MIA dividends at all-time high

Following the publication of the annual financial statements of HSBC Bank Malta plc on 21 February, the earnings season continued in Malta last week with an announcement by Malta International Airport plc.

Given the nature of the business and the excellent communications strategy of the company, the 2023 financial results of the airport operator published last week should not have surprised anyone.

For the past few years with the exception of the turbulent environment during the COVID pandemic, MIA has now consistently followed a similar pattern by providing an initial traffic and financial forecast at the start of the year followed by an update in the summer months in conjunction with the publication of the interim financial statements. Moreover, apart from the statutory semi-annual financial statements, MIA also publishes its Q1 key financial highlights in May and the Q3 financial highlights in November. This provides very strong visibility to the investing community on an ongoing basis on the financial performance and forecasts of the company.

Additionally, during the past two years, due to the faster than expected recovery from the pandemic, MIA issued additional updates to its traffic and financial forecasts in November 2022 and November 2023.

The results announced last week should therefore be monitored against the latest forecasts for 2023 published in November 2023. In fact, while the actual passenger movements in 2023 of 7.8 million were exactly in line with the estimates provided in November, the financial performance was slightly better than anticipated.

Revenue generated by MIA during 2023 of €120.2 million was above the November 2023 estimate of €118 million and more importantly 20% higher than the previous record of €100.2 million achieved in 2019 when passenger movements amounted to 7.31 million.

Likewise, the actual EBITDA of €75.2 million in 2023 was slightly higher than the November forecast of €74 million and 19% above the €63.2 million generated in 2019.

The other financial highlight mentioned in the regular forecasts of the company is the net profit which at €40.3 million for 2023 is a minimal improvement from the November estimate of €40 million but 19% above the 2019 figure of €33.9 million.

In essence, while the 2023 passenger movements increased by 6.8% from the prior record before COVID, the airport’s profitability improved by 19%. This is one of the main takeouts that the investing public should be focusing on when reviewing the recent financial statements of MIA and the company’s future potential especially in the light of the significant expansion to the terminal and other property investments within the vicinity of the terminal. This is a key growth driver for MIA going forward as a result of the significant increase in the footprint of the terminal in the years ahead. MIA is a natural catchment area as evidenced by the growth in passenger volumes which augurs well in terms of the demand for the considerable amount of new commercial space available for rent from the terminal expansion and the construction of SkyParks 2. Once these sizeable investments are completed, the Retail & Property segment (non-aviation) will show a more meaningful contribution to overall revenue from the present level of 31%.

The other main highlight for shareholders last week was the extent of the dividend distribution being recommended at the upcoming Annual General Meeting.

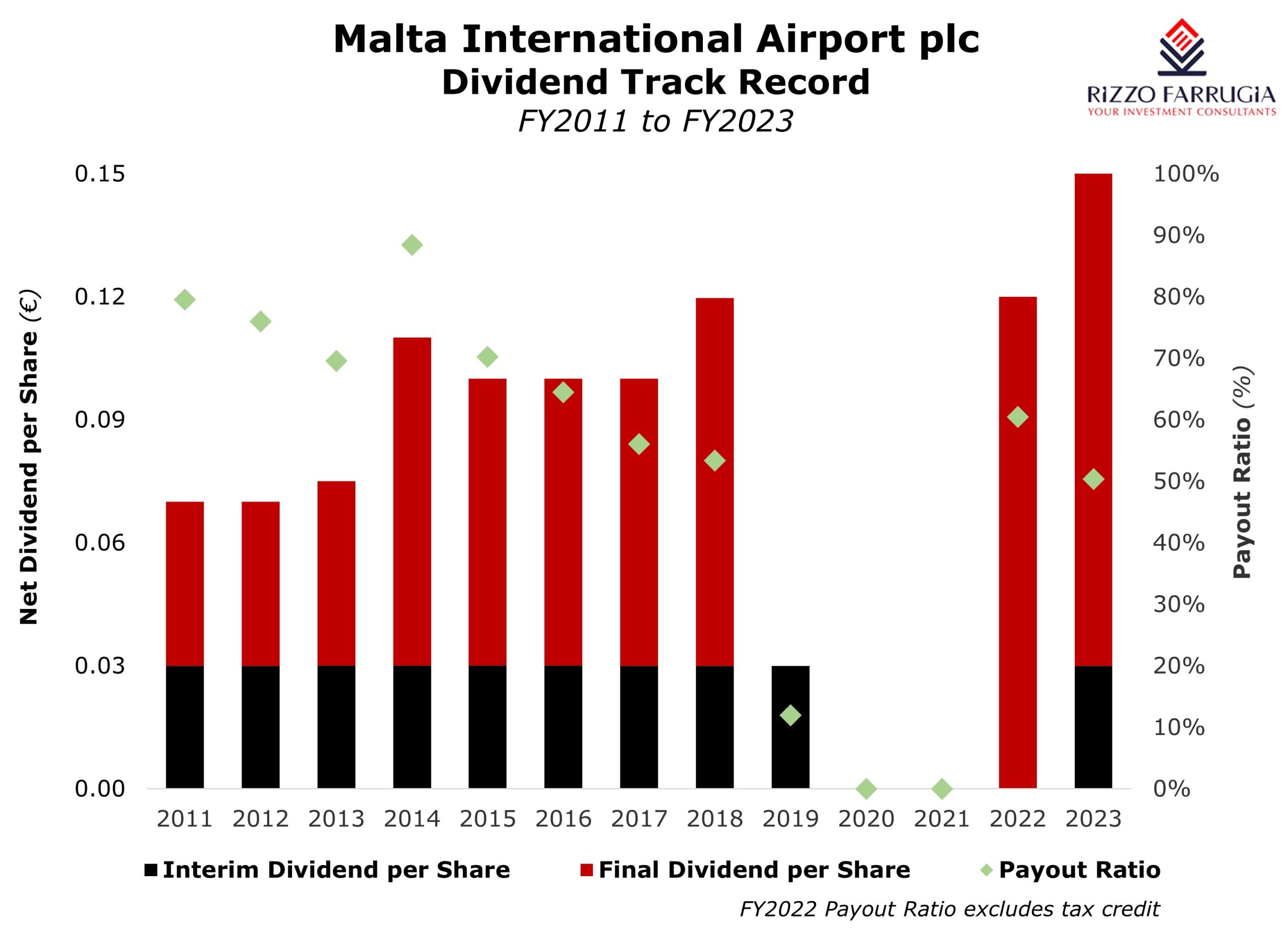

MIA announced that it will be recommending the payment of a final net dividend of €0.12 per share.

In August 2023, MIA had resumed its semi-annual dividend policy (which had been suspended due to the pandemic) with a net interim dividend of €0.03 per share. As such, the total dividend of €0.15 per share in respect of the 2023 financial year represents a new record level in the history of MIA.

However, given the sharp increase in profits in 2023 when comparing these to the adjusted profits in 2022 as a result of the one-off tax credit of €12 million, the dividend payout ratio works out at just above 50% compared to 60% in 2022 and higher payout ratios in previous years. This may have been a surprise given the strong cash flow and debt-free balance sheet.

Earlier this year, MIA had already announced that it is expecting another record performance in 2024. At the time, the company had issued traffic projections at 8 million passenger movements (+2.5% over the 2023 passenger volumes) translating into revenues of €126 million (+4.8% over the actual figure of 2023), EBITDA of €79 million (+5% over the actual figure of 2023) and a projected net profit of €42 million (+4.2% over the actual figure of 2023).

Since then, however, MIA’s largest carrier Ryanair announced additional seat capacity being deployed to Malta. The airline indicated that its foot traffic in Malta can potentially reach 4.5 million passengers between April 2024 and March 2025 representing a very material 22% increase when compared to the last calendar year. With this significant increase coming from the largest carrier to Malta, it is becoming amply evident that MIA is very well-placed this year to easily surpass the 8 million passenger forecast announced at the start of the year. This will become clearer via the publication of the monthly traffic results over the coming months and should be confirmed by MIA once it upgrades its traffic and financial forecasts in summer.

The financial strength of the company is so remarkable that despite the heavy investment plan ahead spread over a number of years, the only criticism from minority shareholders could possibly be centred around the extent of dividend distributions by the airport operator. Given the strong cash generation and in view of the fact that the company has no debt on its balance sheet, MIA can either distribute higher dividends to shareholders (incidentally last week MIA’s parent company announced an increase in its dividend payout ratio from 60% to 66%) and/or initiate a share buyback programme. The latter corporate action could be greatly beneficial to MIA shareholders with the share price still 25% below the record high of almost €8.00 pre-COVID notwithstanding the company reporting much higher profitability levels. The company should consider various actions to accelerate shareholder returns going forward.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.