It’s a Bear Market!

This article was being penned before the extraordinary events on Monday morning when the international headlines were still dominated by the spreading of the coronavirus which hugely impacted the performance of global equity markets. Many commentators and investors generally refer to a bull market or a bear market to describe the different phases of a stockmarket or the performance of a specific asset class. A bear market is normally defined as a decline of 20 per cent in the value of the stockmarket while a bull market represents an upturn in excess of 20 per cent. Meanwhile, when a stockmarket index or an asset class falls by more than 10 per cent from its most recent peak, it is often said to have entered “correction” territory. It is referred to as a correction because historically the drop often “corrects” and the price or the index returns to their longer-term trend.

In February, the European equity market experienced its fastest correction in 30 years. In just nine trading days between 18 and 28 February, the MSCI Europe index fell by 12.5% coinciding with the news of a rapid rise in new COVID-19 infections outside China. During the first week of March, equity markets attempted a recovery but remained extremely volatile from one day to the next despite the surprising 50 basis point interest rate cut by the Federal Reserve on Tuesday 3 March in an effort to protect the US economy from the impact of a coronavirus outbreak.

However, a sudden turn of events over the weekend of 7 March brought another dimension to the performance of the financial markets over recent days. The breakdown of the OPEC talks in Vienna on Friday, followed by Saudi Arabia’s announcement that it would abandon attempts to limit supply, and instead aim to increase its market share, overshadowed the impact of the coronavirus and is now the main driver of stockmarket movements. As a result of this dramatic development, on Monday morning the oil price suffered a historic decline as it tumbled by no less than 30% (the steepest daily decline since the Gulf War in 1991) causing another significant drop across all international equity markets.

Until last week, one of the main questions being asked was whether equity markets will indeed enter a bear market or recover from the ‘coronavirus-induced correction’ and continue their upward trajectory that commenced shortly after the start of the global financial crisis in September 2008.

The steep decline in the oil price coupled with the spiralling impact from the coronavirus amplified fears that a global economic recession will now emerge, sent equity markets deeper into negative territory on Monday.

As a result, all the major European indices are in official bear market territory having fallen more than 20% with the worst performer being the Italian FTSE MIB Index with a decline of 27.5%. In the US, following Monday’s 7.6% decline, the S&P 500 is 19% below its intraday all-time high of 3,393.52 points touched as recently as 19 February and therefore very close to entering a bear market.

Before the events earlier this week, the Organization for Economic Cooperation and Development (OECD) had already stated that the virus had put the world economy in its most “precarious position” since the 2008 financial crisis. There were signs that the virus was stabilising in mainland China, but it is still too early to gauge the duration of this health crisis as the number of cases is still spreading rapidly in certain countries in Europe (mainly Italy) and now also in the US.

Many financial market commentators had been comparing the current situation of the coronavirus to that in 2003 following the outbreak of SARS which was however much less severe. Moreover, certain sectors are performing much worse reflecting the greater importance of Chinese consumers and Chinese demand for commodities than in 2003. Due to the very disruptive containment measures introduced so far in Italy to halt the further spreading of the disease and potentially to be followed in other countries in due course, it is not clear how much economic damage will be caused before things start to improve.

Hopefully, in the not too distant future, the spread of the virus will be brought under control as is evident now in China, a vaccine will emerge and economic activity will start to return to normal relatively quickly similar to the last global health crisis of SARS in 2003.

Many investors may have been looking at the downturn across equity markets to acquire shares of companies that have been worst affected by the coronavirus in anticipation of a swift rally thereafter. However, the extraordinary events earlier this week added another dimension that may not have been taken into account earlier. It is therefore harder to understand the speed with which markets can recover once the virus is contained since it is dependent not only on the scale of economic disruption in the intervening period but also on the repercussions of the oil price shock.

During the recent extraordinary few weeks, certain sectors were very badly impacted while others fared generally better. Luxury goods, oil and gas companies and airlines are among the worst performers.

In the luxury goods sector, LVMH and Kering (the parent company of Gucci) saw their share prices shed 23% and 26% respectively from their recent all-time highs in mid-January. The share price of Ryanair skidded by an extraordinary 35% within a few weeks and similarly in the oil and gas sector, the share prices of most of the major oil producers experienced a significant decline. The share price of BP plc for example sunk by 36% since its 2019 high to its lowest level since 2010.

The utilities, healthcare and consumer staples sectors are generally regarded as defensive sectors and indeed they have significantly outperformed the wider market. However, these sectors still performed negatively with declines of between 9% and 12%

In Malta, the first cases of coronavirus were reported over the weekend. The equity market dropped to a fresh 1-year low on Monday registering a drop of 7% from its recent high which is much less compared to the steeper declines across the larger international equity markets. The equity that was understandably impacted the most was Malta International Airport plc, whose share price entered deep into correction territory as it shed 18.6% from its recent high of €7.00. Moreover, the equity is down by more than 28% from its all-time high of €7.95 in May 2019.

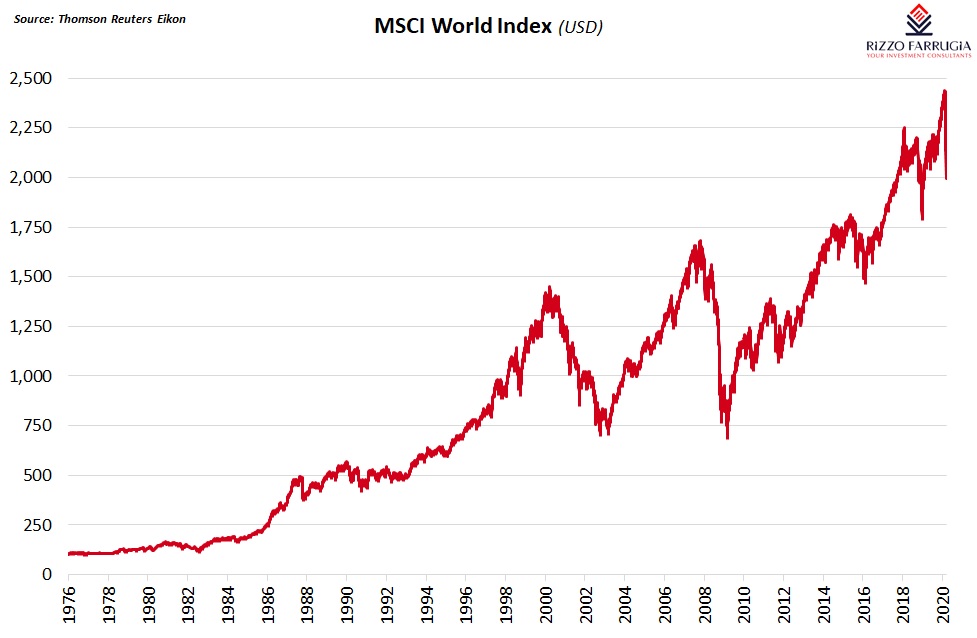

Monday 9 March 2020 will be remembered as a new ‘Black Monday’ for financial markets. Although in times like these many people get frightened and may panic, investors must always keep in mind their medium to long-term investment objectives which should not be affected by such extraordinary events. This graph clearly indicates that periods when markets tumble such as in October 1987, in the year 2000 and in September 2008 (when Lehman Brothers went bankrupt), turned out to be temporary events in a long-term upward trajectory for equity markets.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.