Mizzi Organisation launches €45 mln bond issue

Earlier this week, Mizzi Organisation Finance plc launched a €45 million bond issue carrying a coupon of 3.65% per annum and maturing between 2028 and 2031. In view of the early redemption option, the bonds are classified as complex financial instruments and thus they are only appropriate and/or suitable for investors who have the knowledge and experience to understand the risks that are specifically related to such callable bonds.

This is the third time that Mizzi Organisation is utilising the debt market. The previous bond issues were launched in 2002 and 2009 with the latter €30 million bond being redeemed early in 2016 since it too had been structured as a callable bond.

The new bonds issued earlier this week are unsecured but guaranteed by the main holding and operating companies forming the Mizzi Organisation, namely Consolidated Holdings Limited, GSD Marketing Limited, Mizzi Organisation Limited and The General Soft Drinks Company Limited.

The group is one of the largest private enterprises in Malta with a broad portfolio of business interests across various economic sectors including automotive; manufacturing, importation, and distribution of beverages; hospitality, tourism, and leisure; mechanical and engineering contracting; property as well as food and fashion retail. The various group companies have relationships with a number of well-known multinational companies such as The Coca-Cola Company, the Volkswagen Group, BMW AG, Nissan, Mitsubishi and Hitachi to name just a few.

From a financial aspect, the automotive, beverage and hospitality segments historically contributed the large majority of operating profits at over 70% of EBITDA. Naturally, the outbreak of the COVID-19 pandemic in early 2020 had a sizeable negative impact on the financial performance of the group despite the extensive portfolio of assets and investments across a broad range of economic sectors. The group recorded a drop of more than 40% in EBITDA in 2020 to €9.74 million compared to €16.6 million in 2019 and €14.6 million in 2018. The beverage and hospitality segments were the ones mostly hit by the pandemic due to their dependence on tourism and social events.

The forecasts provided in the Prospectus published earlier this week show that the group is expecting a rapid recovery in EBITDA as this is projected to reach the pre-pandemic level of €16.5 million by 2022. The strong rebound is anticipated to be mostly driven by the beverage and hospitality segments although the extent of the recovery of hospitality (the Waterfront Hotel being the main operating asset in this business segment) is estimated to be at a more gradual pace compared to other business units. In fact, the EBITDA contribution from hospitality in 2022 is still envisaged to be approximately 50% lower than the level achieved prior to the outbreak of the pandemic. Elsewhere, the anticipated surge in EBITDA by the automotive division reflects the expectation that the encouraging momentum in new car sales currently being recorded (also helped by the added costs of importation of used vehicles into Malta post-Brexit) will extend further in the coming months.

Apart from these three important business units generating over 70% of EBITDA, it is worth emphasizing that the Mizzi Organisation is the owner of a significant portfolio of real estate valued at approximately €165 million situated in prime locations. The properties are mainly either used for the group’s own operations or rented out to third parties while others are presently unutilised. It is anticipated that Mizzi Organisation will dispose of some of its non-core properties in the coming years while other properties are earmarked for future development including a sizeable parcel of land located in Blata l-Bajda (known as the ‘Ħofra Project’).

In fact, one of the strategic priorities of the group in the coming years is to optimise its vast portfolio of properties through relocations, consolidation, redevelopment, and/or the crystallisation of the significant amount of value accumulated throughout the years.

One major initiative in this respect is the impending conclusion in the coming months of the sale of a large part of the property in Qormi that in the past used to house the beverage manufacturing factory. This transaction, together with the potential sale of other underutilised properties (which in aggregate have an estimated market value of €18.5 million) will not only serve as a catalyst for a leaner business model but also enable the group to make more efficient allocation of its capital and resources with a view of generating higher returns as new capital is deployed towards avenues that produce additional cash flows.

Over the years I published various articles indicating the importance for investors to assess the financial strength and soundness of a company before contemplating an investment in bonds. This is done by performing an analysis of the financial statements and using financial ratios to gauge the credit worthiness of a company. In recent years I made reference to a number of credit metrics to rank the strength of the Maltese corporate bond issuers by publishing the interest coverage ratio and other ratios to measure the overall level of gearing.

The leverage ratio that was prominently published over recent years was the net debt to EBITDA multiple showing the number of years it would take a company to repay its overall level of borrowings. This is an excellent ratio since it gives a very strong indication on the cash generation of a company and the extent that it can sustain indebtedness.

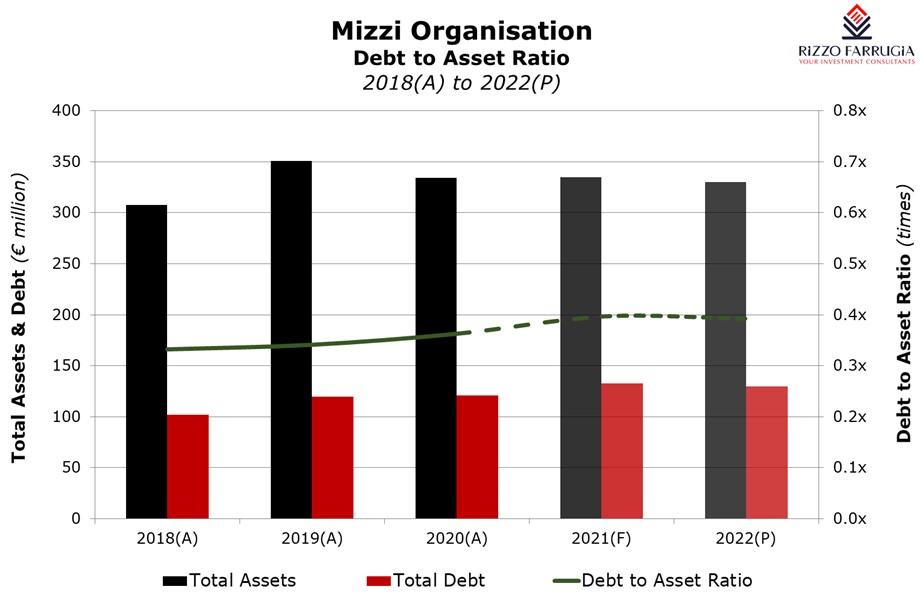

Other more traditional leverage ratios are based on the overall level of assets of a company compared to the debt level. This is an important metric for those companies that hold a sizeable amount of property assets. The debt to asset ratio, also known as the debt ratio, indicates the amount of assets that is being financed by debt. The higher the ratio, the greater the degree of leverage and financial risk of a company.

In the case of the Mizzi Organisation, the total indebtedness following the bond issue will represent just 0.4 times of total assets which means that the amount of total assets is two-and-a-half times Mizzi Organisation’s total debt of around €130 million when including lease liabilities of almost €15 million. As such, the group’s asset base having a book value of well over €300 million is not only reflective of its overall size but should also provide significant comfort to investors in terms of financial strength and credit profile.

Following the €60 million bond issue by GO plc in June, this is the second large corporate bond issue in Malta for 2021. The significant demand shown for the GO plc bonds could have been partly due to a mobilisation by investors of the excess deposits (idle liquidity) within the banking system being channelled into the capital market. This could be one of the catalysts for a very interesting period ahead for the Maltese capital market despite the continued uncertainty arising from the country’s FATF grey-listing.

Rizzo, Farrugia & Co. (Stockbrokers) Ltd is acting as Sponsor and Manager to Mizzi Organisation Finance plc.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.