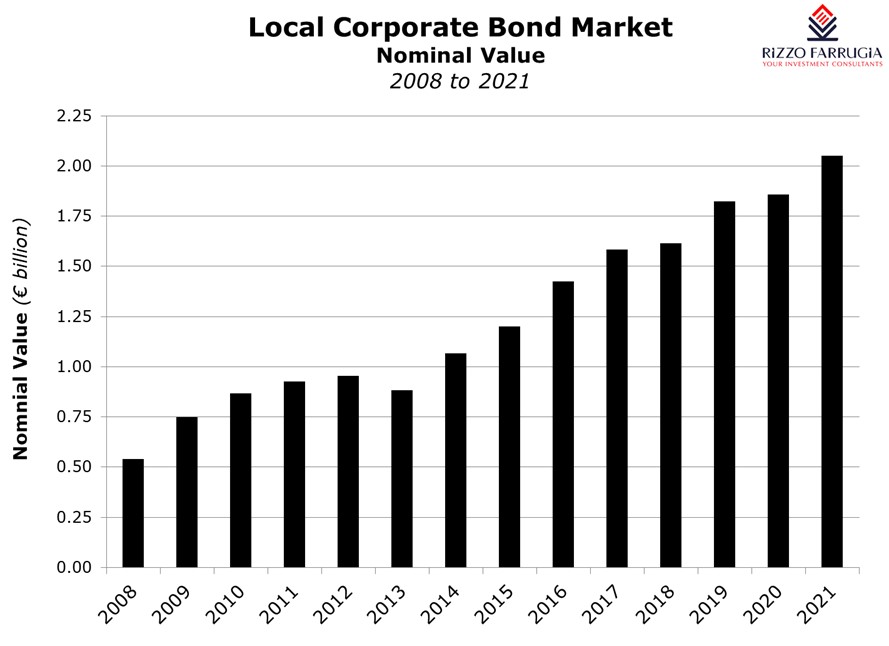

Malta’s corporate bond market reaches €2 billion

Following the successful €80 million fund raise by International Hotel Investments plc earlier this month, the overall size of Malta’s corporate bond market has now surpassed the value of €2 billion. This is an important milestone.

In the coming weeks, the Malta Stock Exchange will be celebrating its 30th anniversary since the start of trading in 1992 and when one monitors the progress of the corporate bond market, it is immediately evident that the stronger rate of growth in terms of new issuance across the primary market occurred in the most recent years. In fact, the overall size of the corporate bond market doubled in value since 2014 when it had reached the €1 billion level.

These values refer to those bonds listed on the Regulated Main Market of the MSE and excludes the smaller issues that appear on Prospects MTF. Across the Prospects MTF, there is a total of €88.4 million in issue across 21 bonds.

There can be multiple reasons behind the increased corporate bond issuance on the Regulated Main Market over more recent years. One of the main factors could be due to the steep decline in secondary market yields across the eurozone following the accommodative monetary policy conditions adopted by the European Central Bank via its various quantitative easing programmes. The decline in yields ought to have made it more attractive for companies to consider debt funding from the general public. Moreover, several companies may have also started to appreciate the benefits of diversifying one’s sources of borrowings and not be strictly dependent on banks. The mix of funding sources could provide multiple benefits to certain companies that would need to maintain a certain element of long-term funding/borrowings in order to optimise shareholder returns.

During the course of 2021, there were three companies that approached the bond market for the first time, namely GO plc with a €60 million bond issue, Brown’s Pharma Holdings plc with a €13 million bond issue and Dino Fino Finance plc with an issue of €7.8 million. Moreover, Mizzi Organisation Finance plc returned to the bond market for the third time in its history with a €45 million bond issue.

Additionally, Smartcare Finance plc and Central Business Centres plc utilised the bond market partly to refinance existing bonds and also raise additional funding for new projects.

When analysing the largest companies on the bond market, the Corinthia Group (incorporating International Hotel Investments plc, Corinthia Finance plc and Mediterranean Investment Holdings plc) remains the largest issuer with total bond issuance of €385 million accounting for 18.8% of the overall market totalling €2.05 billion. The Hili Ventures Group (incorporating 1923 Investments plc, Hili Finance Company plc, Premier Capital plc and Hili Properties plc) accounts for 12.6% of the overall bond market with total bond issuance of €258 million. Bank of Valletta plc is the third largest issuer with total bond issuance of €161.6 million representing 7.9% of the bond market. Following the €60 million bond issue this year, the GO Group (incorporating GO plc and its 62.2% owned subsidiary Cablenet Communications Systems plc) accounts for just under 5% of the overall corporate bond market.

Since the beginning of December, another three companies announced that they obtained regulatory approval for new bond issues. GAP Group plc are offering the option to holders of the €19.2 million 4.25% secured bonds due in October 2023 to exchange their bonds into a new offering of €21 million secured bonds at a rate of 3.9% due to be redeemed between 2024 and 2026. AX Real Estate plc (a subsidiary of AX Group plc) announced a dual offering made up of up to 50 million shares at a price of €0.60 per share together with a €40 million bond issue at a coupon of 3.5% and redeemable in 2032. Moreover, St. Anthony Co plc announced the issue of €15.5 million secured bonds at a coupon of 4.55% and due for redemption in 2032.

During the course of next year, there are three bonds that are up for redemption, namely the €29.2 million 3.65% GAP Group plc in April, the €40 million 5% Mediterranean Investment Holdings plc in July and the €21.5 million 6% Pendergardens Developments plc also in July.

Following the increase in new issuance in the second half of 2021 and the strong momentum going into next year with the three new issues by GAP Group plc, AX Real Estate plc and St. Anthony Co plc, hopefully this vibrant activity will be maintained during the course of 2022 in order to enable the numerous retail investors to continue to seek to diversify across different companies and possibly also different economic sectors.

Following the Listing Policies that came into force in 2013, most of the issuers across the corporate bond market are now required to publish financial forecasts on an annual basis via a Financial Analysis Summary which must be published within two months from the publication of the annual financial statements. As highlighted in my article last week on the need for companies to adopt a more effective communications strategy to enable investors to remain abreast of industry-wide developments, this also applies to the bond issuers. Although some companies organise annual meetings for financial analysts to delve deeper into their financial highlights, this practice is not that widespread and all companies should actively seek to discuss their business strategy to enable the market to gauge their financial soundness.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.