Year-end rally for Malta Government Stocks

Most asset classes performed very positively during the past few weeks as inflation readings across the world pointed to a remarkable slowdown thereby placing pressure on the major central banks to cut interest rates in 2024. The recent movements across the financial markets have been described as an ‘everything rally’ with both equity markets and bond markets performing very strongly.

The US equity markets advanced for six consecutive weeks sending the S&P 500 index to a fresh 52-week high and only 4% below its record level reached on 3 January 2022. Equity markets across the eurozone recently outperformed those in the US with the Euro Stoxx 50 index surging by over 13% since the recent low towards the end of October.

Bond prices also jumped remarkably over the past few weeks following the reassuring inflation readings. Although over the summer, the major central banks were indicating that interest rates will remain ‘higher for longer’ in the months and years ahead, investor sentiment across the bond markets changed rapidly following recent inflation readings with consistent speculation that interest rates will ease rapidly as from the first half of 2024. Bond yields dropped suddenly leading to a sharp rise in bond prices in different parts of the world. In the US, the yield of the 10-year Treasury dropped towards the 4.2% level from a recent multi-year high of just over 5%. Likewise, the German 10-year bond yield reached a multi-decade high of just over 3% in October but this dropped to below 2.2% at the end of last week.

In various articles over the past months and years, I mentioned the manner in which developments across international bond markets are mirrored across the Malta Government Stock (MGS) market via the daily indicative prices published by the Central Bank of Malta (CBM). In this respect, it is noteworthy to highlight that the yield on the 10-year MGS peaked at 4.3% in mid-October and has since dropped to 3.4% implying a significant rally in MGS prices.

This can be depicted in the movement of the RF MGS Index or via the price movements of a number of specific MGS’s. The RF MGS Index climbed by circa 6% over recent weeks bringing this important benchmark into positive territory for the year which is a very welcome development after negative performances since 2020 which culminated in a decline of almost 20% in 2022.

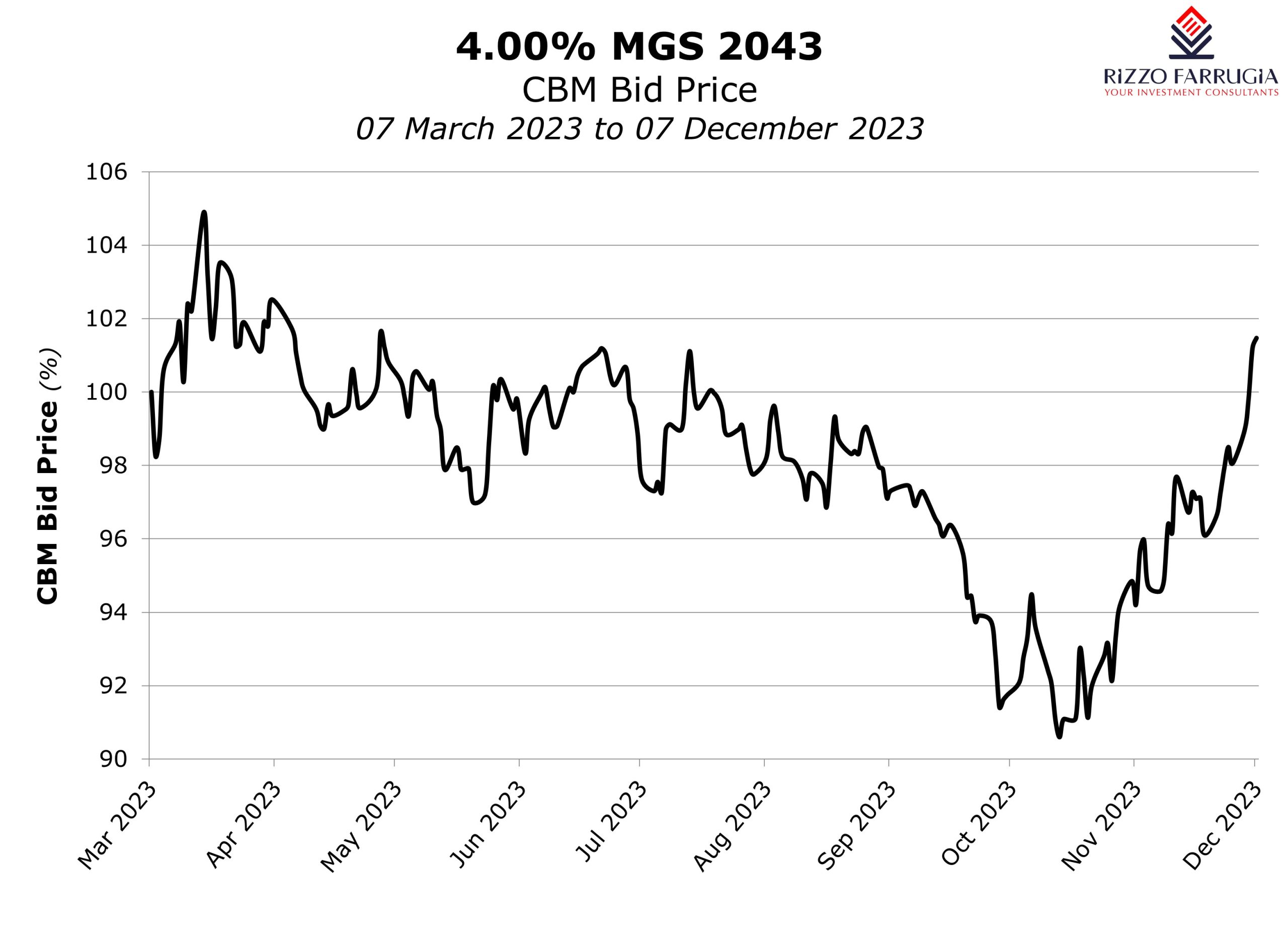

Retail investors will possibly appreciate the extent of the recent sharp movements in the bond market by monitoring the prices of some of the securities issued this year. For example, the 20-year MGS (the 4.00% MGS 2043) was offered to investors at par (100%) in mid-February when €91 million was allotted to investors applying at the fixed offer price. The price of this MGS had dropped to a low of 90.60% in October when international yields had peaked. However, following the turn of events over recent weeks, the price of the 4.00% MGS 2043 climbed to 101.47% last Thursday implying a rally of almost 11 percentage points which is equivalent to over 3 years’ interest. This is a remarkable movement in such a short period of time.

The intense volatility across the bond markets is possibly one of the most notable highlights this year. In fact, shortly after the issuance of the 4.00% MGS 2043, the price had rallied to just below 105% due to the ‘flight to safety’ during the banking crisis in the US and Switzerland.

While MGS prices mirrored the movements of international bond market, the Maltese corporate bond market failed to mirror such changes due to the different pricing mechanism. Corporate bond prices are based on supply and demand dynamics while MGS prices very often move in tandem with the indicative prices quoted by the CBM which in turn are based on international yield movements. In this context, the Green Bond issuance by ClearFlowPlus plc during the summer which was priced at 4.25% representing a slight premium to the yield on the prevailing 10-year MGS at the time, should be a clear example of a corporate bond that should reflect movements in the MGS market in a more efficient manner.

After such sudden movements in the bond markets within a very short period of time, various analysts are correctly questioning the outlook for the upcoming months. The attention now shifts on central banks this week with their final policy decisions of the year. The world’s three major central banks (the Federal Reserve, the European Central Bank and the Bank of England) are on course to end the year holding borrowing costs steady as they come under growing pressure to cut rates in 2024.

In the eurozone, analysts will be closely monitoring new forecasts for economic growth and inflation from the ECB’s economists, which are expected to project weaker economic output and falling price growth over the next three years. This will likely shape expectations for interest rate cuts in 2024. The ECB is expected to be the first among the major central banks to ease its monetary policy next year. Current indications point to a total of six cuts of 25 basis points each from the ECB next year, with the first reduction in March 2024.

The recent rally across the MGS market is good news for all investors who have supported the sizeable MGS issuance this year as they see some notable price gains following the downturn during the third quarter of the year. However, the downturn in yields could have unintended consequences since it is critically important to ensure there is stable demand for new issuance next year to finance the ongoing budget deficit coupled with existing MGS’s that need to be refinanced in 2024. If yields drop too far, this might dampen the appetite for long-term sovereign bonds especially if money-market rates continue to generate yields superior to 10-year bonds.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.