Strong performances by several Maltese equities

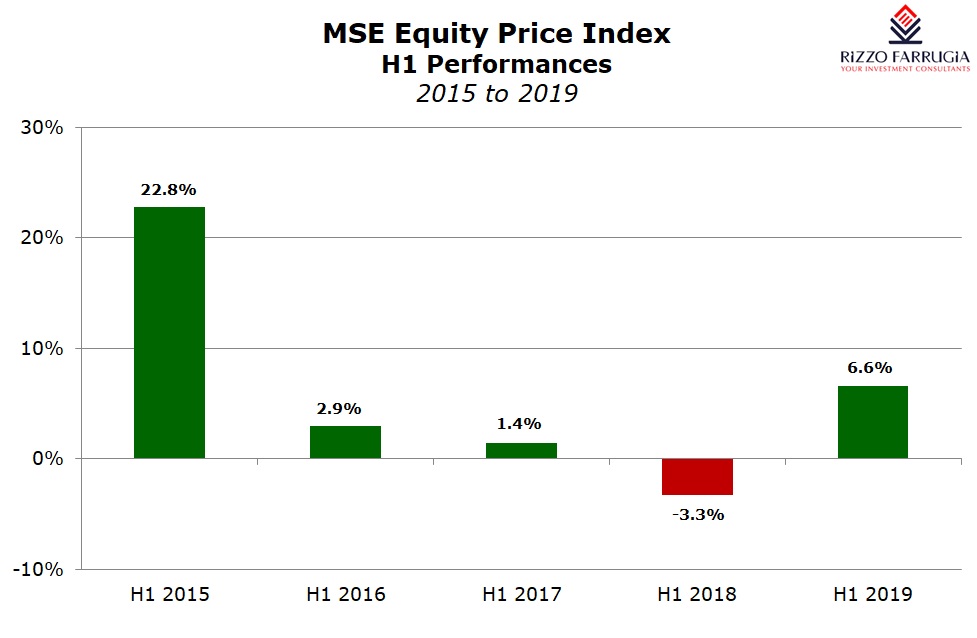

Following the 4.3% upturn during the first quarter of 2019, the MSE Equity Price Index advanced by a further 2.2% during the past three months to bring the performance of the Maltese equity market to +6.6% on a year-to-date basis. The superior performance of the MSE Total Return Index of +8.6% represents the strong dividends distributed by several companies especially the special dividends in GO plc and Mapfre Middlesea plc.

Trading activity across the equity market eased to €21.9 million during Q2 following the very busy Q1 when €28.8 million worth of shares traded. The first quarter of 2019 was the busiest one since Q2 2006. Despite the weaker activity in Q2 compared to the first three months of 2019, the €21.9 million worth of trades between April and June still represents an increase of 17% over the comparative quarter of last year. Moreover, following the very strong activity in Q1, the overall trading activity of €50.7 million in the first half of 2019 represents an increase of 20.7% over the first six months of 2018.

There were strong share price performances by several companies during the second quarter of the year with seven equities posting double-digit gains, namely Trident Estates plc, RS2 Software plc, MaltaPost plc, PG plc, Malta Properties Company plc, Simonds Farsons Cisk plc and International Hotel Investments plc.

The two large banks (Bank of Valletta plc and HSBC Bank Malta plc) continued to underperform other equities and both banks saw their share prices decline during the past three months. The worst performances during the second quarter of 2019 however were Mapfre Middlesea plc (-15.3%), FIMBank plc (-14.7%) and GlobalCapital plc (-12%).

Undoubtedly, the strong gains registered by several companies must have surprised many market participants. Trident Estates plc continued to experience a high degree of volatility from one period to the next. Following the 11.3% decline during the first quarter of 2019, the equity rallied by 44.4% during the past three months to end the quarter at the €1.92 level which is only marginally below the record of €2.00 reached shortly after the company’s listing following the spin-off from Simonds Farsons Cisk plc via a dividend-in-kind of €1.24 per share. Following the extraordinary rally in the past three months, Trident ranks as the second-best performer on a year-to-date basis with a rise of 28%. During the recent Annual General Meeting, CEO Charles Xuereb confirmed that a €15 million rights issue is planned to take place by the end of 2019 to partly fund the development of Trident Park.

The second-best performer during the past three months was RS2 Software plc with a share price rally of 24.5% bringing the market capitalisation of the company above €300 million. The renewed positive sentiment towards RS2 was immediately felt following the publication of the 2018 Annual Report on 29 April when the company detailed a number of important strategic initiatives and the announcement the following day of a major contract in the US. RS2 announced on 30 April that RS2 Software Inc. (the company’s subsidiary in the US with a 64.2% shareholding interest) concluded a major agreement for managed services with Cross River Bank which is a leading innovator and provider of banking services for financial technology companies. The most notable development within the Annual Report was the confirmation that the company is in the process of applying with the German regulator BaFin for a financial institution license in Germany to enable RS2 to provide acquiring services. Moreover, during the AGM on 18 June, CEO Radi El Haj announced that the company is finalising an agreement with one of the largest acquirers in the US which will help RS2 exceed a volume of 1 billion transactions before 2021. The CEO also highlighted the very busy pipeline of potential business in the US with over 20 prospective clients while the company is negotiating another agreement with a very large customer in Asia Pacific. RS2 is also preparing to launch transaction processing services with its alliance partner for the travel industry during the third quarter of 2019 commencing in Europe and then proceeding to Latin America. The CEO also confirmed to shareholders at the AGM that the Board of Directors is considering various options including financing arrangements to enable RS2 to expand in a more significant manner.

Following the 20.9% decline in the share price of MaltaPost plc during the first three months of 2019 to a multi-year low of €1.25, the equity recovered most of the decline during the second quarter as it rallied by 19.2% to the €1.49 level. The company published its March 2019 interim financial statements at the end of May showing a 6% increase in pre-tax profits to €1.37 million and the Malta Communications Authority partially upheld a request by MaltaPost for a revision of local postage rates. Moreover, on 11 June 2019, MaltaPost plc announced that, in line with its strategy to enter the insurance sector, it concluded an agreement with APS Bank plc, Atlas Insurance PCC Ltd and GasanMamo Insurance Limited to form a limited liability company (with every participant holding a 25% shareholding) which, subject to the relevant regulatory approvals, would be registered as an insurance company to carry out the business of life insurance.

PG plc climbed by 15.7% during the past three months to a close of €1.62 after the equity hit a new record of €1.67 in early May. By the end of August, the company will be publishing its annual financial statements as at 30 April 2019. Meanwhile, earlier this week, a second interim dividend was declared by the company for the 2018/19 financial year. Following the unchanged net dividend of €0.01574 per share which was paid on 10 December 2018, PG declared a net dividend of €0.0259259 per share bringing the total dividend to €0.0417 per share, representing an increase of almost 6% and equivalent to a total dividend payout of €4.5 million.

After remaining flat at the €8.75 level during the first quarter of the year, the equity of Simonds Farsons Cisk plc climbed by 14.3% during the past three months to the €10 level after reaching a new record level of €10.90 towards the end of May. On 15 May, Farsons announced that it registered another record financial performance during the 2018/19 financial year with a near 5% growth in pre-tax profits to €14.1 million. Given its obligations as a bond issuer, Farsons will be publishing its financial projections for the current financial year by 15 July.

Malta Properties Company plc saw its share price advance by 13.8% during the second quarter of the year. The company paid its maiden dividend of €0.01 per share on 13 June. Shareholders now await further developments regarding the potential acquisition of a 91% stake in Smart City (Malta) Ltd after Chairman Deepak Padmanabhan remarked in the Annual Report that if successfully concluded, the acquisition “has the clear potential to transform our income streams and take this Group to a completely different level”.

After ranking as the best performer during the first quarter of the year with an appreciation of 24.2%, the share price of International Hotel Investments plc registered double-digit gains once again during the last three months as it added a further 11.7% bringing the year-to-date gains of 38.7%. IHI announced on 30 April that it will be recommending the payment of a further cash dividend of €0.02 per share which has since been approved at the AGM. In the 2018 Annual Report and during the AGM the Chairman announced that the company is considering to dispose of certain properties which may have reached “maturity in their capital gain”. The market now awaits news of the properties being earmarked in this respect and any progress being registered including the potential values that may be raised.

Although Malta International Airport plc and GO plc do not feature among the top performers during the past three months, these equities are still among those with double-digit gains since the start of 2019. MIA’s equity advanced by 6.1% during the second quarter of the year closing the period at the €7.00 level after trading up to a fresh record high of €7.95. The share price of the airport operator rose by 20.7% since the start of the year and investors now await news from the company with respect to any revisions necessary to the 2019 traffic forecast following the initial projections of an expected increase of 5.8% in passenger movements to 7.2 million. GO plc was the second-best performer during the first quarter of the year with an increase of 23.7% to the €4.90 level as the equity rallied in view of the entitlement to the total dividends of €0.55 per share. As the equity traded ex-dividend, it adjusted down to a low of €4.02 before edging back up to the €4.58 level. Despite the 6.5% decline in the past three months, the equity is still up 15.7% since the start of the year.

The half-year reporting season is due to commence next week with the 30 June interim financial statements of Mapfre Middlesea plc. All companies with a December year-end must publish their half-year results by the end of August. Numerous important announcements will therefore be published in the weeks ahead which could lead to wide movements in certain share prices as was evident over the past few months.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.