Save for the short-term; invest for the long-term

It is fair to say that despite the various economic shocks encountered over the past 20 years as a result of the 9/11 terrorist attacks, the global financial crisis in 2008/9, and more recently the COVID-19 pandemic, investors are experiencing yet another period of major uncertainty as the world grapples with huge inflationary pressures exacerbated by the conflict in Ukraine which commenced towards the end of February 2022.

For those investors who do not have decades of experience across international financial markets, this opens up a new dimension since inflation rates over the past 10-15 years were pretty subdued.

Naturally, the sharp rate of increase in inflation in most of the major economies is leading to a strong response by the various central banks thereby also increasing the odds that most of these economies will suffer a recession in the coming months.

Within the context of the higher interest rates being embarked upon in the UK, the US and now also the eurozone, coupled with indications of further hikes being adopted by the central banks in these regions, investors may be questioning whether holding onto cash via savings accounts or fixed deposits is a viable strategy.

The appropriate mix of various asset classes (such as cash, shares and bonds) making up an investor’s portfolio is a widely discussed topic and always remains dependent on each investor’s individual circumstances including their age. This is a major determining factor especially when nearing retirement age and the objective of most investors to generate a reasonable level of income to supplement one’s pension.

In an article I published in mid-August, I made reference to the continued surge in bank deposits highlighting the high savings ratio across the local financial system. A large number of Maltese residents continue to maintain an excess amount of liquidity across a number of banks which is not ideal especially in the current inflationary environment we are experiencing, as the high levels of inflation erode the real value of idle cash.

Although some Maltese banks will undoubtedly begin to offer more attractive rates on term deposits compared to the meagre returns over recent years, and despite the intense volatility seen over recent months across most asset classes including currencies, maintaining an excess level of cash is not an optimal decision for the long-term.

In order to calculate the required amount of cash to remain idle in savings accounts, one needs to determine the level of ongoing expenditure to sustain one’s lifestyle and keep an additional amount for any emergency needs. A very prudent rule of thumb would be to maintain 2-3 years’ worth of ongoing expenditure in cash and reinvest the remaining amount in an appropriate investment portfolio tailored to suit one’s own requirements.

In essence, investors should be guided by the principle of ‘saving for the short-term and investing for the long-term’.

Over recent weeks and months, a number of international fund managers and renowned investors continued to reassert the difficulty in timing movements into and out of various asset classes. The intense volatility experienced across bonds, shares as well as currencies since the start of 2022 is a timely reminder of how difficult it is to gauge the most opportune time to take certain positions or trade other securities.

The lessons that one needs to learn once again from recent events is that in the short-term, an investor has no control whatsoever of movements across the financial markets as these are determined by investor emotions and impacted by economic data, central bank policies, etc.

As such, assuming one’s portfolio is well-structured to take account of the individual circumstances and needs, there is no point trying to worry about market movements. As most of the renowned long-term investors argue, when markets are volatile one should either ignore the ‘noise’ or take advantage of the negative sentiment by acquiring new investments or increasing a stake in a security at a discounted price.

Essentially, within the context of the equity component of a portfolio, if this portion is spread across shares of fundamentally sound businesses and acquired at what should be undervalued prices, then an investor should not need to worry. It has proven time and time again that equity markets generally rise over the long-term.

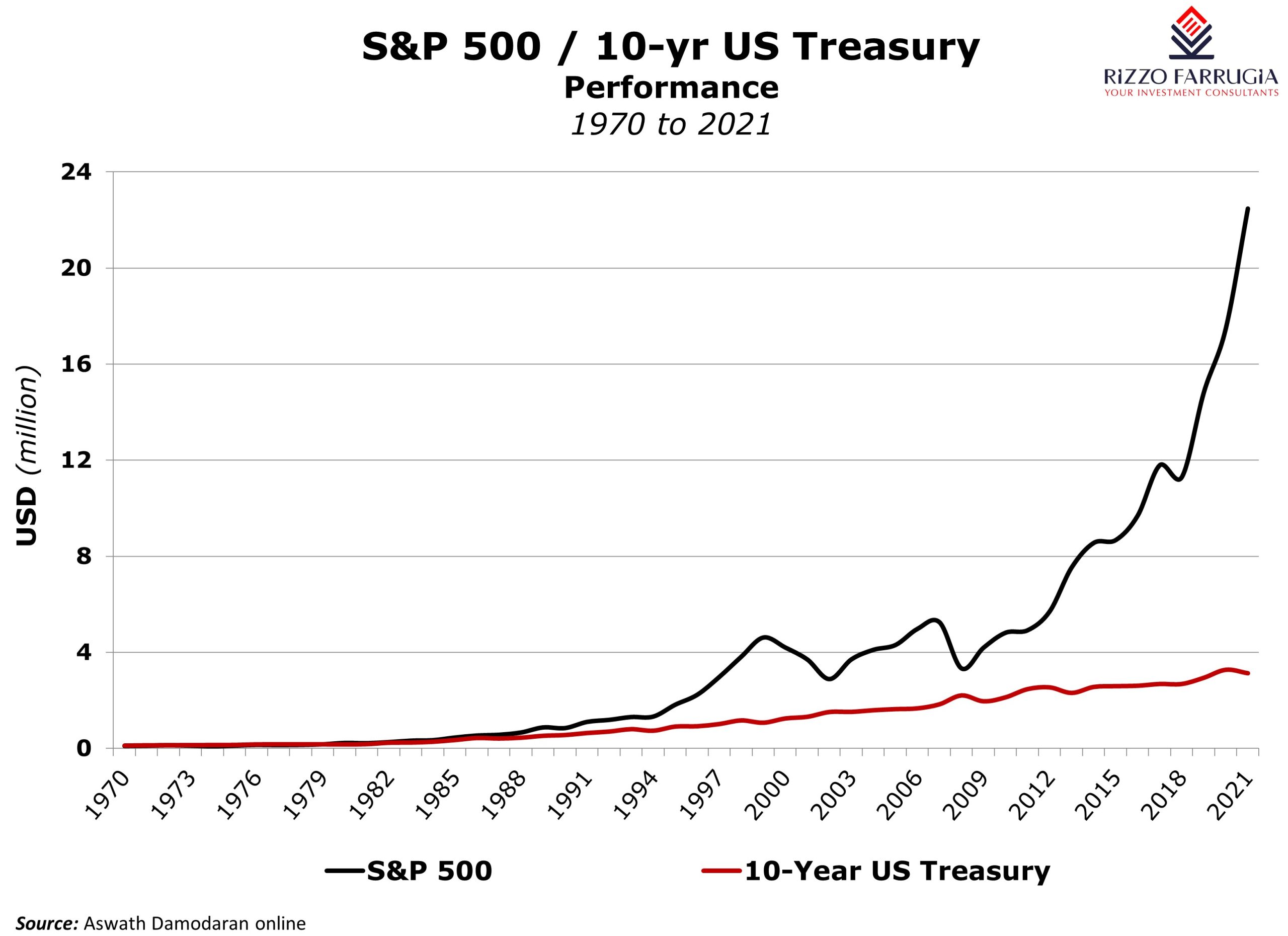

This is very evident from the graph published today which shows the performance of the S&P 500 index over the past 52 years. An investor who invested USD100,000 at the start of 1970 and maintained this position unchanged through the various economic cycles over the years and reinvested all dividends, would today have an investment amount of over USD22 million implying a compound annual growth rate (CAGR) of almost 11%. This shows the power of compounding as explained in some of my articles a while ago and a concept widely advocated by some of the most renowned investors. Even the best investors in the world go through short-term drawdowns but emerge as winners over the long-term. On the other hand, a similar USD100,000 invested in a US Treasury would have grown to only USD3.1 million over a 52-year period implying a CAGR of 6.8%.

At times of economic shocks, stockmarkets tend to over-react as investors hate uncertainty. As such, movements across the markets in the near-term will continue to be driven by macro-economic fundamentals, decisions by central banks and geopolitical developments. Eventually, when there is less uncertainty on the inflation front for example, or hopefully more positive news emerging from the Ukraine conflict, market sentiment will be somewhat different to what it is today. However, one would also expect that when such a scenario materialises, the share prices of the fundamentally strong companies that are being penalised today would be at much higher levels. This is why the most successful investors continue to maintain that the best time for investing is during periods of economic recession.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.