Sharp decline in yield on TBills

In October 2022 and April 2023, I had published two articles explaining the growing usage of the Malta Government Treasury Bill market as well as the sharp rise in yields in the money market.

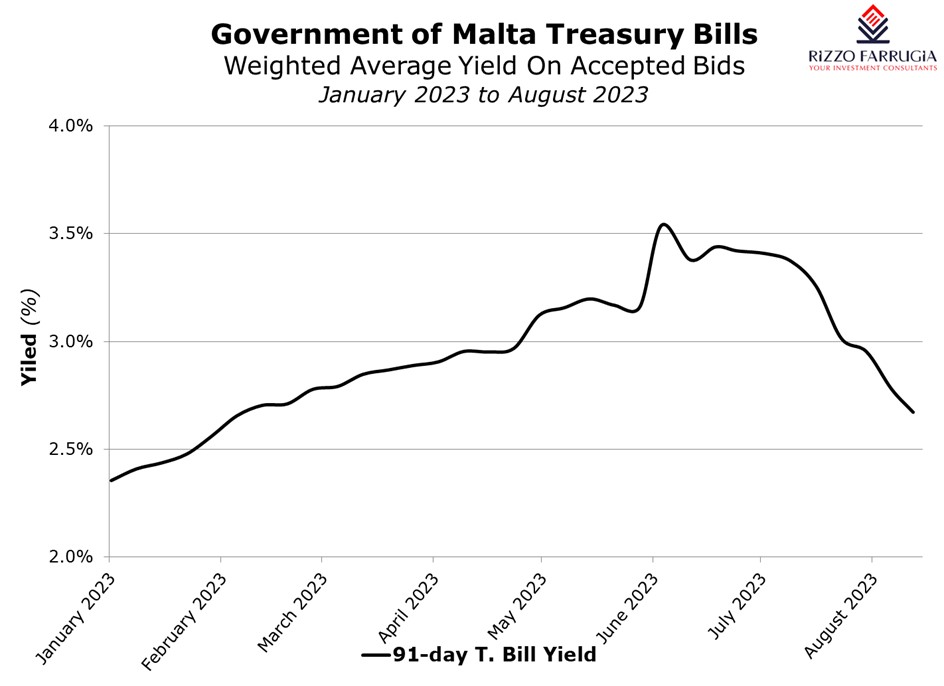

The 3-month T-bill had been producing a negative yield from May 2015 until June 2022 and then edged up to the 1% level in Q4 2022. Over recent months, the weighted average yield of the 3-month T-Bill moved very much in line with the 3-month Euribor which is an important benchmark since it is the interest rate at which a selection of European banks lend funds to one another and follows the deposit facility of the European Central Bank.

The weighted average yield of the Malta Government 3-month T-Bill surpassed the 3% level in May 2023 and then peaked at 3.538% on 8 June. It maintained a level above 3.4% for three successive weeks between 22 June and 6 July but since then, yields declined rapidly back to below the 3% level despite the latest decision by the ECB to hike interest rates further to 3.75% as from 2 August.

In my article in April 2023, I had mentioned that there was a clear change in attitude by retail and corporate investors following the sharp upturn in yields since the second half of 2022 with an evident mobilisation of liquidity which was lying idle in the banking system into other instruments offering superior returns across the financial markets. This was clear in the strong demand for Malta Government Stocks of various maturities in all the recent issues in October 2022, February 2023 and July 2023 as well as in the weekly auctions in the 3-month, 6-month and 9-month T-Bills.

In fact, over recent weeks, total tenders submitted for the 3-month T-Bill was well over €200 million every week. However, the main determining factor behind the decline in yields was the lower amount accepted by the Treasury. During the month of June, the weekly allotted amounts in the 3-month T-Bill were in the region of €35 million with a peak of €50 million on 22 June when the average yield was 3.438%. Since then, the allotted amounts reduced drastically to €26 million in early July and only between €6 million and €14 million each week since then.

This trend is also evident in the total amount of outstanding T-Bills in issue. In October 2022 I had mentioned that the amount of T-Bills increased significantly to a total of €986.5 million from below €600 million at the end of 2021. The level of outstanding T-Bills fluctuated from just under €1 billion since October 2022 but remained close to the level of €800 million level until June 2023. However, since then, the amount issued dropped drastically to only €719 million this week. This reduction in T-Bill issuance could be a result of the €400 million in MGS’s issued during the month of July and indications of a lower amount of the total borrowing requirement by the Treasury for 2023 as the deficit is lower than originally anticipated.

The combination of the consistently strong demand for T-Bills by the investing public together with the sharp reduction in issuance is the main factor driving down the yield on T-Bills. Unfortunately, the auction process is not as transparent as that in overseas markets since the Treasury does not announce the amount of T-Bills which are required on a weekly basis.

On the other hand, the international auctions provide this important information to the investing community.

While the demand for T-Bills by the investing public may seem elevated at over €200 million on a weekly basis, this must be viewed in the context of the sheer amount of liquidity across the banking system. The financial statements published by the two largest banks in recent weeks is another stark reminder of the robust liquidity across the Maltese banking system. The financial statements published by Bank of Valletta plc and HSBC Bank Malta plc as at 30 June 2023 reveal that their deposit base is just over €18 billion.

Since these two banks in particular have yet to reward depositors with higher rates of interest following the sharp rise by the ECB, it is only natural for a section of the depositor base to look elsewhere to generate a positive return on idle liquidity. In fact, in my article in April 2023 I had mentioned that with rates at current levels, the opportunity cost of holding excess amounts of liquidity lying idle is simply too high now.

Although it is evident that many more retail and corporate investors are seeking ways to mobilise their idle liquidity, the auction process is being increasingly difficult since the Treasury does not provide clarity on the amount required.

While it has become difficult to obtain access to the Malta Government T-Bill market, there are alternative avenues for investors to participate in the money markets by availing themselves of other sovereign and supranational issuers across the international markets. These securities are normally highly liquid enabling investors to trade sizeable amounts and more importantly, the yields have so far remained in line with the ECB deposit facility.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.