The Structure of Malta’s Government Debt

Earlier this month, the National Statistics Office (NSO) published a press release providing some interesting data on the structure of the overall indebtedness of the Maltese Government.

At the end of 2019, the overall government debt amounted to €5.7 billion which is very much unchanged from the level in 2016 as budget surpluses were recorded in recent years and no additional funding was required except to finance the redemption of bonds on an annual basis. The debt of €5.7 billion is equivalent to 43% of GDP (pre-COVID-19) which is far below the average across the eurozone economies with some countries having debt levels in excess of 100% of GDP as at the end of 2019 such as Portugal at 117.7%, Italy at 134.8%, and Greece at 176.6%. Other countries are close to the 100% level with Spain at 95.5%, France at 98.1% and Belgium at 98.6%.

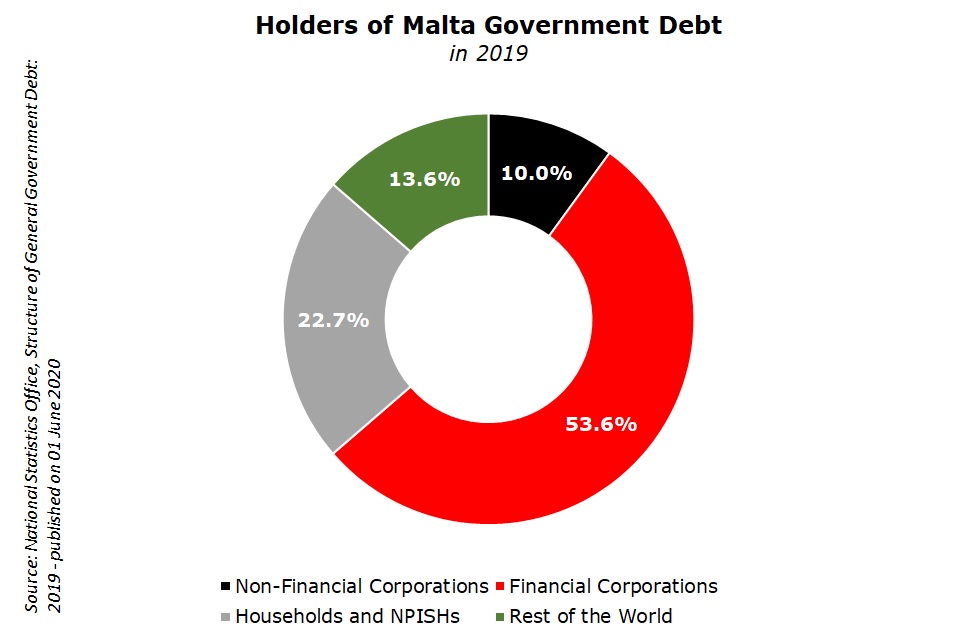

The NSO indicated that the majority of the overall debt of the Maltese Government, equivalent to 59.2% or €3.37 billion, was held by financial corporations, namely commercial banks and insurance companies in Malta. Meanwhile, ‘households and non-profit institutions servicing households’ accounted for 23.5% of the overall debt, equivalent to €1.34 billion. The ‘rest of the world’ category, comprising international financial corporations, represented 15.2% of the overall debt equivalent to €863 million.

It is interesting to note that since 2016, the absolute level of debt held by the ‘rest of the world’ category increased by €255 million while the amount of debt held by both financial corporations and households decreased. The latter category refers to the retail investing public and the decrease in the overall level of debt held must also be viewed in the context of the issuance to eligible senior citizens of Malta Government Savings Bonds in recent years which totalled almost €293 million. This implies that the redemption of bonds over the years held by retail investors and the sales on the secondary market as prices rallied possibly via the Quantitative Easing (QE) mechanism, offset the new issuance of the 62+ Government Savings Bonds.

Another important statistic published by the NSO is the cost of debt. This decreased to 3.2% in 2019 from 3.8% in 2016 reflecting the lower interest rates required by the Government to finance its new issuance compared to previous years.

At the beginning of 2020, the Government intended to issue a further €450 million in debt to finance the redemption of various issues due this year totalling €461 million. However, as a result of COVID-19 and the significant negative impact on government finances, the Minister of Finance presented a Bill in Parliament in April to increase the borrowing requirement up to a maximum of €2 billion in 2020. The Government’s fiscal position is not only being negatively impacted by the lower level of income arising from tax as a result of the decrease in economic activity but also due to the significant fiscal measures implemented over recent months to support the economy and stimulate activity as lockdown measures were gradually released.

So far, the Government issued a total of €700 million in additional debt this year through auctions on 3 separate occasions aimed at institutional investors which were met with significant demand given the very high levels of liquidity held by local credit institutions. Moreover, just over €100 million was subscribed for by international credit institutions. In February, the Malta Government issued its first 25-year bond at a coupon of 1.5% with institutions subscribing for a total of €39.4 million at an average price of 113.22% giving a yield to maturity of 0.92% per annum. Also in February, it is worth highlighting that the average yield of the 6-year bond was in negative territory.

When unveiling the details of the fourth package of fiscal incentives last week designed to regenerate economic activity in Malta including the €100 voucher per citizen aged 16 years and older, both the Prime Minister Dr Robert Abela, and Finance Minister Prof Edward Scicluna indicated that the measures, which will cost the government circa €900 million, are intended to be financed via additional Malta Government Stock issues. The Prime Minister made reference to the fact that deposits in local banks had also risen by €900 million since January. The Government is seemingly aiming to target the additional savings parked away by retail investors to subscribe to some of the upcoming MGS issuance.

In recent years, the issuance of Malta Government Stocks was either made to institutional investors or else to eligible senior citizens of the 62+ Malta Government Savings Bonds at a preferential rate of 3% per annum for a period of only 5 years. In 2017, 2018 and 2019, just under €293 million in Malta Government Savings Bonds were issued. With a maximum of a further €1.3 billion in Malta Government Stocks that can be raised this year, it is as yet unknown how much is intended to come from additional issues targeted towards institutions and the projected amount that is earmarked to be raised from retail investors as indicated by the Prime Minister last week.

Moreover, it is questionable whether significant amounts can be raised if the additional borrowing is targeted only to eligible senior citizens. As such, in order to increase the chances of raising sizeable amounts from retail investors, the Government should widen the target audience. However, in this respect, the Government must also bear in mind the potential difficulties in luring away money saved away in the banks given the very low yields on Malta Government Stocks. A 25-year bond is currently only giving a yield to maturity of 1.7% per annum and it is highly likely that investors will not find such a return attractive enough to subscribe for such bonds. Another important dimension is the price risk that one faces for holding such long-term bonds which was very much in evidence again in recent months. In fact, MGS prices performed very negatively so far this year and by taking the same 25-year bond as an example, the price has dropped from an average issue price of 113.22% at the time of the auction in February 2020 to 96% earlier this week. Prices of other long-term MGS also performed negatively when using the daily indicative bid price quoted by the Central Bank of Malta as a basis for measuring the performance.

In view of these factors, the Government may possibly need to structure the upcoming retail issuance differently in order to increase its chances of success. In an article published in early April, I had opined that in order not to place too much of a burden on the annual debt service requirements of the Government, it should contemplate the issuance of zero-coupon bonds at a steep discount to par value. Meanwhile, in a recent article in The Economist, it was argued that governments should resort to the issuance of perpetual bonds similar to the ‘consols’ that Britain used to finance the Napoleonic wars. The author argues that such bonds may be attractive since “many bondholders care far more about how much income a bond pays than its capital value”. The author also mentions the possibility of issuing fixed-rate and also floating-rate perpetual bonds

In essence, the investing community must understand that it is very difficult for the Government to offer preferential terms similar to the 62+ Malta Government Savings Bonds of 3% per annum for 5 year bonds, 10 year or even 25 year bonds to all retail investors since this will have a huge negative impact on all other fixed rate bonds already listed on the Malta Stock Exchange. Both the Government and the investing public need to think rather differently and in a creative manner to enable a successful offering.

Given the debt to GDP ratio of 43% as at the end of 2019, the Government has ample fiscal space to stimulate the economy through the issuance of higher debt. However, it must ensure that the investing public fully appreciates the changing dynamics compared to the fixed-rate MGS launched several years ago which were often also in high demand as a result of the significant short-term capital gains that were being recorded at the time.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.