Malta’s economic prospects post COVID-19

In recent days, the International Monetary Fund (IMF) and two major credit rating agencies – Fitch Ratings and Moody’s – all published updated reports and analysis on Malta’s expected economic performance post COVID-19. Last month, the other major international credit rating agency S&P had also issued its updated position on Malta. A review of the main highlights from such expert reports is interesting to gauge the different views on Malta’s upcoming economic prospects.

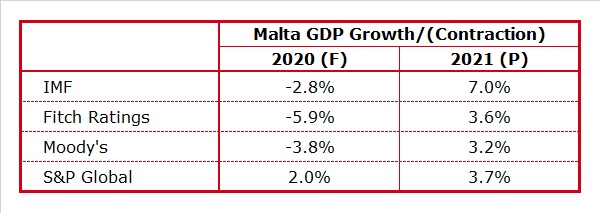

At the beginning of last week, the IMF stated that Malta’s GDP is projected to shrink by 2.8% in 2020 (compared to a growth of 4.4% in 2019). However, the IMF anticipates that the local economy will rebound strongly in 2021 with a growth rate of 7%. Unemployment is also expected to rise to 5% this year according to the IMF before falling slightly to 4.4% in 2021 compared to the unemployment rate of only 3.4% in 2019. In the World Economic Outlook published last week, the IMF estimated that the global economy will contract by 3% as a result of the spread of COVID-19 but is expected to grow by 5.8% in 2021 assuming the pandemic fades in the second half of 2020 and containment efforts are slowly unwound. On the other hand, however, the IMF stated that given the extreme uncertainty surrounding the crisis, there are other possible scenarios which could lead to weaker economic performances around the world if the pandemic does not recede during the second half of this year.

Fitch Ratings maintained Malta’s rating at ‘A+’ but revised the outlook to ‘stable’ from ‘positive’. Fitch said it forecasts real GDP to contract by 5.9% in 2020 and expects GDP growth to be 3.6% in 2021. With respect to the tourism sector, Fitch Ratings stated that it expects Malta to suffer a sharp contraction in the second quarter of 2020, before recovering slowly in the second half of the year. Fitch stated that hotel occupancy in 2020 is expected to be close to 50% of 2019 levels, with the remaining sectors dependent on tourism to be harshly affected as well. Fitch estimates the government to register a budget deficit of 8.2% of GDP in 2020, from a surplus of 0.8% in 2019. The rating agency then expects a budget deficit of 5% of GDP in 2021. Meanwhile, the overall general government debt is expected to increase to 55.7% of GDP in 2020, from an estimated 43.4% in 2019, reflecting the expected additional borrowings of up to EUR2 billion during the course of this year.

However, Fitch Ratings also stated that there could be “material downside risks” to their forecasts. Fitch stated that “the extent and duration of the restrictions on activity could be greater and longer-than-expected, or the tourism sector could fail to recover in 2H20, especially if Malta or its trading partners extend their lockdown periods”. If such a scenario were to materialise, Fitch acknowledged that one “would expect a larger decline in output in 2020 and a weaker-than-expected recovery in 2021, which could have negative repercussions for growth prospects and public finances over the medium-term”. Fitch estimates that Malta’s unemployment rate will increase to 6.1% in 2020 from 3.4% in 2019 before edging down to 5.1% in 2021.

On its part, Moody’s affirmed Malta’s credit rating at ‘A2’ with a ‘stable’ outlook. Moody’s said the stable outlook on the rating reflects its expectation that although the outbreak of the coronavirus will cause a significant economic and fiscal shock in 2020, it expects the outbreak to have a short-lived negative impact on Malta’s economy or public finances. Moody’s expects Malta’s GDP to contract by 3.8% in 2020 and to grow by 3.2% in 2021. Moody’s explained that although tourism remains a key sector, the remote gaming sector and the professional services sector have grown in importance over the past years and these are not expected to be significantly affected by the pandemic, thus compensating for the harder-hit sectors.

S&P was the first rating agency to issue its updated views on Malta. In mid-March, S&P maintained Malta’s ‘A-/A-2’ sovereign credit rating but revised its outlook to ‘stable’ from ‘positive’. The agency explained that the outlook was changed in view of “a likely sharp economic slowdown emanating from the spread of COVID-19, which we expect will have a negative effect on external demand from Malta’s key economic partners”.

Moreover, S&P indicated that the outlook was also changed due to fact that “the country’s reputational risks related to weaknesses in regulatory financial and anti-money-laundering supervision represent an increasing risk to its macro-financial stability”. In last month’s report, the agency estimated that Malta’s GDP will grow by 2% in 2020 down from 4.4% in 2019. The rating agency also anticipated that GDP will grow by 3.7% in 2020.

Another interesting dimension which could impinge on Malta’s economic prospects given the importance of tourism for Malta’s overall economy was provided by Ryanair’s Chief Executive Officer Michael O'Leary in a media interview last week. Mr O'Leary predicted a swift rebound in passenger traffic for Ryanair as a result of what he described as a "massive price-dumping". Ryanair is the single largest carrier travelling to and from Malta, so if the view of their CEO materialises, it would be very reassuring for the tourism industry in Malta in the months ahead.

The coronavirus created the biggest economic uncertainty in several decades for all economies worldwide including Malta. The projections for Malta’s short-term economic prospects by the IMF and the three major credit rating agencies vary significantly. It is very hard to predict what the immediate future will hold given the fluidity of the situation. It is all dependent on the extent of the duration of the economic lockdown and when certain sectors of the economy will start opening up again. Many economic sectors in Europe and also the US seem to be moving to a gradual re-opening during the month of May and it is therefore likely that Malta will also follow the same pattern. However, the overall impact is also largely dependent on when foreign airports resume normal operations and which airlines will take to the skies again. This will then allow the Maltese authorities to consider the strategy for Malta’s airport.

The future performance of Malta’s capital market is naturally dependent on the manner in which Malta’s economy is likely to respond following COVID-19. However, equity markets generally tend to look well beyond the immediate economic outlook. In fact, the US stock market rebounded swiftly from its low on 23 March (with an increase of over 28% by the S&P 500) despite some terrible economic news, a huge increase in unemployment figures as well as the rout in the oil market. This upturn in equities materialised as a result of a massive boost from the Federal Reserve, hopes of a successful reopening of the economy as the number of coronavirus cases may have peaked in various parts of the world, as well as higher hopes for a possible coronavirus medical treatment. This led to a slight improvement in investor sentiment instigating some investors to ‘buy the dip’ so as not to miss out on the eventual recovery in some share prices. This investor reaction was also limitedly evident in Malta recently when the share price of Malta International Airport plc fell sharply to a low of €3.50 incidentally also on Monday 23 March. However, in a spectacular fashion not often seen in Malta, the share price regained the €5.00 level by the end of the same week.

With a number of companies publishing their annual financial statements over the next week, many investors will be seeking any possible guidance that may be provided on the expected performance of the respective companies post COVID-19 despite the very uncertain times ahead. Another important dimension that could largely shape investor sentiment among the local investor community would be any assistance that the Government may launch to assist issuers on the Malta Stock Exchange as highlighted by several contributors in the media over recent weeks.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.