The debt to asset ratio

In last week’s article I made reference to an important leverage ratio that analysts and investors should consider when assessing the financial strength and soundness of a company before contemplating an investment in bonds.

The debt to asset ratio, also known as the debt ratio, indicates the percentage of assets that are being financed by debt. The higher the ratio, the greater the degree of leverage and financial risk of a company while a lower ratio is a more desirable one since it indicates a lower degree of financial risk. The debt to asset ratio is an important metric for most companies listed on the Malta Stock Exchange given the sizeable amount of property assets held by a large number of Maltese companies.

The calculation of this financial ratio last week was made in the context of the recent publication of the prospectus by Mizzi Organisation Finance plc in connection with the €45 million bond issue. The total indebtedness of the Mizzi Organisation following the bond issue represents 0.4 times the overall value of total assets which means that the amount of total assets is two-and-a-half times Mizzi Organisation’s total debt of around €130 million when including lease liabilities of almost €15 million.

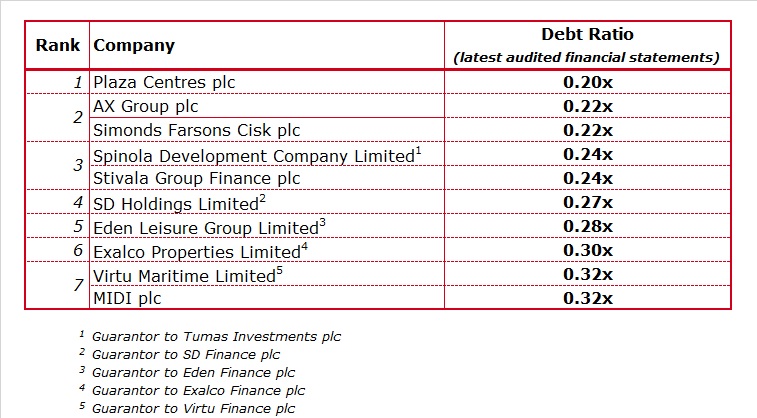

Apart from portraying the strength of the Mizzi Organisation through this financial ratio, it is also important to gauge how other Maltese bond issuers fare in this context. As such, the debt to asset ratio was calculated for all companies (excluding the banks and insurance companies) whose bonds are listed on the Regulated Main Market of the MSE.

The ranking indicates that Plaza Centres plc has the strongest debt to asset ratio with a figure of 0.2 times as at the end of 2020. Plaza sold one of its properties in September 2020 and the financial statements as at 31 December 2020 indicate overall debt of €7.7 million (representing the bonds issued in 2016) and assets of just under €39 million.

Simonds Farsons Cisk plc also have a very strong debt to asset ratio with the annual financial statements as at 31 January 2021 showing a debt to asset ratio of 0.22 times. According to the financial projections published some months ago this is projected to improve to 0.20 times during the current financial year to 31 January 2021 with total debt of €38.9 million and total assets of just under €197 million. Last week, Farsons published its interim financial statements showing a strong improvement in its financial performance from the weak results in the comparative period which was severely impacted by COVID-19 restrictions. The directors opined that the group is well placed to achieve the financial targets published in the Financial Analysis Summary published in July 2021 with revenues of €91.7 million (equivalent to a growth of 25.6% from the comparative period but a drop of 11.4% from the record turnover figure of €103.5 million achieved in the 2019/20 financial year); EBITDA of €19.3 million (equivalent to a growth of 29.1% from the comparative period but a drop of 15.1% compared to the level of €22.7 million recorded pre-pandemic) and a pre-tax profit of almost €10 million (compared to €4.4 million in FY2020/21 and a record of €14 million in FY 2018/19).

AX Group plc and Spinola Development Company Ltd (as guarantor for the bonds issued by Tumas Investments plc) also have similarly strong debt to asset ratios.

The financial projections of AX Group plc for the current financial year to 31 October 2021 indicate that the group will have a debt to asset ratio of 0.23 times with total debt of €81.6 million and total assets of €347.6 million. Likewise, the guarantor of the Tumas bonds is estimated to have a debt to asset ratio of 0.25 times as at 31 December 2021 with total debt of €58 million and total assets of €232 million.

Other hospitality and property companies also have debt to asset ratios below 0.3 times indicating that the overall value of total assets is over 3 times the total debt. These are SD Holdings Ltd (as guarantor to the €65 million bonds issued by SD Finance plc), Eden Leisure Group Ltd (as guarantor to the €40 million bonds issued by Eden Finance plc), Stivala Group Finance plc, and Exalco Properties Ltd (as guarantor to the €15 million bonds issued by Exalco Finance plc.

The largest non-financial corporate bond issuer in Malta is International Hotel Investments plc with total bond issuance of €225 million. IHI has a strong portfolio of property assets in various countries and although the absolute level of debt at €644.9 million as at the end of June 2021 is far higher than all other companies, the debt to asset ratio is also very strong and expected to be at 0.42 times this year. Incidentally, on 31 August 2021 IHI announced that it submitted an application to the Malta Financial Services Authority requesting admissibility to listing of unsecured bonds redeemable in 2031. The information that will be published by IHI should regulatory approval be obtained will enable analysts and investors to calculate updated financial ratios based on the projects being contemplated by the hospitality group of companies.

Another company that is shortly expected to also publish a prospectus is Hili Properties plc. However, the company will not be issuing another bond but instead it indicated that it is issuing new shares presumably to finance other property acquisitions overseas as indicated in a number of recent media articles. Hili Properties had overall debt of just under €80 million as at 31 December 2020 compared to total assets of €149.6 million thereby resulting in a debt to asset ratio of 0.53 times. Hili Properties is a subsidiary of Hili Ventures which is the guarantor of two bonds issued by Hili Finance Company plc. One of the bonds issued by Hili Finance (the €80 million that was issued in 2019) ranks as the largest corporate bond that ever took place in Malta. When analysing the total debt of Hili Ventures, one needs to distinguish between bank borrowings and bonds in issue as well as the value of lease liabilities which are included within total debt as per accounting rule IFRS16. Moreover, one would need to take into consideration the very strong EBITDA generation from its fully-owned subsidiary Premier Capital plc.

The debt to asset ratio calculated across the Maltese bond market provides evidence of the overall strength of a large number of the companies listed on the MSE. As an increasing number of companies utilise the capital market, investors as well as financial analysts will gain access to a significant amount of data, enabling them to compare companies within specific economic sectors which would be useful when deciding on which companies to gain exposure to within an overall investment portfolio.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.