IPO of Valletta real-estate owner VBL

VBL plc published a Prospectus on 27 July 2021 in connection with the issuance of 35,714,286 new shares at €0.28 per share (amounting to €10 million) and in the event that these new shares are taken up, an offer will take place of up to an additional 35,714,286 shares also at a price of €0.28 per share which will see some of the existing shareholders reduce their stake in the company.

Few investors may be aware of the ownership structure and the business model of VBL. The company claims to be the largest owner of real-estate in Valletta. It was set up in 2012 and since then pursued an ambitious and aggressive strategy aimed at building a portfolio of properties mainly targeting the residential and commercial segments in Valletta. The business model centres around acquiring properties characterised by legacy tenants and complex title/legal issues at deeply discounted prices. In addition, VBL provides property management services to third-party property owners (including investors in boutique hotels) which also serve as a platform for the Group to broaden its recognition across the market.

The company currently owns various properties having a total gross area of circa 13,200 sqm with a market value of over €50 million. The majority of these properties form part of the ‘Silver Horse’ project whilst another sizeable portion is made up of properties which, in the main, are leased for residential/hospitality purposes.

The net proceeds from the issuance of the 35,714,286 new shares at €0.28 per share are earmarked towards funding part of the Group’s strategic investment and development plans. In fact, it is estimated that VBL will require a total of €29.3 million over the next five years comprising: (i) the acquisition of new properties for a total amount of €8.3 million; (ii) the development of a number of properties for which VBL already has the necessary planning permits in hand (€10.2 million) and (iii) the development of a number of properties for which VBL is in the process of obtaining planning permits (€10.8 million).

Part of the proceeds from the IPO will be to finalise the acquisition of the ‘Coliseum’ building which is eventually intended to be developed into a complex of luxury fashion and retail brands to compliment the growing presence of up-market brands along Valletta’s main streets.

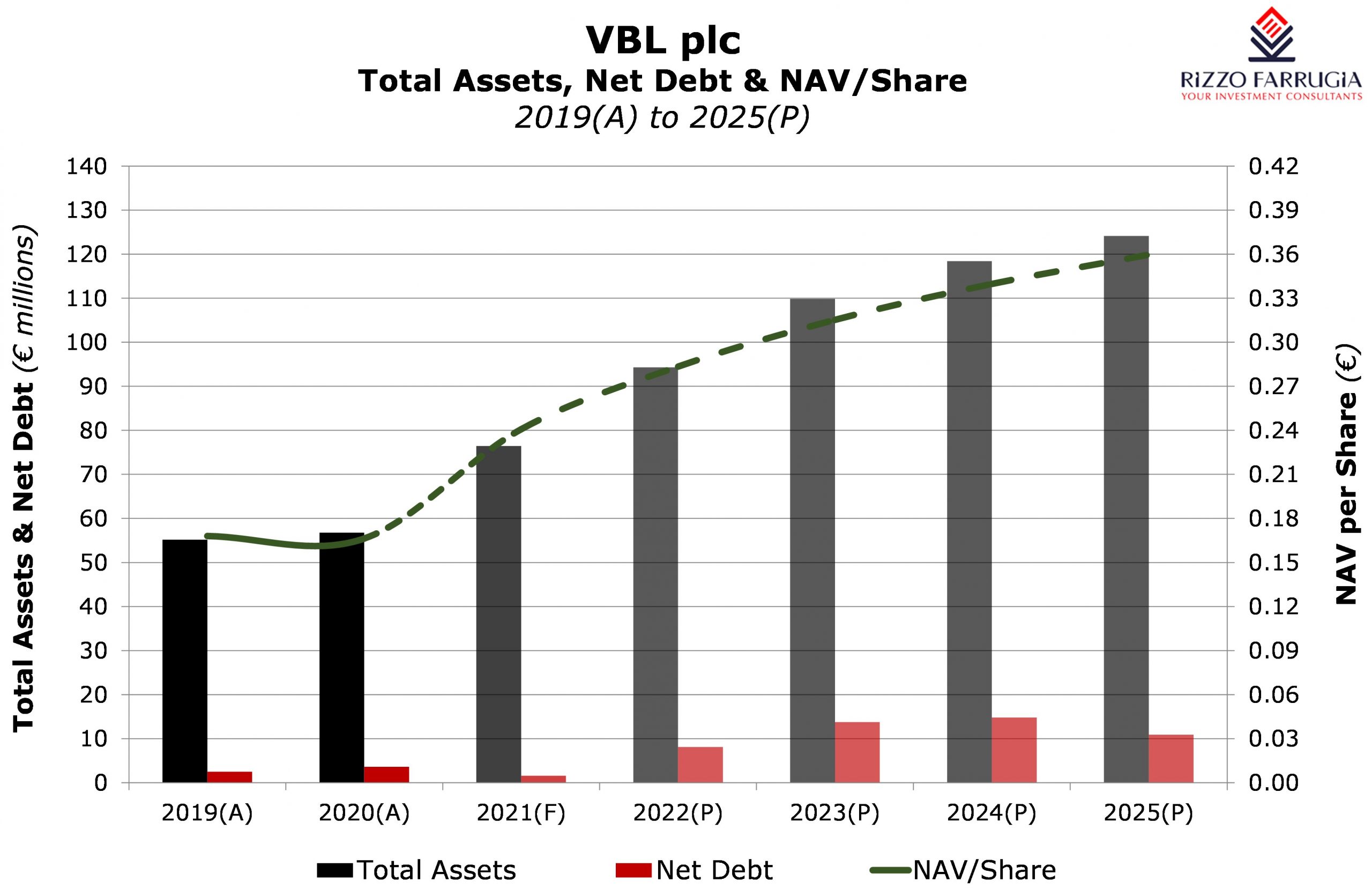

The company has very little borrowings to date and aims to take on additional leverage in 2022 and 2023 to partly fund the upcoming development plan. The prospectus provides the financial projections until 2025 indicating that the overall borrowings will rise to only €15 million by 2024. The company is therefore aiming to maintain a very low level of gearing despite the heavy investments being undertaken in the next few years.

In view of the ambitious development plans and funding needs of the company in the coming years, as well as the fact that a large part of the Group’s assets are as yet not operational and therefore not generating a consistent revenue stream, it is not expected that the company will be in a position to declare high dividends to new investors immediately after the IPO. Notwithstanding this, the company’s dividend policy is to distribute between 30% and 50% of its recurring free cash flow on an annual basis, subject to statutory requirements and availability of profits for distribution. This is expected to become more meaningful in subsequent years once a larger proportion of the property portfolio becomes fully operational.

While some investors may view equities primarily for their dividend stream, the majority of investors ought to participate in equity to participate in the growth element of a company.

In the case of VBL, the objective is for the company to consolidate its position as the largest owner of property in Valletta by developing a number of properties already owned or in the process of being acquired.

These include the completion of the ‘Silver Horse’ project and the acquisition and redevelopment of the ‘Coliseum’ building which together will represent 64% of VBL’s property portfolio in terms of size and will thus be the principal income generators of the Group.

Once fully redeveloped by 2025, the ‘Silver Horse’ will be Valletta’s largest mixed-use project with a total gross area of circa 8,350 sqm (representing almost half of the Group’s property portfolio in terms of size and value) of residential, hospitality, retail, entertainment, and office space. Part of this extensive project, known as ‘The Gut’, is already fully operational and is synonymous with the new entertainment hub created in parallel with the regeneration of the historic Strait Street.

VBL is budgeting a total investment of close to €12 million to acquire and commercialise the ‘Coliseum’ building scheduled for completion by 2025. The property is expected to be the second largest asset of VBL representing 17% of the Group’s total property portfolio when measured by size, and 19% of the total property by value, and will serve as a unique hub for luxury fashion brands in Valletta. The objective is inspired by similar landmark buildings which are usually found at the centre of other capital and major cities across the world that serve as a focal point for high-end travellers.

The projections provided in the Prospectus show that VBL is expecting its financial performance to improve markedly over the coming years. Initially, this is expected to take place on the back of the post-pandemic economic recovery especially in the tourism sector, and thereafter in line with the gradual completion of the various projects which are in the pipeline. In fact, revenues are expected to surge to almost €10 million by 2025 compared to €0.64 million in 2021. The anticipated increase in volume of business is also projected to filter into improved profitability, with the Group targeting an operating profit of €4.84 million by 2025 compared to an operating loss of €0.32 million in 2021.

Moreover, the projections also reveal that the equity base is anticipated to reach nearly €102 million by the end of 2025 compared to the forecasted figure of €68.3 million as at 31 December 2021 which also includes the €10 million equity raise that is currently being targeted. The significant uplift in the projected net asset value of VBL is primarily driven by the annual adjustments to the fair value of the Group’s various property assets reflecting the successful completion of VBL’s investment programme, as well as the additional value to be unlocked in the process of redeveloping its portfolio of properties. In this respect, the net asset value per share of €0.36 based on the projected net asset position in 2025 represents a premium of nearly 30% over the current IPO offer price of €0.28 per share.

While the attainment of this additional net asset value is highly dependent on the Group raising the necessary funding and on the successful execution of its ambitious development plan, it excludes any other potential additional business that VBL could pursue in the future such as the intended regeneration of the large area hosting the Salinos ground through an exclusive strategic relationship with Valletta Football Club. According to recent media reports, the project will include the construction of modern sport facilities covering a variety of disciplines, childcare and other educational facilities as well as an area for commercial activities including a number of retail outlets together with food and beverage facilities within the precincts of a 6,000 square metre garden.

Although there are already a number of different real-estate companies listed on the Malta Stock Exchange ranging from a mix of pure commercial property companies to development companies for specific projects (such as MIDI plc), VBL is pretty unique given its specific focus on real estate in Valletta which is characterised by very limited and fragmented supply.

Rizzo, Farrugia & Co. (Stockbrokers) Ltd is acting as Sponsor, Manager and Registrar to VBL plc.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.