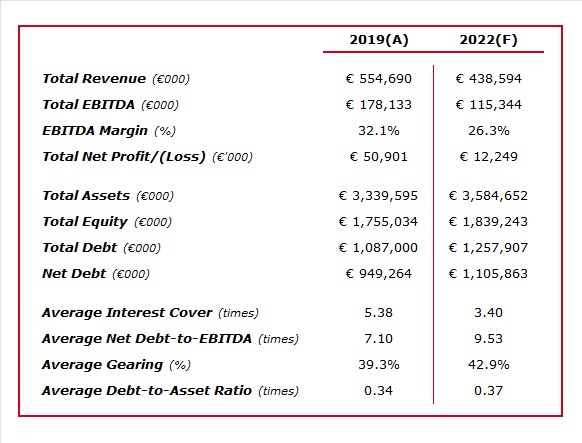

Total revenues expected to be generated in aggregate during 2022 across the 10 hospitality companies are expected to amount to €438.6 million compared to €554.7 million in 2019. This indicates that while the recovery expected in 2022 is meaningful, the overall revenue is still circa 20% below the 2019 figures. A significant amount of this shortfall however could also be due to the other business activities as indicated above, namely property development. Meanwhile, from a profitability perspective, the recovery is anticipated to be weaker since the combined forecasted EBITDA for 2022 is anticipated to be 35% lower than that generated in 2019 while profit after tax is expected to be significantly less than that registered prior to the pandemic. The reason for this could be the higher costs being incurred apart from the lower revenue registered from hospitality as well as property development activities.

Despite the huge negative impact from the pandemic, on an aggregate basis the various issuers are expected to have a larger balance sheet with a 7% increase in total assets and a 5% growth in the level of shareholders’ funds. Likewise, aggregate debt is anticipated to be 16% higher than the level at the end of 2019.

From a credit metrics perspective, there was an overall deterioration when comparing the expectations for this year with the situation prior to COVID-19 but this is to be expected given the calamity of the pandemic. Nonetheless, the overall financial strength of the issuers across the hospitality sectors remain reasonably strong with an average interest cover of 3.4 times compared to 5.4 times in 2019, a net debt to EBITDA multiple of 9.5 times compared to 7.1 times prior to the pandemic and an average gearing ratio of 39% (36.5% in 2019).

An interesting observation is that Spinola Development Company Ltd (as guarantor to Tumas Investments plc) has the best credit metrics across the sector. The interest cover for 2022 is expected to stand at 6.5 times as a result of the forecasted EBITDA of €15.7 million. The net debt to EBITDA multiple is of only 1.8 times implying that the company can repay all its outstanding debt in under two years. The total debt of €56.7 million is mainly composed of the two outstanding bonds on the MSE, namely the €25 million 5.00% Tumas Investments plc 2024 and the €25 million 3.75% Tumas Investments plc 2027.

In recent weeks, there were numerous reports of a number of flight cancellations by major carriers across Europe in view of the severe staff shortages being encountered. As such, while the outcome of the number of tourists visiting Malta this year may still be somewhat uncertain in view of the ongoing changes to schedules of airlines, the figures being registered since the start of the summer schedule in April as well as the financial forecasts published by the hoteliers indicate a strong recovery indeed reflecting significant pent-up demand following two years of major restrictions.

As a result of the fluid situation across the sector, the hotel operators ought to consider publishing an announcement in Q4 of this year to update the market on the performance during the critical summer months and whether the forecasts for 2022 are still achievable in the circumstances.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.