HSBC Malta – smaller but stronger

HSBC Bank Malta plc commenced the financial reporting season last week when on Tuesday it published its 2019 financial statements.

As a result of the restructuring charge of €16 million announced on 18 November 2019, the financial statements were significantly impacted by this sizeable one-off item. In fact, while the reported pre-tax profit of €30.7 million represents a decline of 20%, the adjusted profit before tax shows a 24% increase to €45.3 million.

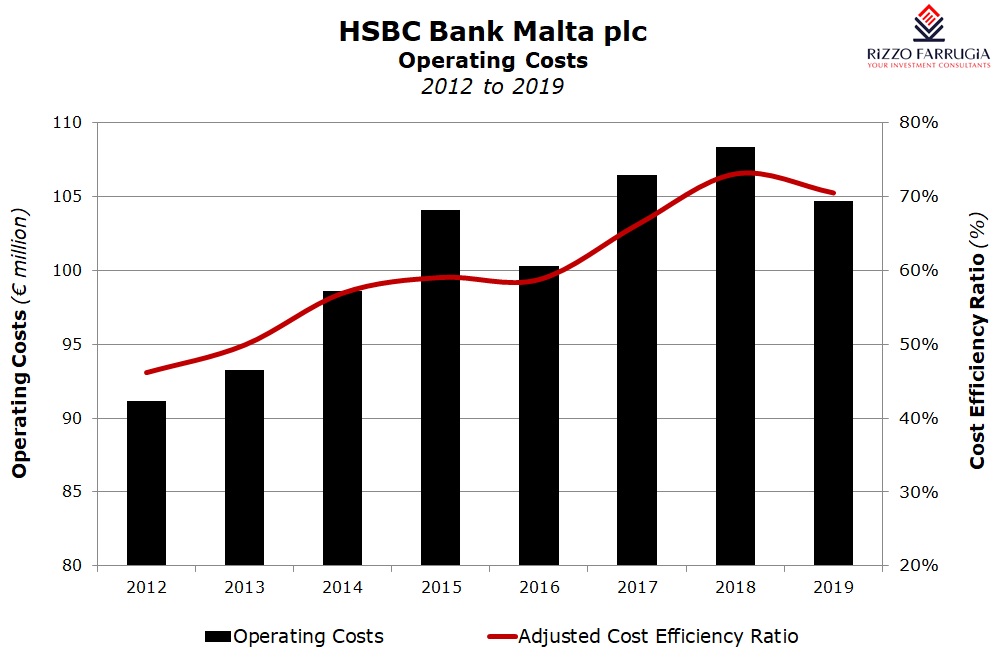

Essentially, the improved profit on an adjusted basis came about from the reduction in costs (-€3.67 million) and a lower level of ‘expected credit losses’ (-€3.1 million) which were referred to as impairments in the past. Meanwhile, the overall level of income was largely unchanged from one year to the next when excluding the fair value gain of €1.83 million on the equity stake in VISA.

HSBC Malta had announced in October 2019 its decision to close a number of branches and also reduce its headcount. The new strategic plan was aimed at increasing the bank’s focus on digital banking services and modernising its branch network while at the same time mitigating the long-term impact of negative interest rates on the bank’s profitability.

While the lower level of costs during the 2019 financial year resulted from various cost reduction actions in order to achieve a more efficient cost to income ratio following the deterioration in past years, a similar positive impact will show up in subsequent years following the termination of employment of the equivalent of 180 full-time employees.

In last week’s announcement, HSBC Malta explained that the initial impact of the cost savings from the retirement scheme will be visible in 2020 while the full annualised savings will be accounted for as from 2021. When questioned during the press conference on guidance on the amount that should be recognised as annual cost savings from this major restructuring given that it could well be the major factor for improved profitability in 2020 and 2021, HSBC Malta’s CEO Mr Andrew Beane stated that the bank does not provide any ‘forward-looking statements’.

HSBC Malta should pro-actively issue forecasts on some key performance indicators similar to its parent company and also similar to some other equity issuers across the Maltese capital market. In fact, in its announcement also last week, HSBC Holdings plc indicated that it is targeting “more than USD100 billion of gross risk-weighted asset reductions, a reduced cost base of USD31 billion or lower, and a Group return on average tangible equity of 10% to 12% in 2022”.

Given the ‘low for longer’ interest rate environment which is a significant headwind for the entire banking industry, the provision of forecasts of some key performance indicators is very important for financial analysts and the entire investment community. This may help to improve investor sentiment towards HSBC Malta following the steep decline in the share price in recent years to its lowest level since mid-2003.

Meanwhile, since mid-October 2019, the equity dropped to below its reported net asset value (€1.304 per share as at the end of 2019) for the first time in several years. The various articles across the international media in recent weeks speculating on the extent of the restructuring plans of the HSBC Group worldwide and its impact on subsidiaries in certain European countries including Malta, also contributed to the weakening sentiment.

One of the key statements made in last week’s announcement by HSBC Malta was the CEO’s explanation of the transformation of the bank in recent years which has “necessarily resulted in a business which is smaller but stronger”. This is the result of the major de-risking exercise that took place over the years. The Maltese investment community must understand that this was a focused strategy aimed at curtailing the bank’s operations also at a time of a very challenging operating environment. However, Mr Beane also emphasised that “this phase of our strategy is complete and, as we evidenced in 2019, the future focused HSBC model is strongly profitable, is producing dividends for shareholders and is protecting our stakeholders from the range of risks we face”.

It would be interesting to see whether HSBC Malta can begin to improve its income generation in the coming reporting periods or whether it is dependent on cost saving actions for improved profitability and a higher return on equity compared to the adjusted 6.4% level achieved in 2019.

Another interesting statement made by HSBC Malta was that its “conservative appetite for risk is unlikely to change until we see the promised improvements in supervisory standards take effect and a re-balancing of the economic model to one that can drive sustainable growth for the country at a more moderate level of risk”. This is a clear message from HSBC on the unfortunate developments that impacted Malta and its views for improved standards going forward.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.