PG’s revenue approaches €200 million

In the last few days of August when many companies were publishing their 2024 interim financial statements, PG plc published its annual financial statements for the 2023/24 financial year that ended on 30 April 2024.

Since PG’s policy is to distribute dividends to shareholders semi-annually in July and December and such dividend declarations are announced separately to the publication of the semi-annual financial statements, the company announcement published on 28 August may not have been deemed to be important by the investing public. However, given the overall size of the company and the increasingly competitive sector in which the group operates, some important findings are evident from a review of these financial statements.

At the outset it is important to highlight that the last financial year between 1 May 2023 and 30 April 2024 was yet another positive one for the PG Group with a record financial performance on the back of double-digit revenue growth across both business units. Revenue from the PAVI and PAMA supermarkets and retail operations grew by 14.6% to €165.5 million while the Zara® and Zara Home® franchise operations generated an increase of 10.4% in revenue to €32.6 million.

Total revenue during the 2023/24 financial year of just over €198 million is remarkably more than double the revenue achieved in the 2016/17 financial year at the time of the Initial Public Offering. Since the listing of the shares on the MSE in 2017, PG achieved a consistently strong and improving financial performance with revenue and operating profit increasing in each financial year. Shareholders were consequently also rewarded via improving dividend distributions coupled with the growth in the share price leading to double-digit annual returns. The dividends distributed in December 2023 and July 2024 in respect of the last financial year amounting to €7.25 million (or €0.0671 per share net of tax) is also a record and 70% above the dividend payments in the 2017/18 financial year shortly after the IPO.

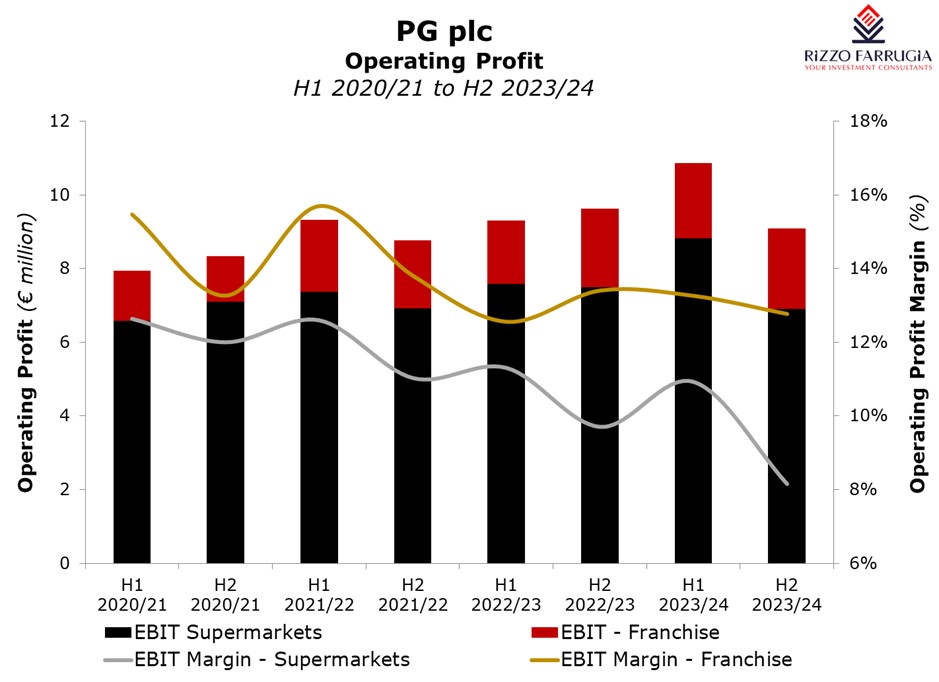

However, back to the analysis of the 2023/24 financial year, while revenue increased by 13.9% to €198 million, the operating profit (EBIT) rose by 5.5% to just under €20 million and pre-tax profits increased by 6.2% to €18.7 million. The Group EBIT margin eased to 10.1% in the 2023/24 financial year from 10.9% in the previous financial year.

Moreover, a closer look at the segmental analysis between the two business units as well as a comparison of the results between the first half of the 2023/24 financial year and the second half highlights some important dynamics of how the PG group has positioned itself in view of the increasingly competitive environment especially in the supermarket sector with the entry of another major hard discounter penetrating the Maltese market. The strengthening of the two large discounters in Malta should not be underestimated and the success of PG in recent years to achieve such growth rates despite the large market share locally of one of Europe’s largest operators is surely an important achievement.

The segmental analysis shows that during the last financial year, while the EBIT from the Zara® and Zara Home® Franchise Operations grew by 10.3%, the EBIT from the PAVI and PAMA Supermarkets & Associated Retail Operations increased by 4.3%. This is reflected in the movements in the margins with the EBIT Margin from Franchise Operations remaining stable at 13.0% while the EBIT Margin from the Supermarket segment dropping to 9.5% from 10.4% in the previous financial year. This is the segment’s lowest margin since the IPO in 2017. Nonetheless, the bulk of Group operating profits (78.8% or €15.7 million) is still being generated from the PAVI and PAMA Supermarkets & Associated Retail Operations which is another important observation.

A more interesting picture emerges from a comparison of the results between the second half of the financial year (1 November 2023 to 30 April 2024) compared to the first half between 1 May 2023 and 31 October 2023. While both operating segments registered record revenues during the second half of the 2023/24 financial year, both segments suffered from margin contraction during this period. The EBIT Margin of the Franchise Operations eased to 12.8% compared to 13.3% during the first half of the year while in the Supermarket segment, a sharper deterioration was evident. The EBIT Margin dropped to a record low of 8.2% in the second half of the year compared to 10.9% in the first half. This shows the deliberate and clear strategy adopted by the company in response to the increasingly competitive landscape. The strategy is paying off in terms of footfall and revenue generation with record revenue of €84.7 million across the two supermarkets during the past six months and a record of €17.1 million from the franchise stores.

Although margins have deteriorated, the Group is still generating improving profitability levels showing the strong appeal of the PAMA and PAVI shopping villages together with the Zara® and Zara Home® outlets. This is an important observation within the context of the plans to expand the operations of both shopping villages.

Excavation works on the site in close proximity to the PAVI Shopping Complex commenced earlier this year. The aim is to significantly expand the retail offering at PAVI thus replicating the success of the PAMA Shopping Village. The company has yet to disclose the overall cost of this major project and the additional rentable area that will be generated in the coming years upon completion. This project also provides additional benefits as a result of the extensive storage facilities that will be made available and additional parking facilities for the enhanced PAVI complex. Meanwhile, the eventual use of the large parcel of land leased next to the PAMA complex has yet to be finalised depending on planning permits that can be granted.

Over the years, the PG Group has not only rewarded shareholders regularly via semi-annual dividends but through the growth in profitability also enabled it to position itself very strongly for the future. As at the end of April 2024, the Group held cash balances (including term deposits) of €12.3 million and other financial assets of €4.5 million, which outweigh the bank overdraft of €5 million, largely comprised of unpresented cheques. In the absence of any debt and the growing cash accumulation, the PG Group can easily defend its market positioning in this competitive landscape, carry out the ongoing investments and most interestingly be prepared to consider new projects in order to eventually expand beyond the three assets currently in operation.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.