Maltese shares stage year-end rally

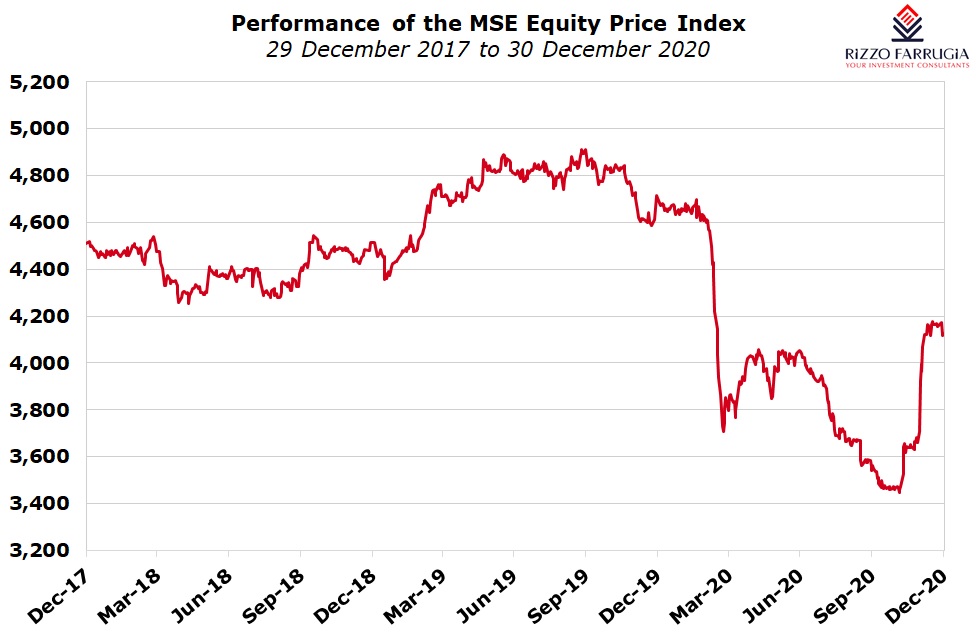

Until the penultimate trading day of the year which took place yesterday, the MSE Equity Price Index suffered a decline of 12.7% during the course of 2020. Accordingly, the Maltese equity market underperformed most of the larger developed global stockmarkets.

Equity indices in the US posted sharp gains principally as a result of the spectacular performances of the largest technology companies – namely Apple, Microsoft, Amazon, Alphabet and Facebook. In fact, the NASDAQ index rallied by over 40% with the S&P 500 up by nearly 16% and the Dow Jones Industrial Average heading to the year-end with a gain of over 6%.

In contrast, equity markets in Europe had mixed performances. The Euro Stoxx 50 is showing a decline of 4.5%. The DAX 30 is the strongest performer in continental Europe with a slight gain of 4%. This is however dwarfed by the 34% upsurge of the OMX Copenhagen 25 index which tracks the largest companies in Denmark. On the other hand, the Spanish IBEX 35 is the worst performing major index as it is down by over 14%.

Naturally, the pandemic was the overriding factor that impacted the performances of all equity markets during the course of 2020. This triggered the quickest fall into a bear market on record for the S&P 500 index in the US as it took just 16 days to slump from all-time highs to bear market territory representing a drop of 20%.

In the case of the Maltese equity market, it is worth remembering that the onset of the pandemic towards the end of Q1 2020 followed the political crisis that engulfed our shores during the latter part of 2019. The impact of the political crisis on the Maltese equity market should not be underestimated as the negative investor sentiment that prevailed during the fourth quarter of 2019 and the beginning of 2020 was very much evident with the MSE Equity Price Index shedding around 6%. As such, the shock of the pandemic came about when investor sentiment was already fragile reeling from the worst political crisis in several years.

As the first few COVID-19 cases were reported in Malta in March 2020 leading to a number of unprecedented measures by the health authorities effectively shutting down a large part of the economy including air travel, share prices of companies on the MSE dropped heavily mirroring the trend seen internationally. The share price of Malta International Airport plc for example shed just over 49% from the beginning of 2020 until its low of €3.50 on 23 March 2020 (coinciding with the low in the stockmarkets in the US) before staging a remarkable recovery in the final days of Q1.

The Maltese equity market remained largely subdued for most of the year with very little activity taking place across the larger companies listed on the MSE. Between January and October 2020, the MSE Equity Price Index shed 26.4% translating into a loss of €1.38 billion in market value. It is interesting to highlight that in its 25-year history, the Maltese market already had instances of such substantial losses. In 2001, the equity market had tumbled by 34.8% and a similar performance was registered in 2008 with a decline of 35%.

As international developments during the course of November indicated the strong progress achieved by a number of the front runners of the COVID-19 vaccine developers, investor sentiment also started to improve locally possibly also on the back of the very strong gains registered across international equity markets. The MSE Equity Price Index climbed by 6.9% in November on the back of a sudden upturn in the share prices of Malta International Airport plc (+24%) and International Hotel Investments plc (+25%) and a more contained gain in HSBC Bank Malta plc of 12.7%.

The recovery that commenced during November gathered momentum in the final weeks of the year with the MSE Equity Price Index increasing by over 11% in December following double-digit gains across 10 companies. Among the larger-capitalised companies, Malta International Airport plc and Bank of Valletta plc underperformed as these share prices only gained 4.3% and 1.1% respectively during the final month of the year.

Meanwhile, International Hotel Investments plc which ranks as the third largest company on the MSE, gained a further 15% during the month of December to trim the year-to-date losses to 13%. The share price of IHI had dropped to a low of €0.452 during the year which implies that the share price has rallied by nearly 60% from this all-time low.

The share price performance of RS2 Software plc was rather subdued in recent weeks following the 19 November announcement that the company convened an Extraordinary General Meeting for 15 December to approve a large number of resolutions mainly related to a proposed issuance of preference shares.

GO plc and HSBC Bank Malta plc both experienced double-digit share price gains of 18% and 12.5% respectively during the month of December which helped trim the sharper declines in earlier months. Following the recovery in recent weeks, GO’s equity is heading for a decline of 17% throughout 2020 with a steeper decline of 31% for HSBC Bank Malta despite the rally of just over 28% from the 12-year low of €0.70.

The most spectacular performances in recent weeks came about from some of the smaller capitalised companies that had fared very badly for most of the year. The US Dollar denominated share price of FIMBank plc jumped by over 66% in December trimming the year-to-date losses to just under 17%. The second-best performing equity during December was of Medserv plc with a rise of 41%. Notwithstanding this spectacular upturn, the share price of the oil and gas logistics operator still shows a decline of 30% since the start of the year following the failed takeover and the difficult trading conditions across the oil and gas sector. The equities of FIMBank and also Medserv saw some particularly robust trading activity in recent weeks.

When analysing the movements across the equity market during the course of 2020 as a whole, one notes that only 6 companies saw their share prices perform positively during the year with the star performer being Lifestar Holdings plc (formerly GlobalCapital plc) with a gain of just over 78%. Following the announcements that took place in September and October, the market now awaits further details on the new proposed bond issue and the IPO of the life insurance subsidiary.

On the other hand, 11 companies experienced double-digit declines in their share prices as they were knocked by the serious consequences from the pandemic. The worst performer during 2020 is Simonds Farsons Cisk plc with a share price drop of 32%. The company is particularly hit by the pandemic in view of its dependence on the tourism sector as well as events and social gatherings among the Maltese community.

It is naturally very hard to predict whether the spectacular recovery in some share prices over recent weeks will continue during the first few months of 2021. The share price performances of several companies would be dependent on any company-specific developments that may take place. The upcoming issuance of preference shares by RS2 Software plc is an important development for the company and the wider Maltese capital market as the company seeks to expand aggressively in the US and Europe. The first few months of next year will also be characterised by the difficult operating environment brought about by the ongoing pandemic while the main focus during the second half of the year will likely be on the extent of any recovery that will be registered by the Maltese economy and the individual companies listed on the MSE as a result of the rollout of a number of vaccines on a global level.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.