PG generates record pre-tax profits of €16.7 million

On 25 August, PG plc published its annual financial statements as at 30 April 2022 showing a 12.4% rise in pre-tax profits to €16.7 million. PG organised a meeting for financial analysts on the same day of the publication of the financial statements to provide a detailed review of the performance of the supermarkets and retail businesses as well as the Zara® and Zara Home® franchise operations.

The last two financial years (2019/20 and 2020/21) were impacted by COVID-19 restrictions on the retail and catering outlets within the PAMA and PAVI shopping villages as well as the Zara® and Zara Home® franchise operations. Despite this, the PG group still generated record financial performances in both these pandemic-impacted years as a result of the strong contributions from the PAMA and PAVI supermarket operations.

Meanwhile, during the latest financial year between 1 May 2021 and 30 April 2022, the group had no COVID restrictions although tourism levels were particularly weak for most of the period which could well have negatively impacted revenue generation primarily at the Zara® store in Sliema. Despite this, the Zara® and Zara Home® franchise operations generated overall record revenues of €25.9 million during the 2021/22 financial year since it was the first financial year without any interruptions and closures following the major expansion project of the Zara® Sliema store that was completed in late November 2018.

In fact, the segments results published in the annual report show that revenues from the ‘Franchise Operations’ surged by 42.7% to €25.9 million (FY2020/21: €18.1 million). The ‘Supermarkets & Associated Retail Operations’ also had another record performance as revenue from the PAMA and PAVI shopping villages rose by almost 8.9% to €121.2 million (FY2020/21: €111.3 million). In total, PG reported a 13.6% increase in revenues during the 2021/22 financial year to a new record of €147 million.

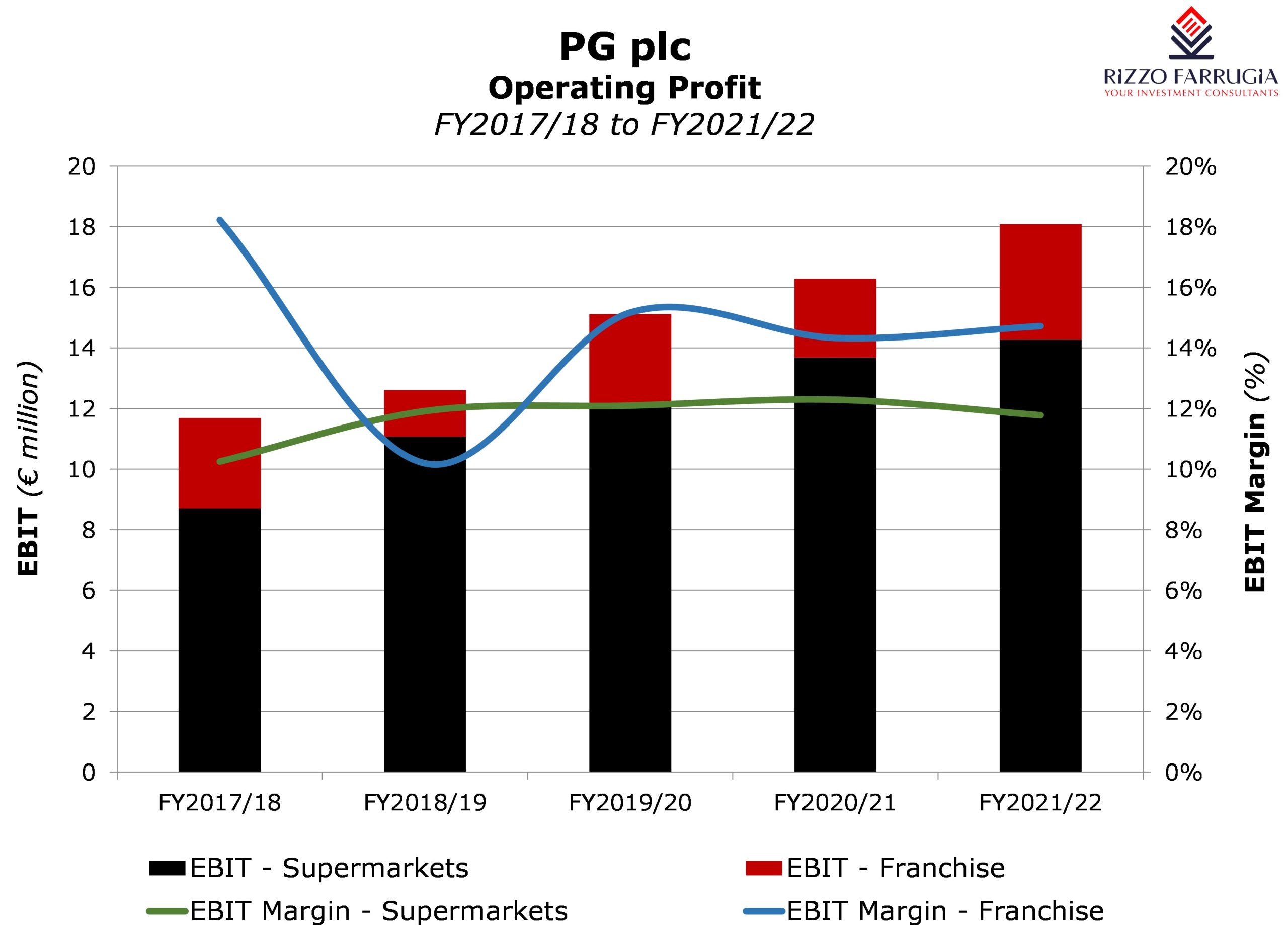

The operating profit of the supermarkets segment increased by 4.3% to €14.3 million with the margin easing to 11.8% from 12.3% last year. On the other hand, the operating profit of the Zara® and Zara Home® franchise operations jumped by 46.6% to a record of €3.8 million with the operating profit margin improving to 14.7% compared to 14.3% during the previous year financial year.

Prior to the investment in the Sliema expansion project, revenue from the Zara® and Zara Home® franchise operations had amounted to €16.5 million and operating profit had amounted to €3 million. As such, the major expansion and refurbishment project undertaken some years ago was clearly a positive development which is reaping the desired results when seeing the more recent performance of this segment although the margin contribution naturally remains below the very high levels achieved in the financial years when the smaller store was being operated.

In line with expectations given by PG’s Chairman in recent meetings, the group ended the year with virtually no borrowings as the cash in hand of €8.7 million is almost equal to the bank borrowings of €8.95 million. This very strong financial standing will undoubtedly not only enable the group to maintain its semi-annual dividend policy of distributing circa 50% of the overall profits to shareholders but also be in a position to fund some potential new projects and expansion plans in order to grow the business even further.

In this respect, PG’s Chairman emphasised once again that the prime focus remains that of growing the core business of the group and discussions are taking place on a new investment that may result in PG entering into a long-term rental and investment agreement. Moreover, Mr Zarb confirmed that PG have now formally rented the site adjacent to the PAMA Shopping Village which will enable the group to extend the retail offering subject to obtaining the necessary planning permits. Meanwhile, a similar extension to the PAVI Shopping Village is still being examined. The Chairman also highlighted that the impact on the financial statements of the group in the event of a successful conclusion to negotiations on any new ventures will only take place in around 3 years’ time.

During last week’s meeting, PG’s Chairman also provided an update on the group’s financial performance during the first few months of the current financial year to 30 April 2023. Mr Zarb highlighted the very positive start to the year with overall group revenue showing an encouraging increase of 13% between 1 May and 15 August 2022 over the comparable period in 2021. However, he warned that in view of the severe cost pressures being experienced, the group may not necessarily manage to generate improved profits during the current financial year. In fact, this is also evident from a comparison of the operating profit margin of the supermarkets business between the first half of the 2021/22 financial year and the second six months. The operating profit margin declined to 11% during the period from 1 November 2021 and 30 April 2022 compared to 12.6% in the prior 6-month period. Since the ‘Supermarkets & Associated Retail Operations’ business segment accounts for almost 80% of the overall operating profit of the group, this will be a key indicator for shareholders and financial analysts to monitor in the upcoming periods as a result of the elevated inflationary pressures.

While the upcoming reporting periods may represent a more challenging environment for the PG group, shareholders may be comforted by the very strong returns being generated (a return on equity of 23% in the last financial year) which also translates into high levels of cash flows, an exceptionally robust financial position, as well as the fact that the group operates in one of the most resilient sectors in times of a recession.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.