Shareholder returns during the pandemic

Following the conclusion of the annual reporting season, I generally publish an updated dividend league table and also an article showing the Maltese companies generating a double-digit return on equity (ROE) to assist investors to gauge those companies producing the highest returns to shareholders.

The start of the pandemic in early 2020 naturally impacted the dividend distributions to investors. Over the past year, most companies adopted a cautious approach to dividend payments and sought to retain higher levels of cash by cancelling or reducing their dividends due to the unprecedented level of uncertainty. Other companies, namely the banks, were prohibited by their regulators to distribute any dividends to shareholders.

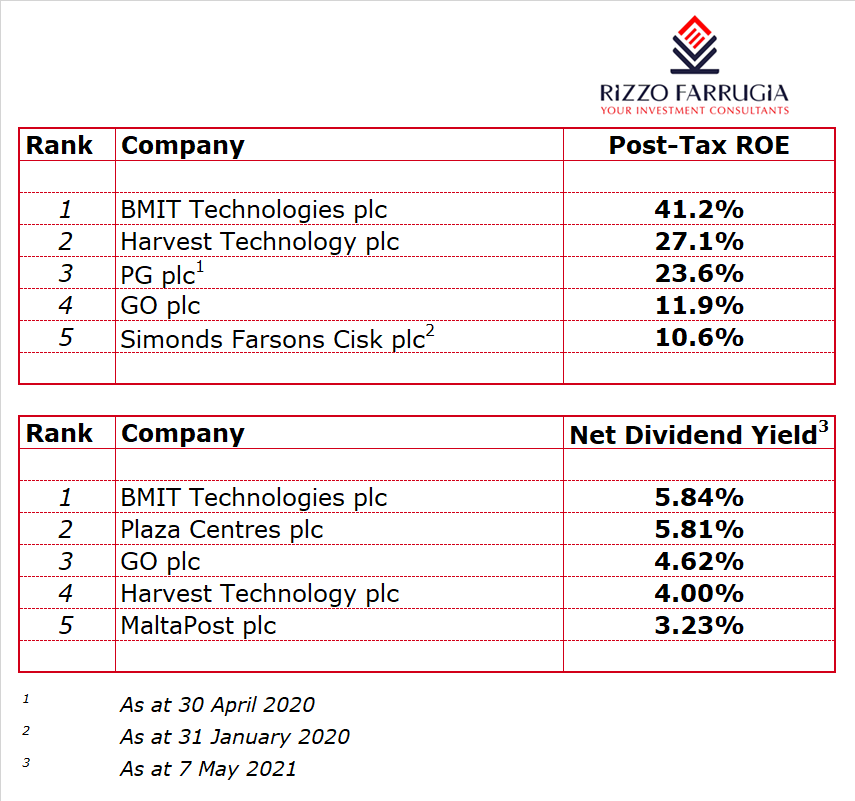

When analysing the dividend league table and the ROE league table of those companies whose equity is listed on the Malta Stock Exchange, a number of important observations emerge.

From a return on equity perspective, during the last financial year, only four companies produced double-digit returns namely BMIT Technologies plc (41.2%), Harvest Technology plc (27.1%), PG plc (23.6%) and GO plc (11.9%). One must exclude Simonds Farsons Cisk plc since the company has not yet published its January 2021 annual financial statements and although the January 2020 financials show a ROE of 10.6%, the financial projections published on 23 September 2020 indicated that in view of the substantial negative impact from the pandemic, the profit for the 2020/21 financial year was estimated to have dropped to only €1.88 million which would translate into a return on average equity of 1.6%. In fact, in the interim results for the six-month period ended 31 July 2020, Farsons reported an annualised ROE of 2.8% reflecting the initial impact of the pandemic.

One of the main observations is that Malta International Airport plc does not feature among the list of those companies producing a double-digit ROE for the first time in several years. The airport operator had been among the companies that performed very consistently over the years until the huge impact from COVID-19 on the tourism industry.

Moreover, in previous years, RS2 Software plc also featured among the companies with the highest ROE, however the company reported losses in the past two financial years as it invested heavily to scale up its operations in the US and other regions. The projections available until 2023 indicate that the company is aiming to achieve a profit after tax of €4.8 million in 2022 and €14.8 million in 2023 partly as a result of the initial revenue recognition of the 10-year processing agreement with one of the largest banks in the US. Although these profit targets were based on RS2 raising €25 million in fresh capital from the issuance of new preference shares (compared to the actual take-up of €15.7 million), should the company still achieve these profitability levels, its ROE would easily exceed the 10% level once again.

Technology companies generally have high returns on equity. In fact, it is not a coincidence that the other two technology companies listed on the MSE rank as the top performers in terms of ROE. BMIT reported a ROE of 41.2% in 2020 and Harvest Technology achieved a ROE of 27.1%. Moreover, few investors may realise that in view of the strong performance of these companies and the low level of borrowings, these are also among the companies generating the highest dividends for shareholders.

BMIT recommended the payment of a net dividend of €5.95 million (equivalent to €0.02922 per share), representing a 35.5% increase over the dividend distributed in June 2020 in respect of the 2019 financial year and almost 22% higher than the projected net dividend of €0.024 per share at the time of the Initial Public Offering in late 2018. Once approved by shareholders during the upcoming AGM, the dividend will be paid on 28 May 2021. The dividend yield based on the current share price is of 5.8%.

Harvest Technology plc also had a positive year in 2020 despite the pandemic as the group reported a profit before tax of €4.5 million compared to €3.04 million in 2019 and the projected figure of €3.1 million at the time of the IPO in late 2019. Moreover, Harvest confirmed that it expects to maintain a similarly positive performance in 2021 with profits before tax estimated to amount to €4.0 million compared to the previous estimate of €3.4 million. In its quarterly financial update published last week, Harvest also indicated that it expects to distribute an aggregate dividend amount similar to that distributed in 2020 (which amounted to a total net dividend of €0.06 per share) which translates into a dividend yield of 4%.

Until a few years ago, the banks generated high ROE’s and also distributed attractive dividends to shareholders. However, it should not be surprising to those investors who closely follow local and international developments that the returns offered by the banks are now a fraction of what they used to be several years ago. The negative interest rate environment coupled with the higher costs being incurred to comply with the ever-growing regulatory obligations have led to a significant reduction in profitability over the years.

Apart from the two technology companies BMIT and Harvest, the other two companies that generated a double-digit ROE during 2020 were PG plc and GO plc. Although the ROE of 23.6% for PG is based on the April 2020 annual financial statements, the interim financial results as at October 2020 reveal the sustainability of the company’s performance despite the impact of the pandemic on their retail operations. PG should also have maintained an ROE of above 20% during their last financial year. The annual financial statements for the period 1 May 2020 to 30 April 2021 will be published by the end of August. PG has regularly distributed semi-annual dividends to shareholders ever since the company’s listing on the MSE in the first half of 2017. As a result of the strong and sustainable financial performance annually, dividends to shareholders were also very consistent over the years in line with the company’s dividend policy of not less than 50% of the group’s net profit. However, following the strong rally in the share price to a new record high, the net dividend yield has shrunk to below 2%.

On the other hand, the dividend yield of GO plc has improved to 4.6% based on the recently declared dividend of €0.16 per share. However, the company clarified that the dividend of €0.16 per share is made up of a distribution of €0.14 per share in respect of the financial performance in 2020 and an additional €0.02 per share as partial compensation for the reduction in the final dividend distribution (from €0.14 per share to €0.10 per share) in respect of the 2019 financial year. GO’s financial performance has been relatively consistent over the years enabling it to register a double-digit ROE.

Another company that paid a high dividend to shareholders last year was Plaza Centres plc. However, this was boosted by the extraordinary interim dividend of €1 million (€0.0354 per share) given to all shareholders in November 2020 following the successful sale of the Tigné Place commercial building in September 2020 for a total consideration of €14 million compared to the acquisition price of €9 million paid for in 2016.

Although the main observations from the league tables indicate some important trends, it is also worth highlighting to investors that 2020 was undoubtedly not a normal year given the very challenging economic conditions across various industries. For example, one would expect dividend payments by both Malta International Airport plc and Simonds Farsons Cisk plc to resume once conditions normalise and both companies should achieve double-digit ROE once again in the foreseeable future. Investors however need to position their portfolios in a manner that reflect the main observations within this article and the emerging trends post-pandemic should they wish to achieve consistently positive returns in future years.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.