The unexpected rally

In early March when international equity markets had just plunged at their fastest rate on record, it would have been unthinkable to imagine that four months later we could look back to one of the sharpest recoveries across equity markets despite the unravelling of the pandemic and the dire economic forecasts issued by most economists and supranational bodies for 2020 and also 2021.

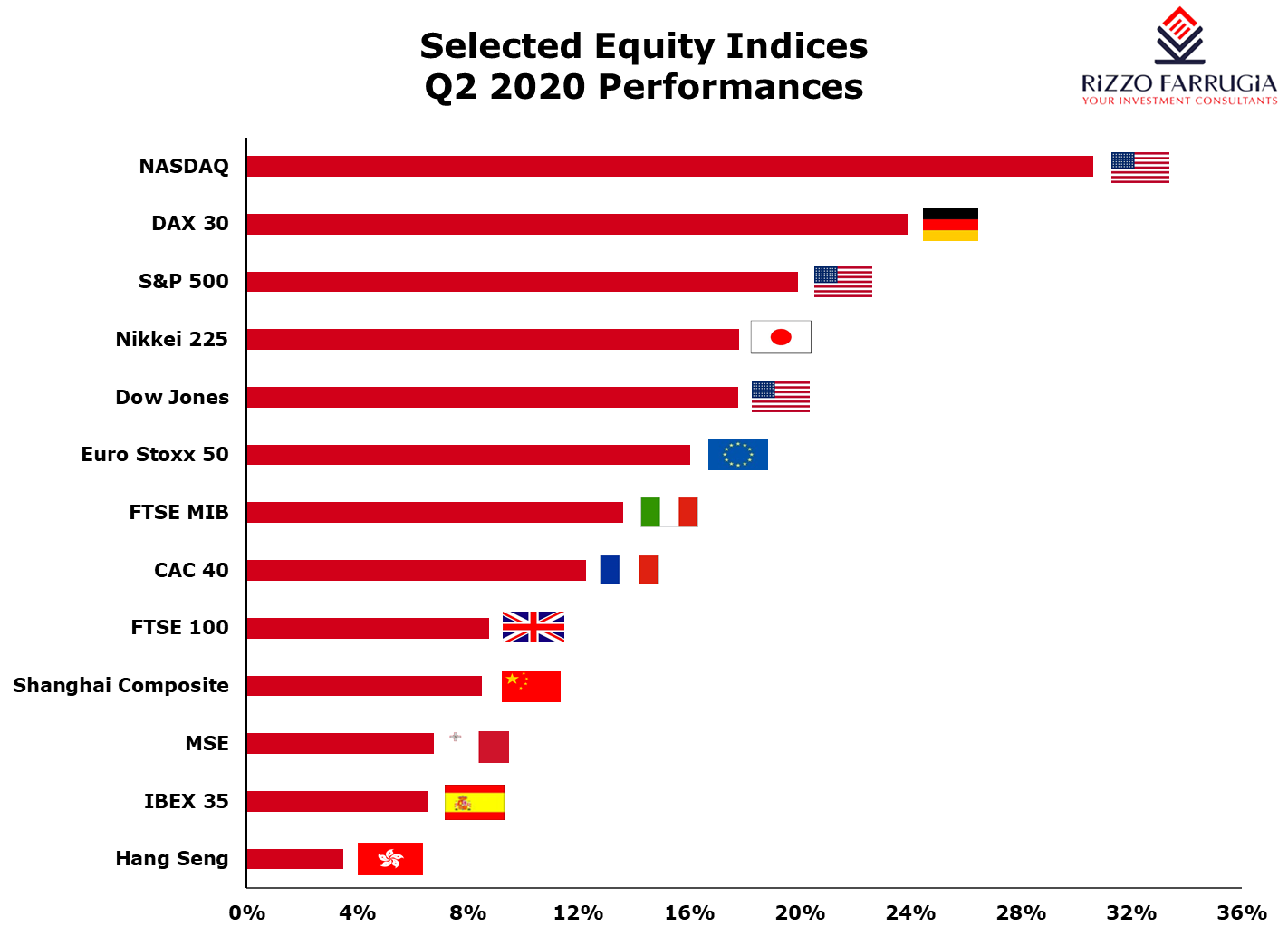

The S&P 500 Index in the US closed the first quarter of the year with a decline of 20% and it took just 16 days to slump from the all-time high of 3,386.15 points on 19 February to enter into bear market territory (a drop of 20%). The S&P 500 hit a low of 2,237.40 points on 23 March 2020 (a decline of 30.7% from the high on 19 February) and rallied strongly since then with an upturn of 38.6%. Following an impressive gain of 15.5% from the low of 23 March to the end of March, the US equity benchmark continued on an almost uninterrupted rally during the second quarter of the year posting a further gain of 20% between the end of March and the end of June. This represents the S&P’s best quarterly performance since 1998 and the best ever Q2 performance ever since the S&P 500 was created in 1957. Following the strong rally during the end of March and the second quarter of the year, the S&P 500 trimmed its losses for 2020 to just 4% despite the huge economic impact from the pandemic which saw the unemployment rate in the US spike to 14.7% in April from a 50-year low of only 3.5% before COVID-19.

The other US equity indices also posted robust gains during the second quarter of the year. The Dow Jones Industrial Average advanced by 17.8% – its best quarter since 1987. Meanwhile, the NASDAQ outperformed with a gain of just over 30% during the second quarter – its best quarterly performance since rising 48.2% in fourth quarter of 1999. The NASDAQ is up over 12% during the first half of 2020.

The major reason for the outperformance of the NASDAQ compared to the S&P 500 and the Dow Jones Industrial Average is that more than half of the NASDAQ’s market cap consists of Apple, Microsoft, Amazon, the two classes of Alphabet shares, Facebook, Intel and Tesla. Most of these share prices experienced stellar returns in recent months. The share price of Apple jumped 43.5% during Q2, Microsoft rallied by 29% and Amazon climbed by 41%. Tesla’s share price more than doubled during the second quarter of 2020. The electric-car maker saw its equity rally by 158.1% during the first half of 2020. Other components of the NASDAQ also saw spectacular returns with payments company PayPal Holdings adding 82% during Q2 and Zoom Video Communications, whose video conferencing technology lets businesses hold meetings remotely, rallied by 73.5%. Zoom’s share price registered a gain of 273% so far this year.

Across Europe, the pan-European Stoxx 600 closed up almost 13% in the second quarter representing the best quarter for the index since the first quarter of 2015. Most of the individual European markets underperformed the US with the exception of Germany where the DAX 30 rallied by 23.9% during the second quarter of 2020 bringing the loss for the first half of the year to 7%.

Some investors may be confused at the extent of the rally across international equity markets despite the long-term implications on global economic performance from COVID-19. The overall improvement in the equity markets can be mainly attributed to the unprecedented government action taken in the midst of the pandemic. As I had indicated in my article in early April, the House of Representatives in the US approved a USD2.2 trillion stimulus bill. This entailed stimulus cheques of USD1,200 that were sent to most Americans, hundreds of billions of dollars were lent to firms struggling from the lockdown measures and unemployment benefits were increased for the millions of workers that were laid-off (more than 47.3 million Americans have filed jobless claims since March). Moreover, the Federal Reserve expanded its balance sheet by more than USD2.8 trillion, which was mainly used to buy US Treasuries and mortgage-backed securities. The decision by the Federal Reserve to drop interest rates close to zero and the aggressive buying by the central bank pushed down interest rates, thereby prompting investors to seek better returns across equity markets.

In essence, the second quarter rally reflected confidence in the US central bank, optimism that the pandemic was coming under control with better virus rates registered in most countries than initial expectations and some positive economic news as economies began to open up from the several restrictions. Unemployment figures in the US began to improve in recent weeks. As economies began opening up, the price of crude oil almost doubled in the second quarter of the year (the best quarter since 1990) after a 66.5% slump in the first three months of 2020.

The Q2 earnings season which commences shortly will undoubtedly show dismal figures for the large majority of companies since few sectors escaped from the impact of the pandemic. While the rebound in equity markets was welcome news for investors following the very rapid decline between mid-February and mid-March, uncertainty will continue to dominate investor sentiment during the third quarter mainly on account of the resurgence of the virus which is also forcing some countries to reverse their re-opening strategies. The future direction of equity markets is likely to be dependent on the flow of economic data and the shape of the economic recovery as well as any news of a potential coronavirus vaccine.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.