It’s a bull market

In last week’s article I explained a number of important achievements over recent months as international equity markets performed remarkably well despite multiple sources of uncertainty arising from both the macro-economic environment as well as the geopolitical situation.

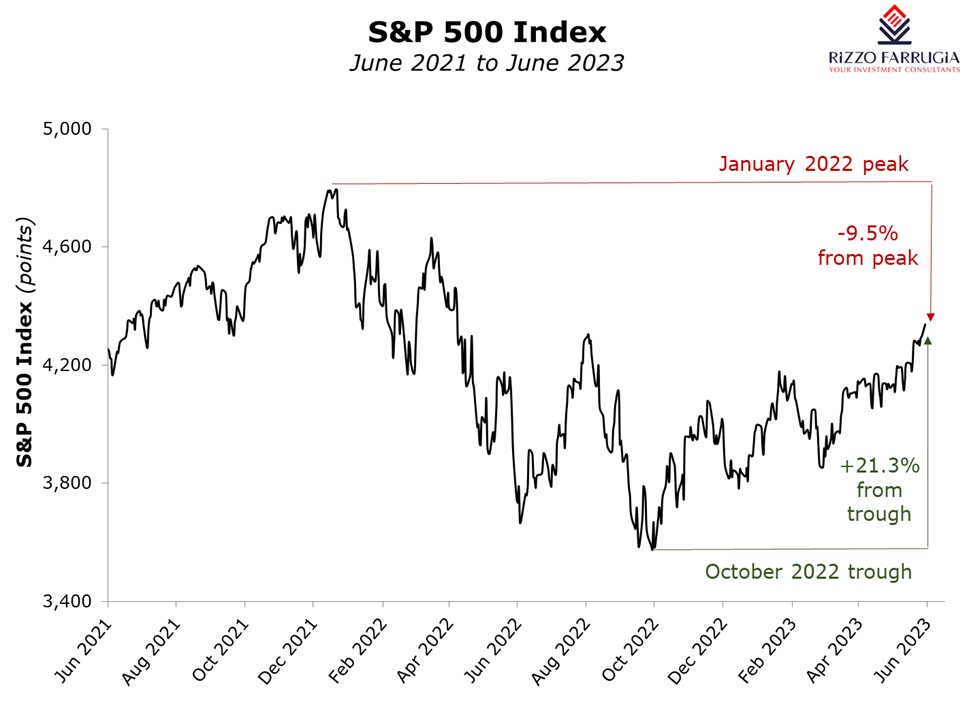

Incidentally, last Thursday, the S&P 500 index in the US reached another important milestone as it entered a theoretical bull market having recorded a 20% jump from its low of 3,577.03 points on 12 October 2022. This brought to an end the bear market that began in January 2022. Statistics indicate that this ranked as the longest bear market since 1948. It lasted 282 days between 3 January 2022 and 12 October 2022 and during this period, the S&P 500 index shed 25.4%. Despite the duration of the bear market, it ranks as a mild downturn given the fact that the average bear market since 1929 resulted in a decline of 39.4%.

Following the initial relief rally during the fourth quarter of 2022, the S&P 500 has gained just under 13.5% this year mainly due to the fact that the economy has so far avoided a sharp downturn despite the consistent interest rate hikes by the Federal Reserve. Moreover, recent inflation readings have shown that inflation has come down significantly from last summer’s peak without higher interest rates triggering a sharp increase in unemployment.

Over recent weeks, the rally gathered momentum following the deal reached to end the debt ceiling crisis as well as growing optimism that the Federal Reserve will pause rate hikes during the scheduled monetary policy meeting taking place this week. The US equity market continued to perform positively at the start of the week with the S&P 500 index jumping to its highest level since April 2022.

Notwithstanding the 20% gain in the index since the low of 3,577.03 points last October, the S&P 500 index has not yet reached a new high. In fact, the S&P 500 index is still circa 9.5% below the record level of 4,796.56 points on 3 January 2022.

This latest bull market is considered to have begun on 13 October 2022, a day after the S&P 500 closed at its most recent low. As such, theoretically, it has taken 164 days for the index to enter into bull market territory. Looking back at previous market rallies, one notes that since 1932, the average bull market has lasted nearly five years and delivered a 178% gain.

There are mixed views from several market commentators on whether this fresh bull market will last or whether it will prove to be a short-lived rally.

One of the reasons behind the scepticism for the strength of this bull market is the fact that the current rally is primarily driven by gains in the large technology companies. In fact, across many financial journals, these companies have been defined as the “Super 7’s” most of which are benefiting directly from the AI boom. Nvidia, Tesla, Alphabet, Microsoft, Apple, Amazon and Facebook’s parent Meta Platforms are the companies that contributed to the current bull market. In fact, if you remove these companies from the S&P 500 and consider the remaining 493 companies forming part of the benchmark, then the index would not show any gains this year. Moreover, this can also be analysed through the performance of the tech-heavy Nasdaq Composite which is outperforming the broader US equity benchmark with gains of over 33% from its 52-week low last October.

Since the start of the year, the share price of Nvidia is the star performer with a gain of 175% helping it become the sixth largest public company in the world valued at over USD1 trillion.

Tesla gained 131% and Meta’s share price has so far jumped 117%. Meanwhile, Apple, and Amazon are both up over 45% while Alphabet is up almost 40% over the past 6 months.

Apart from the Super 7’s, two other companies forming part of the S&P 500 index also showed remarkable gains so far this year although they are much smaller in size to have a large impact on the overall direction of the market. Advanced Micro Devices, a semiconductor company also benefitting from the AI boom, is up 101% and Royal Caribbean is showing gains of 92% following a stronger-than-expected demand for travel following the pandemic.

Furthermore, a key concern is whether inflation in the US will remain well-above the targeted level, as it raises the prospect that the Federal Reserve has not yet finished with its aggressive interest rate increases and will resume hikes in July following the widely-anticipated pause during this week’s monetary policy meeting.

Naturally, a key determinant of whether this bull market will be maintained will be upcoming interest rate decisions by the Federal Reserve. Many market commentators believe that the rally can be sustained if the interest rate hike expected in July will be the final increase of the monetary tightening cycle but this is all dependent on the inflation rate.

One particular investment bank that until recently was rather bearish on the future outcome of the market has now turned bullish by claiming the S&P 500 could climb to a new all-time high of 4,900 points within the next 12 months which would imply a gain of a further 13% from current levels. This would be very much in line with similar trends in the past. In fact, after surpassing the 20% threshold, the S&P 500 on average continued to rise over the next 12 months in 92% of the time with an average return of 19%.

As explained last week, it is always extremely difficult to time the markets to perfection. Few retail investors would have expected such a recovery in technology companies after such a dismal performance in 2022 given the prospect of further hikes in interest rates. Yet again, the unpredictable outcome over recent months indicates that if one invests in a portfolio of high-quality businesses at reasonable prices, this should generate very handsome returns over the long term.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.