QE returns across the eurozone

The main event across international financial markets last week was the European Central Bank’s monetary policy meeting that took place between Wednesday 11 and Thursday 12 September. This was a widely anticipated meeting as many economists were expecting new stimulus measures to support the ailing eurozone economy in what was President Mario Draghi’s final meeting before the end of his eight-year term on 31 October.

The European Central Bank (ECB) utilised almost every possible tool available in a fresh bid to boost the eurozone economy.

The ECB announced a cut in its deposit facility (the first change since March 2016) by a further 10 basis points to a new record low of -0.5%. This was widely anticipated ahead of the meeting, with the main question being whether the deposit facility will be reduced by 10 basis points or 20 basis points. In this respect, the ECB reinforced its forward guidance by stating that it “expects the key ECB interest rates to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2%”.

In addition, the ECB confirmed that it will resume its Asset Purchase Programme (quantitative easing) at a monthly pace of €20 billion as from 1 November 2019. This will be the second round of quantitative easing (QE) from the ECB as the initial package that started in March 2015 was stopped at the end of 2018. More importantly, the ECB stated that the purchases of bonds will now “run for as long as necessary to reinforce the accommodative impact of policy rates”. This implies that the second QE programme is essentially open-ended until such time that inflation expectations are “sufficiently close to, but below, 2%”. Since the ECB reduced its inflation forecasts last week for 2020 by 40 basis points to just 1% and expect inflation to rise to only 1.5% in 2021, then the QE programme is likely to remain in force for quite some time. In view of this, some financial analysts also commented that this could be described as ‘QE infinity’.

The ECB also announced that it will be introducing “a two-tier system for reserve remuneration … in which part of banks’ holdings of excess liquidity will be exempt from the negative deposit facility rate”. Initially, banks will pay 0% on up to six times their required reserve holdings which will help those European banks that have a large amount of excess deposits.

Finally, the ECB also modified its targeted longer-term refinancing operation (TLTRO) to make the loans to banks more generous by cutting the cost of borrowing and extending the maturity by a year. This measure is aimed at assisting those European banks which continue to suffer from higher funding costs.

In the customary press conference following the publication of the policy statement, ECB President Mario Draghi exerted more pressure on national governments as he argued that fiscal policy needs to become the primary instrument to stimulate economic growth and that “governments with fiscal space should act in an effective and timely manner”. Mr Draghi stated that it is “high time for fiscal policy to take charge” and also openly praised the recent intention of The Netherlands to conduct a €50 billion fiscal expansion programme. On the other hand, Germany announced that it is sticking to its balanced budget policy despite its rapidly declining debt burden.

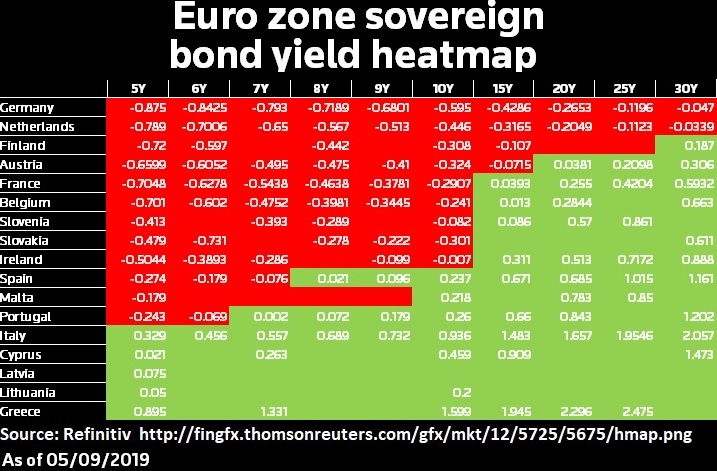

Given the importance of such monetary policy statements to all asset classes, it is indeed interesting to note how international financial markets reacted to the fresh bout of stimulus measures from the ECB. The initial reaction to the renewed monetary easing was as one would generally expect, with the single currency dropping in value towards its two-year low against the US Dollar of USD1.0926, bond prices rising (yields declining) and European equity markets also rising. The rally in bond prices was especially evident across some of the ‘peripheral countries’ with significant gains registered in the sovereign bonds of Italy, Greece, Spain and Portugal. For example, the 10-year yield on the Italian sovereign bond dropped to a fresh record low of +0.75%.

However, these movements only lasted for a very brief period as, just a few hours after the ECB policy statement, benchmark bond prices started weakening as yields recovered and the euro began to strengthen once again. In fact, benchmark eurozone yields recovered to a six-week high last Friday with Germany’s 10-year yield rising to -0.45% (its biggest weekly jump since June 2017) and the yield on the 30-year German bund back with a positive yield as this recovered to +0.10% compared to an all-time low of -0.31% recorded in mid-August.

This sudden change was possibly an indication that the markets are doubting the long-term effectiveness of the ECB’s most recent efforts in raising inflation without fiscal policy assistance. Moreover, some commentators believe that there is evident fatigue across the bond markets following the strong rally in recent months, with sovereign bond markets already pricing in a full-blown global recession while economic data and reactions from central banks indicate a mere slowdown across various economies as opposed to a deep recessionary environment.

Sovereign bond prices across the eurozone had been rising well ahead of last week’s ECB meeting as it had become evident from recent statements, coupled with continuing disappointing economic data, that the ECB would have to introduce new stimulus measures. In fact, yields declined to fresh record levels with the 10-year German benchmark bund yield dropping to as low as -0.74% earlier this month after breaking through the negative barrier again in the second half of March 2019. In fact, the previous all-time low was in July 2016 when the 10-year German benchmark bund yield had dropped to -0.20% before initiating an extended recovery to almost +0.81% by the first half of February 2018. Moreover, all German bonds were recently trading with negative yields as the 30-year bund dropped to a negative yield of -0.31% in August but has since moved back into a positive yield.

The steep decline in yields in recent months resulted in almost a quarter of all debt issued by national governments and companies around the world to trade at a negative yield. Negative yields occur when bond prices rise to such an extent that investors who buy and hold them until maturity are guaranteed to experience a negative return when taking into account interest payments and the return of capital (excluding inflation which further erodes “returns”).

Another surprising reaction across financial markets was an upward movement across bank share prices although a weaker negative interest rate environment is generally seen as being a drag on bank profitability.

The promise by the ECB to maintain the QE programme open-ended once again drew parallels to the situation in Japan as some commentators believe that Europe and even the US are heading towards the fate of Japan – an economy characterised by a huge amount of government debt, significant central bank intervention coupled with slow growth and chronically weak inflation.

The attention across international financial markets is now upon the upcoming meetings of other major central banks with the US Federal Reserve having concluded their two-day meeting yesterday followed by the Bank of Japan and the Swiss National Bank today. These meetings are also important for the future direction of financial markets after US President Donald Trump repeatedly called on the Federal Reserve to follow other major central banks in adopting loose monetary policy including negative interest rates. Meanwhile, the attack over the weekend on the world’s most important oil facilities in Saudi Arabia resulting in a spike in the oil price adds another twist to the ongoing volatility across international financial markets.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.