HSBC’s profits surge to record level

The earnings season in Malta commenced in a very positive manner last week with HSBC Bank Malta plc reporting a surge in profits to €133.9 million. This ought to have been expected given the increase in the interest rate environment throughout 2023 and the quarterly reporting adopted by the bank with the September 2023 results showing pre-tax profits of €100.8 million during the first 9 months of the year. Quarterly reporting should be adopted by all companies listed on the Malta Stock Exchange. The investing public deserves to be presented with regular updates on key financial indicators and company developments. Less frequent reporting (on a semi-annual basis by most other companies as per current obligations) and very brief announcements leave potential room for disappointment across the investing community.

The key driver behind the surge in profits for HSBC Malta to a new all-time high (the previous record level of profits was in 2007 at €114.6 million) was undoubtedly the normalised interest rate environment following an extended period of low to negative interest rates across the eurozone. Central banks across the world (including the European Central Bank) embarked on a rate hiking cycle since 2022 to combat post-pandemic inflation. A rising or elevated interest rate environment is generally good news for banks and explains the 81% spike in HSBC Malta’s net interest income to €195.8 million which accounts for 84.5% of total operating income. The increase in net interest income was driven by the higher interest on placement of excess liquidity as the overnight deposit facility of the European Central Bank (ECB) improved from negative 0.5% (until 26 July 2022) to positive 4% as from 20 September 2023.

The upwards trajectory of HSBC Malta’s net interest income on a semi-annual basis easily depicts the correlation to the interest rate environment. During the second half of 2023, HSBC’s net interest income surged to €106.1 million compared to €89.7 million in H1 2023, €62 million in H2 2022 and €46.2 million in H1 2022.

One of the key financial indicators tracked by most financial analysts across the banking sector is the net interest margin (NIM). This is the difference between the rate charged on loans and that paid on deposits, expressed as a percentage of interest-earning assets. HSBC Malta’s NIM climbed to 2.95% from 1.71% in 2022 and well above that of HSBC Holdings of 1.66%.

The surge in the overall revenue generation also led to a sharp drop in the cost to income ratio to a very attractive level of 44% (the strongest level since 2007). Likewise, the return on equity (ROE) of 17% represents the best return for HSBC Malta since the very high ROE’s in excess of 20% between 2006 to 2008.

During 2023, HSBC Malta experienced a €91.3 million decrease in loans and advances to customers to €3.1 billion. Meanwhile, customer deposits grew by 3% to €6.1 billion, with the loan to deposit ratio easing to 50.2%. The loan to deposit ratio deteriorated from a peak of 79% in 2009 following a consistent increase in customer deposits (rising from €4.5 billion in 2012) and a static loan book in part due to the de-risking strategy adopted by HSBC Malta as well as the increasing levels of competition.

HSBC Malta is experiencing an increase in its excess liquidity and also in its portfolio of financial assets as a result of the rising deposit base and lower size of the loan book. In order to reduce the dependency of the bank on the interest rate environment, HSBC explained last week that it is increasing its investment portfolio “to reduce the sensitivity of banking net interest income to interest rate movements and stabilise future earnings”. In fact, the financial investments portfolio increased by 31% during 2023 to €1.32 billion while excess liquidity rose 6% to €1.7 billion.

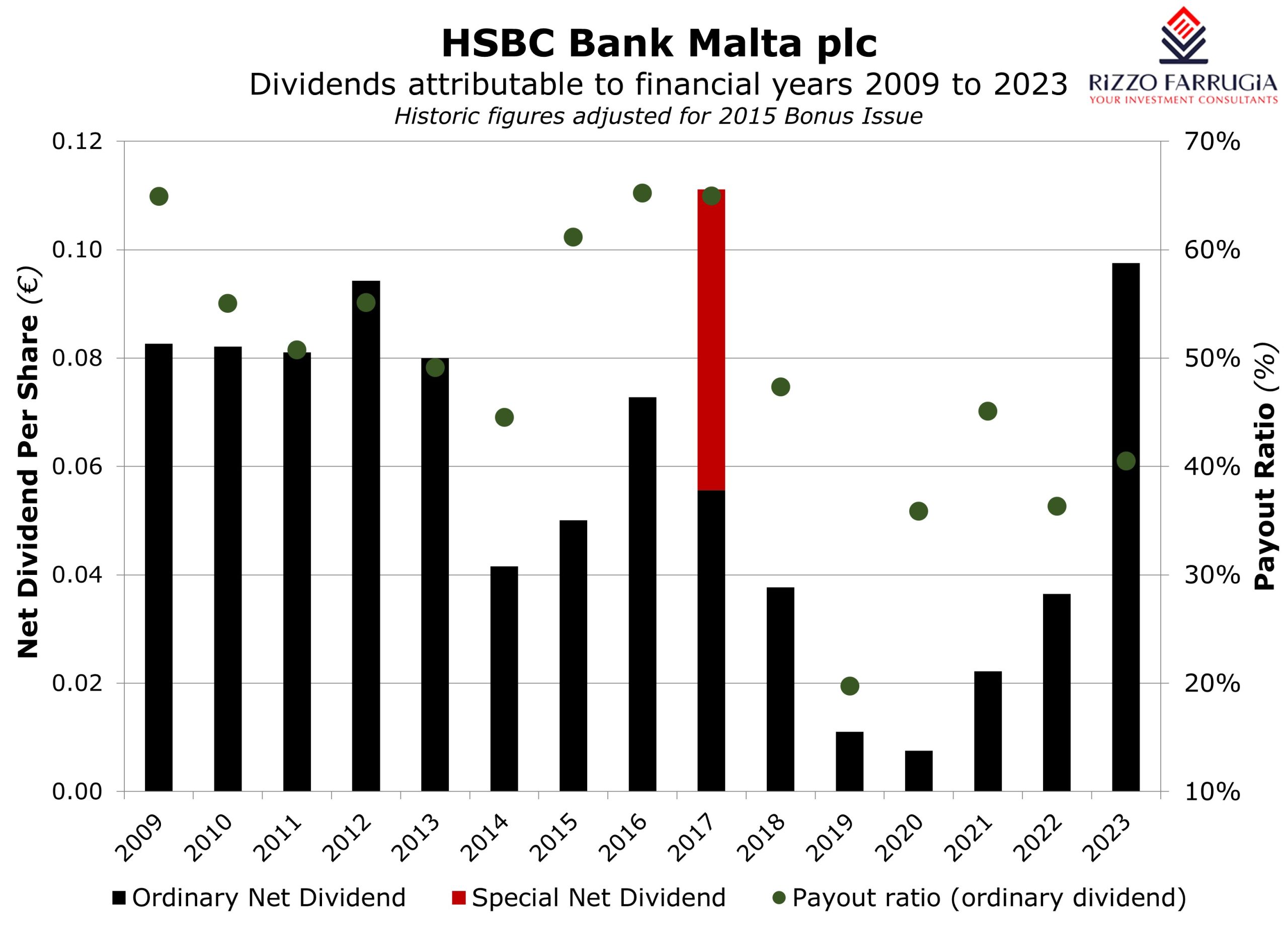

As a result of the bumper profits generated in 2023, dividends to shareholders in respect of the past financial year totalling net dividends of €0.0975 per share (interim dividend of €0.039 per share paid in September 2023 and €0.0585 per share to be paid in April 2024 subject to approval at the AGM) will be at their highest level since 2007 (when excluding the special dividend distributed in 2017). This should be welcome news after a period of subdued distributions to HSBC Malta shareholders for most of the past decade especially during the last three years. Meanwhile, the net asset value per share jumped by 14.7% to an all-time high of €1.507.

Although the major central banks are all widely expected to start cutting interest rates during the course of this year, the magnitude and timing of these rate cuts remains uncertain and dependent on a variety of factors. However, with a rate cut almost ruled-out at the next ECB meeting due on 7 March, and the possibility that rate cuts will commence at the meeting on 6 June, the current interest rate environment at 4% will lead to continued high levels of profitability for HSBC in 2024 and all other banks with high levels of liquidity. Unfortunately, HSBC Malta does not provide forward guidance similar to HSBC Holdings which last week announced that it is expecting net interest income to rise by a further 14% during the current financial year.

Dividends by HSBC Malta are easily sustainable not only due to the elevated profitability expected again in 2024 as a result of the current interest rate environment but also given the very high capital ratios (Tier 1 ratio of 20.6% compared to 14.8% for HSBC Holdings plc). Moreover, one must not overlook the importance of being a subsidiary of the wider HSBC Group which is beneficial in the context of regulatory approval for dividend distributions. Finally, HSBC Malta’s dividend payout at 40% for 2023 is below the dividend payout ratio of 50% of HSBC Holdings plc and one would expect the ratio of HSBC Malta to converge to international group policy over time under normal circumstances. Despite the rally in the share price towards the €1.40 level (the highest since October 2019), the net dividend yield equates to just above 7%. This high yield is likely to get some investors questioning their strategy of being hugely overweight bonds when some companies in Malta provide substantially higher dividends than those offered across the bond market where coupons are reported gross of 15% final withholding tax.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.