Nasdaq enters bear market territory

On Monday 7 March, the Nasdaq Composite index dropped by 3.6% after the price of Brent crude touched the highest level since mid-July 2008 at just under USD140 per barrel. This took place on the news that the US and its European allies were in discussions to potentially ban oil imports from Russia (ranking as the third largest oil producer in the world behind the US and Saudi Arabia) after the invasion of Ukraine.

The spike in the price of oil added to increased concerns about inflation and the inevitable upcoming hikes in interest rates from the world’s major central banks.

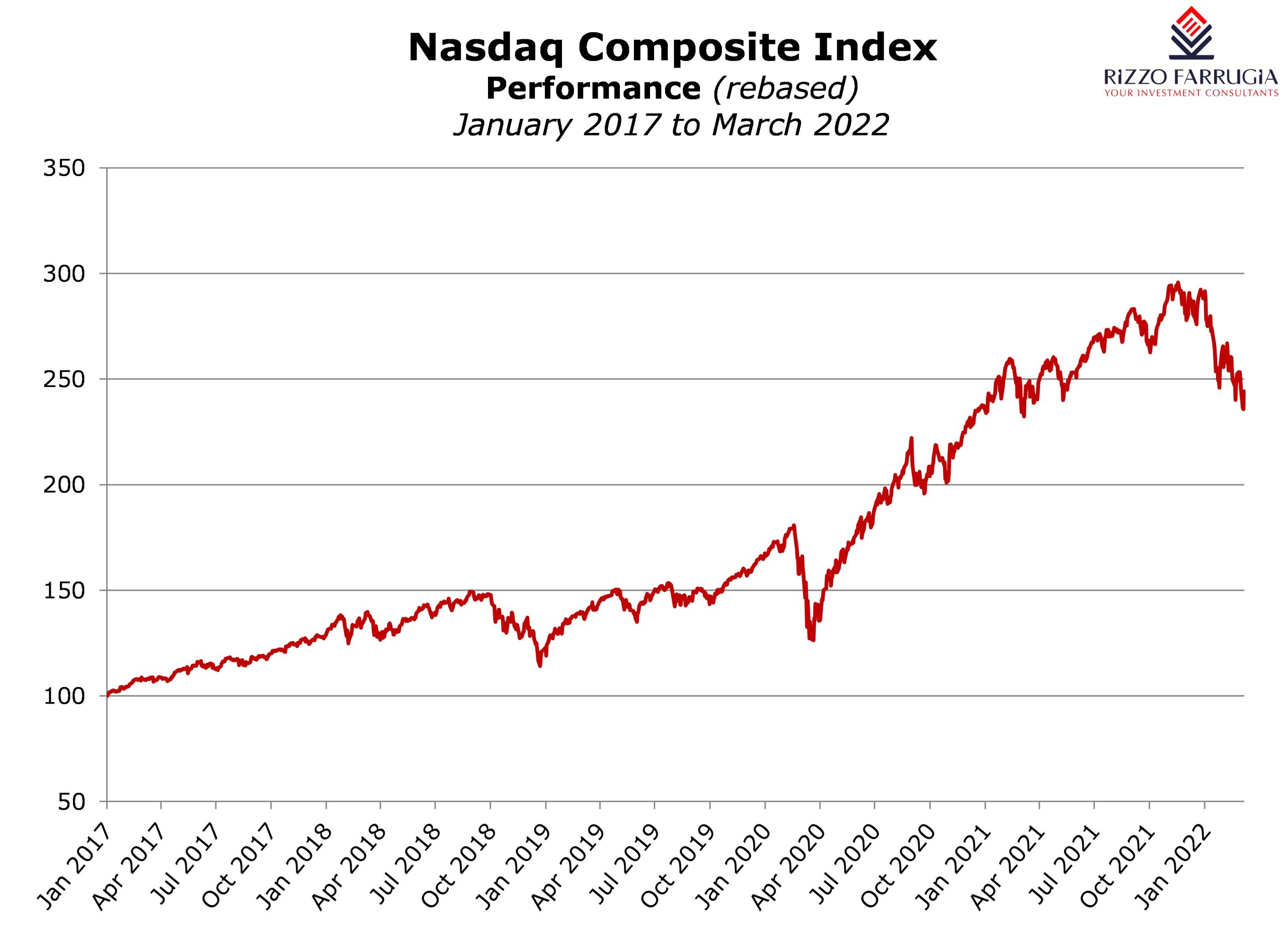

The sharp decline in the Nasdaq index at the start of last week pushed the technology-heavy index into bear market territory, which is measured as a decline of 20% or more from a recent high. In fact, the Nasdaq is now down by 21% from its all-time high of 16,212.23 points recorded on 22 November 2021.

The invasion of Ukraine that commenced on 24 February is the latest major uncertainty impacting equity markets in recent months following the growing expectations of a series of interest rate hikes amid the persistently high levels of inflation triggered by the pandemic-induced monetary and fiscal stimuli as well as the considerable disruptions to supply-chains and global trade.

The Nasdaq index has been particularly impacted negatively in recent months as yields soared on the prospect that the Federal Reserve will start withdrawing the massive monetary stimulus that has supported the US financial system since the start of the pandemic in early 2020. The spike in yields is particularly detrimental for ‘growth stocks’ which are dependent on generating positive cash flows in the longer term and whose valuations had shot up during the pandemic.

Apple and Microsoft together account for 21% of the total weight of the Nasdaq Composite index. The share prices of the two largest companies in the world have performed better than many other constituents of the index. Apple’s share price is down 15% from its all-time record of just under USD183 in early January 2022, while Microsoft’s decline amounts to 20% from its 22 November 2021 high of almost USD350.

The other large components of the Nasdaq, namely Alphabet (the parent company of Google) and Amazon, have experienced declines of 14% and 23% respectively from their recent highs.

The other three Nasdaq companies with a market value in excess of USD500 billion suffered significantly worse performances. Tesla and the semiconductor giant Nvidia saw their share prices slide by 37% while Meta Platforms (the parent company of Facebook) saw its market cap contract by a whopping 51%. Similarly, the share price of Netflix also tumbled by around 50% to USD340 which translates into a loss in market value of circa USD150 billion.

More alarmingly, the fitness company Peloton Interactive (a once favoured stock of investment celebrity Cathie Wood) saw its share price shrink by more than 85% since early 2021. Likewise, the share price of Zoom Video Communications is down by more than 80% from its highs after a meme-like rally during the start of the pandemic in 2020.

The prevailing decline of the Nasdaq into a bear market places it among other notable setbacks across the US market since the turn of the century. The bursting of the technology bubble after the prior peak in the Nasdaq of 5,132.52 points recorded in March 2000 was followed by the global financial crisis culminating in the bankruptcy of Lehman Brothers in September 2008. Meanwhile, the most recent bear market was exactly two years ago at the start of the COVID-19 pandemic.

Indeed, it is worth recalling the volatile journey of the Nasdaq over the past 24 months. After reaching an all-time high of 9,838.37 points on 19 February 2020, the Index plummeted to 6,631.42 points by 23 March 2020 – i.e. an astonishing drop of 32.6% in just 33 days which marked the fastest bear market of all times.

However, as central banks and governments intervened strongly with unprecedented amounts of stimuli, coupled with the evident rebound in company earnings as well as the discovery of a COVID-19 vaccine on Monday 9 November 2020, equity markets across the world rallied almost uninterruptedly until last November. In fact, the Nasdaq closed 2020 at 12,888.28 points representing a 12-month gain of 43.6% and an upsurge of 94.4% from the pandemic low on 23 March 2020. Thereafter in 2021, the tech-oriented Index rallied by a further 25.8% to reach a new all-time high of 16,212.23 points on 22 November 2021. Despite the setback during the last few weeks of 2021, the Nasdaq still closed the year with a gain of 21.4%.

Looking ahead, Russia’s invasion of Ukraine only seems to be making a tough macro-economic prospect look worse. The invasion has already exacerbated inflation (as seen by the incredible lift in the prices for certain commodities and raw staples like wheat) which, in turn, will likely force central banks to tighten monetary policies even faster. In addition, following the strong rebound in economic activity across the world after the pandemic-induced recession, the more normalised growth rates coupled with high inflation are widely expected to lead to stagflation — meaning a period of high inflation and stagnant growth. This could force the Nasdaq to decline further as already opined by some leading market commentators who are now cutting their year-end targets whilst also suggesting overweight positions in energy and defence companies.

In the near-term, the performance of equity markets is likely to remain dependent on the developments with respect to the war in Ukraine. Last Friday, Russian President Vladimir Putin claimed that “certain positive shifts” have occurred in the talks between the two countries. Moreover, last Sunday, the President of Ukraine indicated that Russia was beginning to “engage constructively” in its talks and negotiations.

In the event that a ceasefire is declared and geopolitical tensions ease, one would expect equity markets to stage a relief rally. Moreover, the recovery may then gather momentum should the Federal Reserve and other major central banks manage to contain the spike in inflation with gradual hikes in interest rates. Conversely, if the global economy enters into a period of stagflation similar to that experienced in the 1970’s, then further declines in equity markets may be inevitable.

The current situation across equity markets is indeed very uncertain given the fluidity in the conflict between Russia and Ukraine which has a meaningful impact on valuations and inflationary expectations. One hopes for a quick resolution not only for the health of the global economy and financial markets but more so given the devastating impact on the many innocent civilians in Ukraine.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.