Surge in corporate bond market activity

Amid the ongoing uncertainties related to the COVID-19 pandemic and more recently the war in Ukraine, there has been a marked surge in issuance of new corporate bonds across the Maltese capital market. Since the start of the year, a total of €239 million in bonds have been listed or are in the process of being listed on the Regulated Main Market of the Malta Stock Exchange after obtaining regulatory approval.

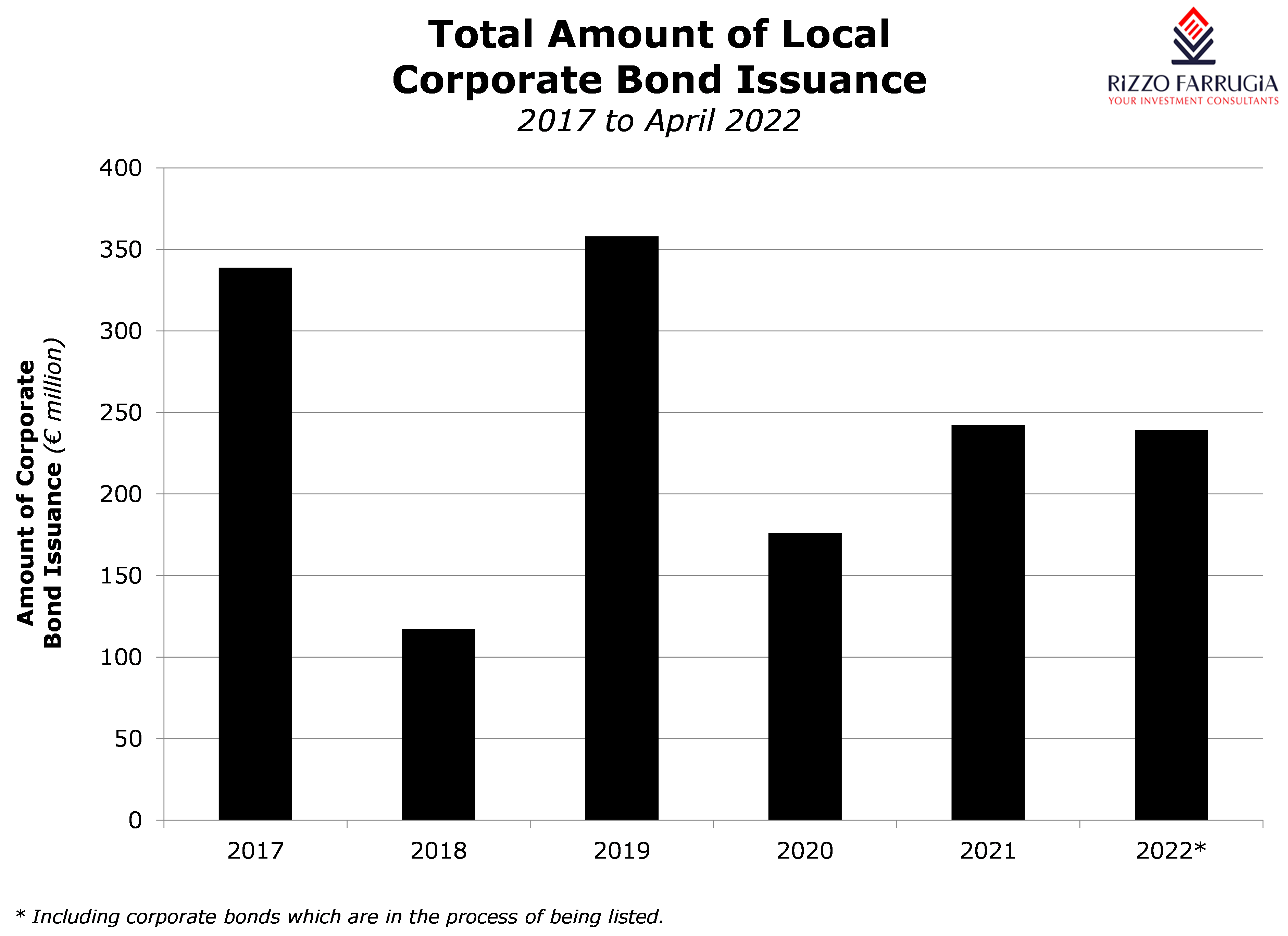

To place this into perspective, the level of issuance in the first few months of 2022 is almost equivalent to the total amount issued during the course of 2021 at €242 million. Should the elevated issuance persist in the months ahead, we could be on course to reach the record issuance levels seen in 2019 at €358 million and in 2017 at €338 million.

From an issuers’ perspective, it is now very evident that many companies are appreciating the benefits of diversifying one’s sources of borrowings and not be entirely dependent on the banking sector especially now given the changing scenario of an increasing interest rate environment on the horizon. In fact, while the Bank of England as well as the Federal Reserve in the US have already commenced tightening their respective monetary policies, it is widely anticipated that the European Central Bank will announce at least one interest rate hike during the fourth quarter of 2022.

The increased issuance over the past few months by a number of Maltese private companies could also be as a result of some delays in capital expenditure plans during the peak of the COVID crisis between early 2020 and mid-2021. The lifting of the few remaining restrictions across Europe and now also in Malta is expected to translate into a healthy recovery across the hospitality sector and other related/ industries over the summer months and as such, a number of companies may have a clearer and more positive outlook on what lies ahead.

Meanwhile, from the perspective of the retail investor, there may be two important factors at play contributing to the increased participation and appetite for Maltese corporate bonds. With retail investors potentially now realising more than ever before that idle deposits within the banking system do not generate any meaningful investment income despite the changing interest rate environment and with inflation rising sharply, several investors are increasingly mobilising some of the idle liquidity held with a number of banks.

From the recent financial statements published by the three largest retail banks in Malta (namely Bank of Valletta plc, HSBC Bank Malta plc, and APS Bank plc), it is worth highlighting that there are over €7.4 billion worth of idle deposits in the banking system – more than half the size of Malta’s entire GDP. As such, the issuance in recent months of over €200 million represents a tiny fraction of what is still a large wall of money seeking positive investment returns. This augurs well should additional companies plan to tap the bond markets in the months ahead.

The other factor that may be contributing to the sizeable appetite for most of the new bonds being issued is the sharp decline in the prices of Malta Government Stocks in recent months. Since the start of the year, the RF MGS Index slumped by 6.5% with prices of a number of the medium and long-term sovereign bonds sliding by over 9 percentage points. In view of the very weak performance of the MGS market and the very low yields on offer by Maltese sovereign bonds, retail investors may be crystallising their gains before further declines in prices materialise and reinvesting into the corporate bond market offering higher yields depicting the additional credit risk.

The rotation out of the very low yielding MGS market into the higher yields offered by corporate bonds is also evident across the secondary market as several corporate bonds are registering meaningful trading activity on a daily basis. The sharp improvement in the liquidity aspect of the corporate bond market is also fuelling additional appetite by many investors to consider participating in corporate bonds as opposed to remaining over-exposed to the MGS market given the elevated price risk due to the inflationary environment. Moreover, the increased liquidity across the corporate bond market is surely also contributing to the mobilisation of idle deposits at the banks into capital market instruments.

Bond buy-backs by a few companies is also helping the corporate bond market to be a more liquid venue for the investing public. In fact, it is interesting to note that throughout 2021, a total of €4.78 million (nominal) in corporate bonds were bought back, principally by Gap Group plc (€1.78 million), Best Deal Properties Holding plc (€1.73 million), Pendergardens Developments plc (€0.75 million), Plaza Centres plc (€0.47 million), and Mediterranean Investments Holding plc (€0.05 million).

Moreover, a further €8.36 million (nominal) in corporate bonds were repurchased and cancelled so far this year, with the substantial increase largely driven by Together Gaming Solutions plc (€5.24 million – following an intra-Group restructuring) and Plaza Centres plc (€1.41 million – as part of its €2 million bond repurchase programme rolled out in September 2020).

Following the new bond issuance in recent months, the size of the bond market has now surpassed €2.2 billion. The Corinthia Group (represented by International Hotel Investments plc, Corinthia Finance plc and Mediterranean Investments Holding plc) remains the single largest issuer at €385 million (accounting for 17.2% of the overall bond market), followed by the Hili Ventures Group (represented by Hili Finance Company plc, Premier Capital plc, Hili Properties plc and 1923 Investments plc) at €308 million (accounting for 13.7% of the overall bond market). Incidentally, following the start of the Ukraine invasion on 24 February, the prices of most of the bonds by the two largest issuers in Malta eased in price. The Corinthia Group has a direct exposure to Russia in view of its sizeable hotel and investment property in St. Petersburg, as well as the upcoming investment in Moscow through a small minority stake. On the other hand, while the Hili Ventures Group does not have a direct exposure to the Russian Federation, it generates a sizeable portion of its overall revenue from neighbouring countries including Romania, Poland and the Baltic states.

Among the 8 new issuers so far this year, there are four newcomers to the Maltese capital market, namely St Anthony Company plc (operating within the nursing and residential retirement home sector), G3 Finance plc (a hospitality company with two hotel properties located in Mellieha), Ferratum Bank plc (a mobile-lending specialist) and IZI Finance plc (the new operator of the National Lottery). The latter operates within the land-based gaming sector and is the second issuer within the gaming industry to utilise the bond market following the issue by Together Gaming Solutions plc in 2019.

Last week, GAP Group plc redeemed its €29 million bond issue. When such redemptions take place in cash, most investors generally quickly utilise these investible funds in new or existing securities across the capital market. The other redemptions due this year are both taking place in July. On 6 July, a €40 million bond by Mediterranean Investments Holding plc is due to mature and on 31 July, a bond of just over €21 million by Pendergardens Developments plc is also due for redemption. As yet, these companies have not publicly announced whether investors of these bonds will be receiving their capital in cash or whether new bonds are being issued to refinance all or part of the upcoming redemptions.

The growing size of the corporate bond market is a positive development not only for the capital market but especially for the entire Maltese economy. The proper functioning of a capital market is necessary to support economic growth and financial stability through the transfer of liquidity from investors holding surplus funds to companies that require funding to grow their businesses. For this reason, further initiatives need to be taken onboard to take the local capital market to its next stage of development, including a new strategic plan in line with Malta’s economic objectives for the future.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.