US market gains for 3rd consecutive quarter

In last week’s article, I reviewed the performance of the Malta capital market during the third quarter of the year showing some interesting movements across the sovereign bond market and strong gains in some individual Maltese equities.

The international financial markets exhibited a high degree of volatility. This was, once again, fuelled by continuing political drama in various parts of the world and widespread action by several central banks amid mixed economic signals. It was reported that a total of sixteen central banks around the world adopted interest rate cuts during the third quarter.

The Dow Jones Industrial Average and the S&P 500 both gained 1.2% during the third quarter of 2019 as US equity markets recovered strongly in September from the losses experienced during the month of August. Across the eurozone, the Euro Stoxx 50 advanced by 2.8% during Q3 2019 with a minimal 0.2% gain in the German DAX and stronger performances in France (+2.5%), Italy (+4.1%) and Spain (+0.5%). Meanwhile, the FTSE 100 in the UK performed negatively with a decline of 0.2% amid continued Brexit uncertainty and as Britain’s economy shrank 0.2% during the second quarter of the year marking the first quarterly contraction since 2012.

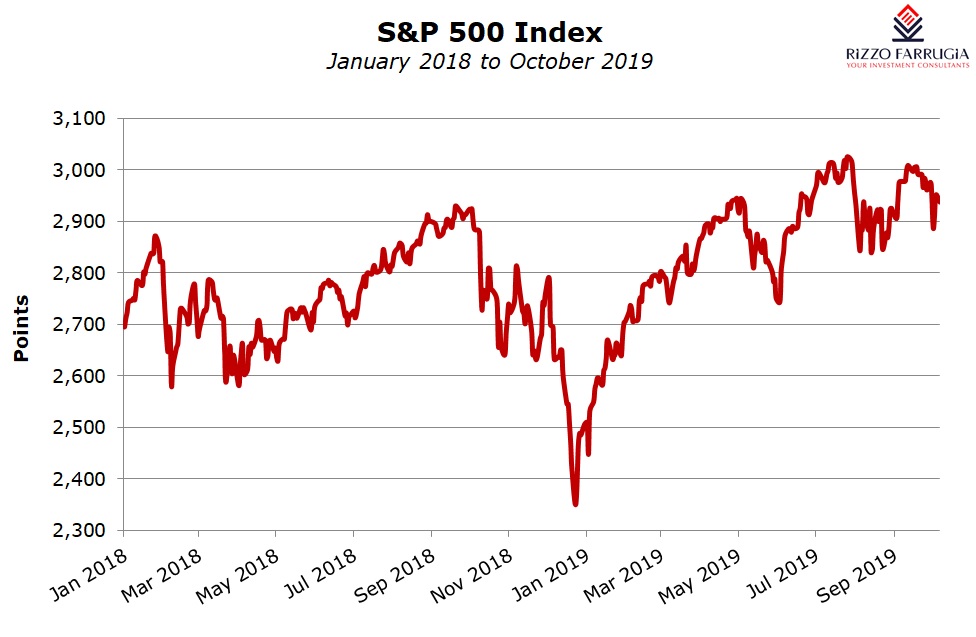

Although US equity markets advanced for the third consecutive quarter, the gains registered during the summer period were much lower than those during the previous two quarters. In fact, the S&P 500 rallied by 17.4% in the first half of 2019 following the strong upturn of 13.1% during the first quarter of the year.

US equity markets were off to a strong start in the summer with the S&P 500 reaching a fresh all-time high of 3,028 points towards the end of July before suffering a decline of 1.8% during the month of August.

Tensions between the US and China continued to leave a marked impact across global equity markets over recent months as the conflict between the two largest economies in the world has the potential to trigger the next global recession. In early July, it was reported that US President Donald Trump agreed not to impose new tariffs on USD300 billion worth of Chinese goods and that he would allow American companies to sell products to Huawei, the Chinese telecoms firm which was blacklisted in May. In exchange, China’s President Xi Jinping agreed to make new purchases of US agricultural products.

The July rally brought about by the softening of the potential trade war was then offset by data published at the end of the month showing that the US economy grew by an annualised 2.1% during the second quarter of 2019 compared to a growth rate of 3.1% during the same period last year. Moreover, although the Federal Reserve cut interest rates by 25 basis points again on 18 September (the second rate cut this year), the Chairman of the Federal Reserve Jerome Powell cast several doubts on the future path of further monetary easing sparking further open criticism by Donald Trump which added to the declines across equity markets during the month of August.

Additionally, the fears of a full-blown trade war between the US and China erupted once again towards the end of August when China reportedly announced that it will impose tariffs on USD75 billion of American imports from September and that it would reintroduce duties on American cars and car parts from December. On his part, US President Donald Trump threatened to impose additional tariffs on USD300 billion of Chinese imports into the US.

During the final part of the third quarter, another political twist was added after the Democrat-led House of Representatives launched a formal impeachment inquiry against US President Donald Trump. The President is being accused of withholding nearly USD400 million in military aid to Ukraine just days before pressuring the country’s president to investigate the son of his political rival and former US vice-president Joe Biden.

The overall gain of 18.7% for the S&P 500 in the nine-month period until 30 September is the best performance since 1997. Although the gain since the start of 2019 is truly remarkable, it is worth highlighting that the strong upturn during the first quarter of the year came about following a significant sell-off during the end of 2018 when the S&P 500 tumbled almost 20% during the final quarter of the year. In fact, the S&P 500 is only 2.2% above the level at the end of September 2018 showing how the market barely moved in recent months but in effect continued to trade sideways since the beginning of 2018 albeit with a high degree of volatility from one month or one quarter to another.

The volatility during the summer months was not solely limited to the equity markets. As explained last week, sovereign bond prices in the US and across the eurozone rallied during the month of July and August with the yield on the 30-year German bund dropping to a fresh record low of -0.31% and similarly the 30-year yield on the US Treasury touching a new low of just above 1.9%

The oil market also experienced a volatile period after the price of oil jumped following an attack on Saudi Arabia’s oil infrastructure. Despite the initial spike of almost 20% of the price of Brent to above USD71 per barrel in the immediate aftermath of the attack, the oil price dropped back and ended the quarter at USD60.78 representing a decline of more than 7%.

The Repo market also made the headlines on a number of occasions in recent weeks after the Federal Reserve Bank of New York had to intervene and provide temporary funding following a spike in interest rates on short-term loans in the inter-bank market. Although some financial journalists claim that the spike in rates was brought about by a sharp increase in demand for liquidity in order to meet corporation tax payments and for the US Treasury department to increase its own cash pile in order to fund spending, others believe that this indicates deeper troubles within the global financial system.

The volatility across the equity markets intensified during the first few days of October as fresh data indicating a continued slowdown in global manufacturing in September sent benchmark indices tumbling early last week. In the US, the S&P 500 dropped by 1.23% on Tuesday and by a further 1.79% Wednesday, and all major equity markets followed suit. The FTSE 100 dropped 3.2% last Wednesday - its biggest daily decline since January 2016.

The main drivers of stock market movements during the final three months of 2019 will remain the release of economic data which would indicate whether a global recession can be averted as well as political developments on various fronts mainly related to the trade tensions between the US and China and Brexit, apart from geo-political tensions in the Middle East and continued protests in Hong Kong. All eyes are therefore firmly set on discussions between the US and China that are expected to take place over the next two days in Washington. Statements and actions by the major central banks on how they will respond accordingly to these various developments will also continue to have a wide-ranging impact on equities, bonds, currencies as well as commodities.

Although many retail investors always seek to time the market perfectly by exiting the market during periods of uncertainty and entering once again after any downturn in share prices, some financial commentators recently reminded such investors that the best days for equity markets usually take place immediately after some steep declines and in such volatile times, it is impossible to gauge what factors could lead the market to dive or to rally from one day to another. As such, unless investors require cash for alternative investments, it is usually stated that “time in the market is likely to beat trying to time the market”.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.