Interest rate cuts ahead

Following the recent short-term correction across international equity markets and the subsequent sharp rebound with the S&P 500 index now just minimally below the all-time high registered in mid-July, the main focus of attention last week was the speech by the Chairman of the Federal Reserve at the annual Jackson Hole Economic Policy Symposium.

In his highly anticipated speech, the Chairman of the Federal Reserve Jerome Powell said “the time has come” to start cutting interest rates. Mr Powell also stated that “confidence has grown that inflation is on a sustainable path back to 2%,” after rising to about 7% during the COVID-19 pandemic. Mr Powell also commented that the upside risks to inflation have diminished.

The Chairman of the Federal Reserve was unequivocal that “the direction of travel is clear” and added that “the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

Meanwhile, he also said that a slowdown in the labour market is “unmistakable” and “the downside risks to employment have increased.” He stated that the Federal Reserve “will do everything we can to support a strong labour market as we make further progress toward price stability.”

In his intervention Mr Powell acknowledged recent softness in the labour market and said that the Federal Reserve does not “seek or welcome further cooling in labour market conditions.” From the numerous articles I read over recent days covering the outcome of this important event, a number of market commentators claimed that this statement was the most important part of his speech.

Essentially, the Federal Reserve has two goals – to maintain stable prices and to maximise employment. It is always delicate to balance these two goals. If a central bank waits too long to lower interest rates, the higher borrowing costs may negatively impact economic performance and the state of the labour market.

With inflation now within reach of the central bank’s 2% target, the priority of the Federal Reserve is to stop the labour market from deteriorating further via the stimulus that lower interest rates can bring.

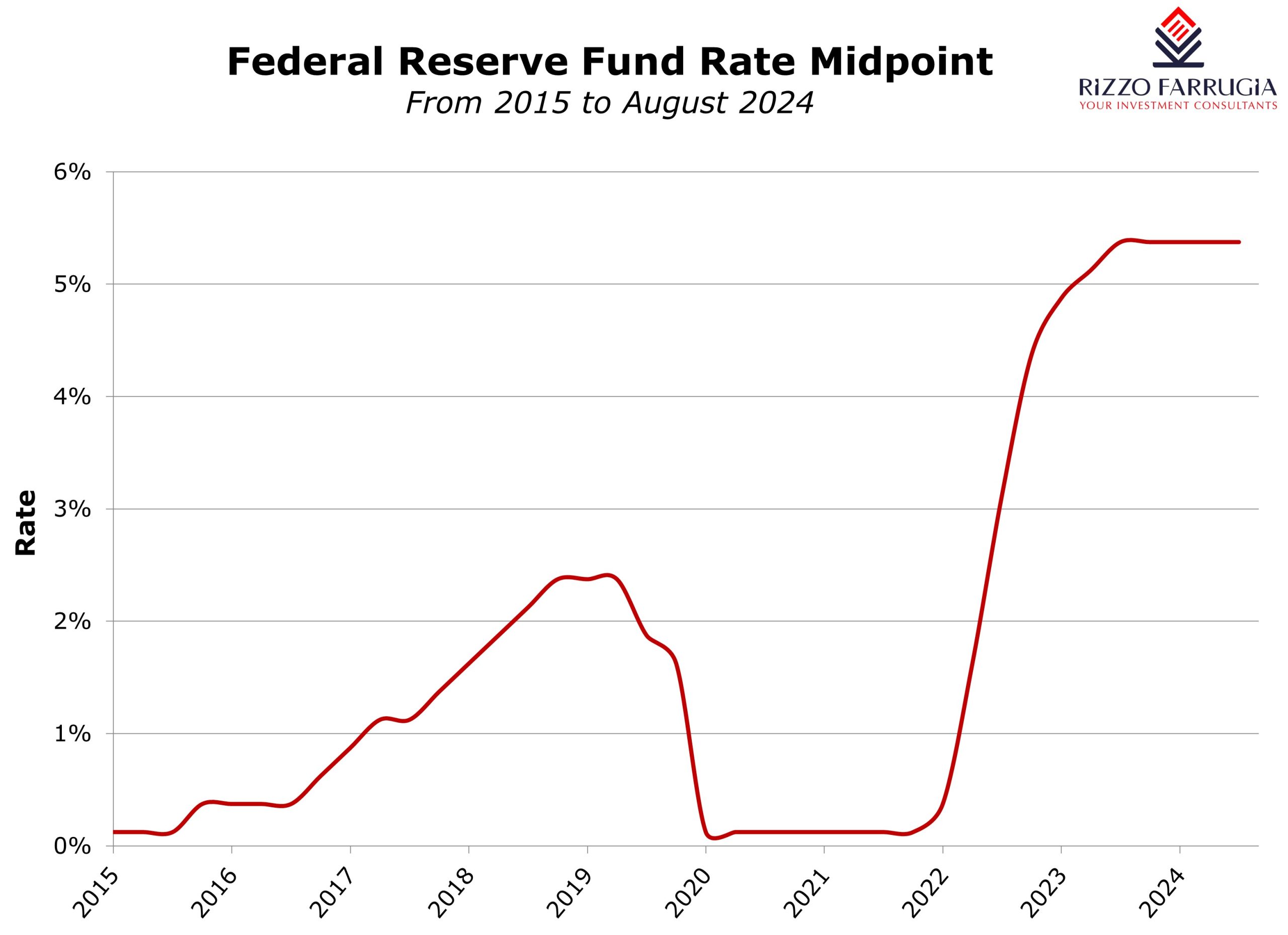

Most analysts are currently forecasting that the Federal Reserve will commence monetary policy easing measures with a reduction of 25 basis points (0.25 percentage points) in the Federal funds rate at the upcoming meeting being held on 17 and 18 September from the current range between 5.25% and 5.50%. This would mean that the Federal Reserve is beginning a new interest rate cycle more than two-and-a-half years after it started hiking borrowing costs in order to stem the surge in inflation following the pandemic.

However, the recent emphasis by the Chairman of the Federal Reserve on protecting the labour market raises the chance of a bigger cut in interest rates, especially if the upcoming jobs report for August, due to be released next week (6 September) shows further deterioration following the July employment figures. Earlier this month, the weaker-than-expected July jobs report rattled markets as it revealed that there were just 114,000 jobs added to the economy last month with the unemployment rate rising to 4.3%, the highest since October 2021.

Mr Powell was not specific about the potential pace of future cuts in interest rates or on the possible extent of the envisaged decline in the federal funds rate. Money markets are currently indicating that the federal funds rate will be within the range of 3.00%-3.25% by the end of 2025 implying a decline of more than 2 percentage points (200 basis points) from current levels.

Following the upcoming Federal Reserve monetary policy meeting in mid-September, there are a further two meetings this year scheduled for 7 November and 18 December.

The consensus view is that the Federal Reserve policymakers are more likely to start with a cut of 25 basis points in September, while leaving open the possibility of a larger move if broader labour market conditions deteriorate rapidly thereafter.

The upcoming interest rate cuts in the US would align the Federal Reserve with many of its peers, which have also eased monetary conditions as inflation has fallen across developed economies.

The European Central Bank lowered its key deposit rate by 25 basis points in June to 3.75% and maintained this level at the most recent meeting in July. However, a further two additional cuts of 25 basis points each are expected by the ECB until the end of this year bringing its key deposit rate to 3.25%.

In the UK, the Bank of England also reduced its policy rate in August, although the Governor Andrew Bailey gave clear indications against the idea of a series of further cuts in the immediate term.

The current environment of two of the major central banks already reducing interest rates and the Federal Reserve following in their footsteps imminently marks a new cycle in the interest rate environment following the sharp upturn in rates that took place between 2022 and 2023. Although there is still a lot of uncertainty on the pace of future cuts in interest rates by all three central banks and the widespread view that interest rates will not go down to the historically low levels that investors became accustomed to for a number of years before 2022, only a few days ago, one of the most prominent investment banks in the US indicated that the Federal Reserve is likely to reduce interest rates by 150 basis points within the next twelve months, the ECB by 125 basis points and the Bank of England by 100 basis points.

In previous cycles of interest rate reductions by the Federal Reserve, statistics dating back to 1989 indicate that, as long as the economy did not enter a recession, the S&P 500 index gained at least 11% within 12 months of the first interest rate cut. However, when the US economy entered a recession in the following 12 months, the S&P 500 fell by at least 14% over the next year.

Meanwhile, for bond investors, the changing interest rate environment should translate into higher bond prices (and lower yields). This would be positive for those investors already invested in such fixed-income securities. However, for those investors sitting on idle cash or using treasury management options for their current needs could end up finding it increasingly difficult to continue to achieve those returns going forward or investing into medium to long-term bonds at lower yields than those currently prevailing.

Print This Page Disclaimer

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.