MIA’s road to recovery

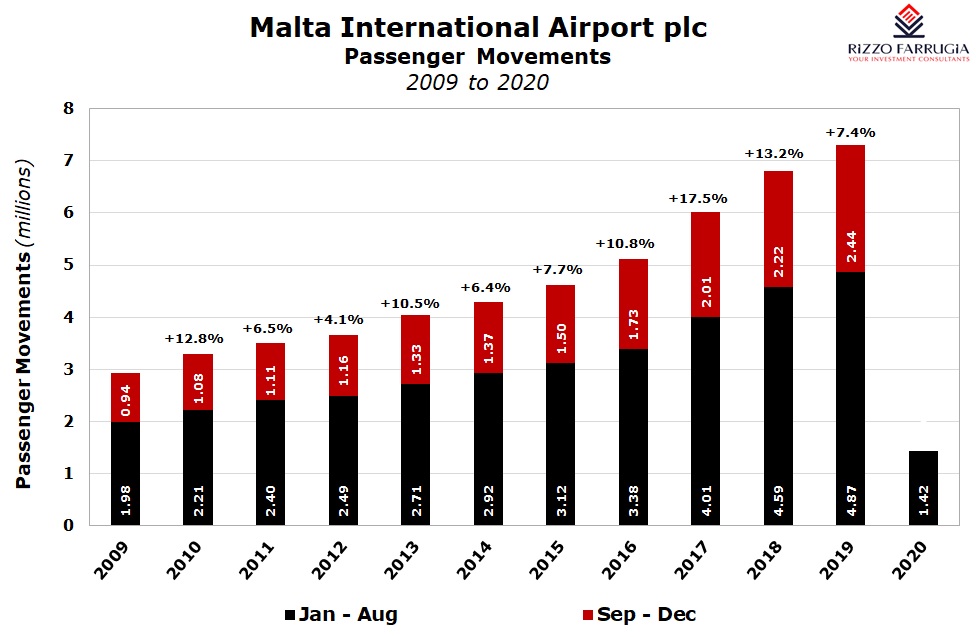

Over recent years when reading the regular announcements of Malta International Airport plc related to the monthly traffic results or the semi-annual financial statements, many would have taken for granted that the airport operator would register yet another record result. Despite the strong rate of growth in passenger numbers in recent years, and the expectation at the start of every year that it would be hard to achieve another record milestone, passenger numbers kept shooting higher. In fact, over the past 10 years, passenger numbers passing through MIA increased at a compound annual growth rate of 9.62% reaching a record of 7.31 million in 2019 from just 2.92 million in 2009.

2020 was expected to be yet another record year for the airport as the company had issued its passenger and financial forecasts in January 2020 indicating that it was anticipating achieving 7.5 million passenger movements this year which would have represented a growth rate of between 2% and 3% over the 2019 record figures. In fact, 2020 was off to a bright start with record figures in both January and February as passengers grew by 14.2% and 17.3% respectively over the comparative months in 2019.

The pandemic hit Malta in March and dealt an immediate blow to MIA and the entire aviation industry worldwide. The temporary ban of all inbound commercial flights to and from Malta as from 21 March 2020 led to a 64.5% decline in passenger movements during the month of March to just under 170,000 passengers. As the ban on all inbound commercial flights continued until 1 July, virtually no passenger movements were recorded during the second quarter of the year between 1 April and 30 June. With MIA recording just over 1 million passenger movements during the first half of the year representing a drop of 68.7% over the first six months of 2019, the company announced on 29 July that it had incurred a loss after tax of €2 million during H1 2020 – something unimaginable until recently.

MIA held a virtual analyst meeting last week providing an overview of the COVID-19 impact, a review of the traffic and financial results so far this year and also to update the market on its investment programme.

Despite a resumption of commercial flights to and from Malta on 1 July, seat capacity was weak and MIA only registered just over 150,000 passenger movements during the month of July representing a drop of 80.9% compared to July 2019. The company had a better start to the month of August but following renewed travel restrictions as the number of virus cases started to increase once again across Europe, the company registered an immediate drop in traffic during the second part of August. In total, just over 250,000 passenger movements were registered in August (-69.4% compared to August 2019). During the period from January to August 2020, only 1.4 million passenger movements utilised MIA representing a decline of 70%.

In last week’s virtual meeting, MIA’s CEO Mr Alan Borg made reference to a recent publication by ACI World which indicated that global passenger traffic volumes are not forecast to recover to the levels prevailing in 2019 before 2023 and those markets largely dependent on international traffic are not expecting a recovery until 2024. Mr Borg explained that the worst-hit segments are the hub traffic as well as the long and super-long haul. On the other hand, regional traffic (such as within Europe) is expected to make a quicker recovery when compared to cross-regional and transatlantic traffic. With this in mind, the CEO said that in a best-case scenario, in 2023 MIA will experience a recovery in passenger numbers towards the level of over 7 million seen in 2019. While acknowledging that significant uncertainty will prevail in the near-term, the CEO also highlighted the fierce competition that will be emerging between airlines and destinations. Moreover, Mr Borg argued that travel patterns are likely to change in due course and domestic travel will likely remain the preferred choice in the short term.

Interestingly some weeks ago a foreign financial analyst reviewing Vienna International Airport, the parent company of MIA, disclosed financial forecasts also for MIA until 2022. This analyst anticipates that in 2022, MIA’s revenue will recover to €87 million compared to a record of €100.2 million in 2019. During the current financial year to 31 December 2020, this analyst anticipates that revenue at MIA will amount to €32 million before almost doubling in 2021 to €61 million.

In early April when the travel ban was imposed, MIA had retrieved its guidance for 2020 and in view of the fluidity of the situation, no further guidance was provided during last week’s virtual meeting.

Revenue of €32 million being forecast by this foreign analyst for 2020 should be seen in the context of the actual revenue of €14.9 million achieved by MIA during the first six months of the year. A significant level of uncertainty is still prevalent on whether MIA can truly achieve overall revenue of €32 million in 2020 since the revenue in the first half of the year includes the first two months pre-COVID when just over 840,000 passenger movements were registered.

With respect to the current investment programme and plans for the continued development of the airport, MIA’s CEO explained that since works at the multi-storey car park and also the cargo village were at an advanced stage when the crisis commenced, both projects continued and are expected to be completed by the end of 2020. Meanwhile, the company is currently analysing the four bids submitted with respect to the operation and maintenance of the proposed business hotel forming part of the SkyParks 2 development. A decision on whether to proceed or otherwise with the overall SkyParks 2 development will be taken by the end of 2021 depending on prevailing circumstances at the time. MIA’s CEO confirmed that given recent circumstances with a sharp decline in aviation income, the company needs to give due consideration to its strategy of expanding the non-aviation income.

Earlier this year, MIA had unveiled a €100 million investment in a major terminal expansion project which was then suspended “with immediate effect” in April 2020 in view of the severe blow to the industry from COVID-19. However, last week, the CEO clarified that this major project was put on hold “temporarily” until MIA gains better visibility of the developments and the business dynamics going forward.

The extent of the recovery in passenger traffic is very much dependent on consumer confidence and the demand for travel. Improved consumer confidence and the resumption of travel is in turn impacted by the resurgence of virus cases in various parts of the world and subsequently the availability and effectiveness of a vaccine. MIA’s road to a recovery to attain passenger movements in excess of 7 million registered last year could be a bumpy one in the near term with the CEO anticipating a very tough winter ahead. Hopefully, as a few of the major vaccines undergoing trials are expected to start being distributed during the course of 2021, airlines will resume the deployment of their aircrafts to various destinations including Malta thereby helping MIA achieve in excess of 7 million passengers in 2023.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.