Outlook for Malta’s capital market

The first half of 2022 is already over and as one takes stock of the developments that characterised the Maltese equity market during the past six months, it is fair to say that the main highlight was the extent of the new issuance across both the equity and bond markets. The enthusiasm shown by the investing public to the recent Initial Public Offering of APS Bank plc was undoubtedly a major milestone in the first half of the year. It was the largest public share offering since the privatisation of Maltacom plc (now GO plc) in 1998 and the strong demand for APS shares amounting to over €100 million is a good omen for further equity offerings in the future. APS was not the only new equity listed on the Malta Stock Exchange in the first half of 2022 as AX Real Estate plc and M&Z plc (the first Fast Moving Consumer Goods company to obtain a public listing) were other additions to the list of equities.

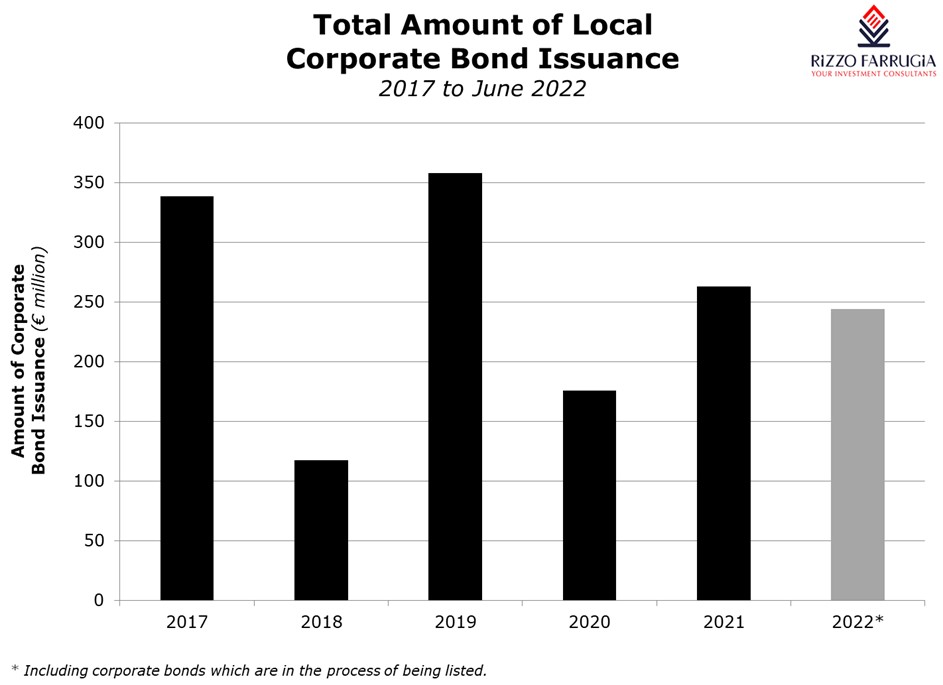

Across the corporate bond market, a total of €244 million in new funds were raised by 9 issuers. Most of these came from companies gaining access to the capital market for the first time as Mediterranean Investments Holding plc was the only issuer to perform a roll-over of €30 million ahead of an upcoming bond redemption of €40 million next week. Hopefully, the strong level of new issuance can be sustained in the months ahead thereby providing further depth to the Maltese corporate bond market and opportunities for additional diversification across issuers and economic sectors to the growing investing community. The increased popularity of the Maltese corporate bond market can also be gauged by the trading activity on the secondary market. This remained robust during the first half of 2022 with a total of over €55 million changing hands as a further sign that part of the very high levels of liquidity across the financial system is being channelled into the capital market. This is providing a significant level of support for Maltese corporate bonds in contrast to the sharp decline in prices across international corporate bonds.

On the other hand, the Malta Government Stock market suffered a significant setback with many securities posting sharp double-digit declines reflecting similar price drops across international bond markets as bond yields moved sharply higher. This took place amid spiralling inflation and subsequent monetary policy tightening measures by the major central banks. In the context of the sharp movements in yields with the yield on the 10-year Malta Government Stock jumping from 0.75% at the start of the year to above 2.7%, it will be interesting to see how this would be impacting the structure of the upcoming new MGS issuance since an amount of up to circa €870 million is still required by the Treasury to finance the budget deficit and the additional €134.4 million in MGS redemptions in July and August 2022. Could the Treasury seek to target the retail market for some of the new issuance required given the upturn in yields, or will the new securities be targeted again at institutional investors only?

The outlook for the Maltese equity market is dependent on the performance of the local economy as well as several company-specific developments. In the immediate future, the local economy should be boosted by the strong rebound that is taking place in tourism which has a positive ripple effect across several sectors of the economy.

This is likely to lead to improved financial results for companies such as Malta International Airport plc and Simonds Farsons Cisk plc as well as companies within the hospitality, retail and real estate sectors. The recent decision by the European Central Bank to halt the Asset Purchase Programme (quantitative easing) and hike interest rates will be positive for the banking sector especially those institutions with very high levels of idle liquidity currently being subject to negative interest rates such as Bank of Valletta plc and HSBC Bank Malta plc. Meanwhile, some other company-specific developments are important determinants of overall performance and investor sentiment. The most noteworthy would be the successful conclusion of the sizeable capital injection by the Qatar Development Company into International Hotel Investments plc. The creation of 100 million new shares at a price of €1.22 per share would be a major milestone for the Corinthia Group and the entire Maltese capital market. Another important development could be the completion of the share transfer within RS2 Software plc between two significant shareholders of the company as originally announced by the company on 24 March 2022.

The recent decision by the Financial Action Task Force to remove Malta from its ‘grey list’ should also help overall investor sentiment. On the other hand, however, the ongoing war in Ukraine and its impact on inflation as well as the growing recessionary fears across the world’s major economies could cloud investor sentiment.

Within the context of the many economic factors and uncertainties ahead, all issuers across the Maltese capital market need to increase their endeavours in providing more frequent and detailed updates to the investing public as this will help investors to take well-informed decisions.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.