PG’s profit margins decline

Last week PG plc published its interim financial results for the six-month period ended 31 October 2022 with the company reporting record revenue generation at the half-year stage of €80.8 million (+13.8% over the comparative period from May 2021 to October 2021).

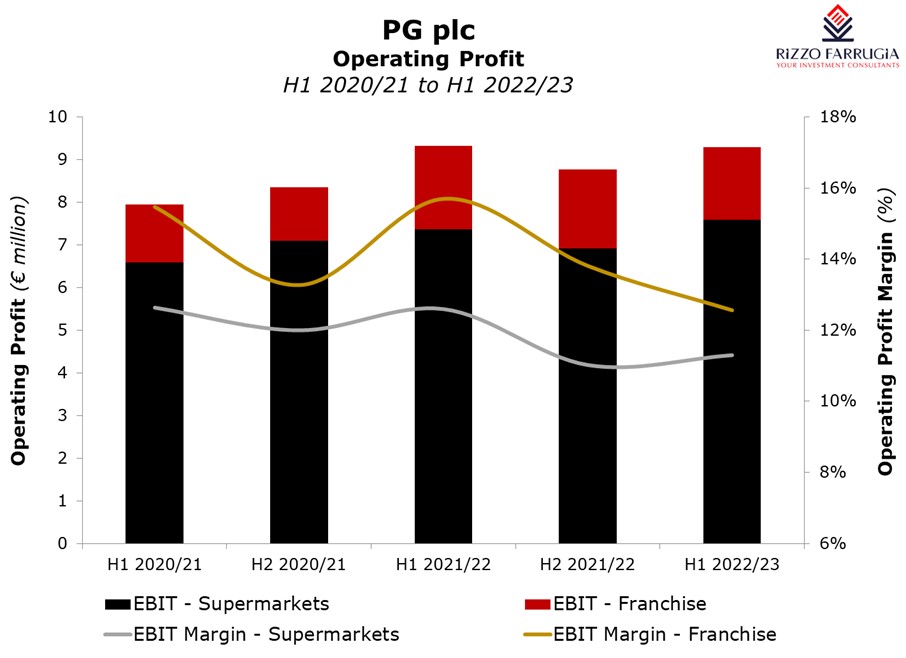

The main highlight of the first half of the current financial year was the margin compression suffered by the PG Group. In fact, since operating costs increased by 16.2% to €71.5 million, the operating profit eased by 0.3% to €9.30 million which translates into a lower EBIT margin of 11.5% compared to 13.1% in H1 2021/22. When reviewing the segmental results, it also becomes evident that the lower margins were even more evident within the ‘Franchise Operations’ business unit when compared to the ‘Supermarkets & Associated Retail Operations’ segment.

The EBIT margin of the ‘Supermarkets & Associated Retail Operations’ declined to 11.3% in the past six months (from 12.6% in H1 2021/22) as the PG Group reported a revenue of €67.1 million from the PAVI and PAMA shopping villages and an EBIT of €7.6 million. Meanwhile, the EBIT margin of the ‘Franchise Operations’ fell to 12.6% from 15.7% in the same period last year as the PG Group reported a revenue of €13.6 million from the Zara® and Zara Home® franchise operations and an EBIT of €1.7 million.

While the extent of the margin compression may surprise many investors, this was to be expected from the indications provided by PG’s Chairman Mr John Zarb at the time of the publication of the 30 April 2022 annual financial statements in August 2022. Mr Zarb had warned that in view of the severe cost pressures being experienced, the Group may not necessarily manage to generate improved profits during the 2022/23 financial year.

The financial results of the first half of the year clearly demonstrate that the Group was heavily impacted by cost increases in various areas. Moreover, it is also evident that the Group opted to absorb an element of the cost price increases to maintain its competitiveness.

Essentially, as a result of the inflationary environment and the strategy adopted by the PG Group, profits after tax at €6.10 million are marginally lower compared to the comparative period despite the jump in revenue of almost €10 million.

Cash generation remained particularly strong enabling the company to maintain its semi-annual dividend policy as well as accumulate additional cash. The Directors of PG reported that as at 31 October 2022, the cash at bank exceeded the level of bank borrowings.

This strong financial position provides the Group with ample financial resources to continue expanding. On 22 November 2022, PG announced that it entered into an agreement with Nylon Knitting Limited to acquire the remaining 90 years of the temporary utile dominium of a large parcel of land for €7 million which is in close proximity to the PAVI Shopping Complex.

PG would require a few years to redevelop this site and lease out the rentable area to start generating additional income in their financial statements. Moreover, PG have also recently entered into a 50-year lease agreement on a large site adjected to the PAMA Shopping Village. PG have applied to the planning authorities to allow the redevelopment of the existing built-up area on this site, the redirection and improvement of an exit road, and provide land earmarked for other uses consistent with its agricultural nature.

While at first glance investors may be disappointed at the extent of the margin compression suffered in recent months, the revenue growth especially within the ‘Supermarkets & Associated Retail Operations’ (+14.9%) shows the attractiveness of the two locations. These two hugely popular shopping villages combined with the correct pricing mechanism adopted over recent months should serve the Group well especially as competition from new hard discounters is set to intensify in the first half of 2023.

PG reported that revenue growth accelerated during the month of November and early December. This augurs well for the months and years ahead. The company seems to be more optimistic for the second half of the year compared to the comments made some months ago on the expectations for the 2022/23 financial year. Although margins are likely to remain subdued compared to previous comparative periods, if the rate of growth in revenue is sustained in the months ahead, then the PG Group should be able to surpass last year’s record pre-tax profits of €16.7 million.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.