Yields pop in latest MGS auction

Last week the Treasury carried out a further issuance of new Malta Government Stocks – the 4th offering so far this year. The new MGS’s were not available for retail investors since the minimum subscription amount was of €500,000 nominal. Moreover, the two fixed income securities were available through a competitive bidding process which is the customary procedure for institutional investors when participating in a new MGS issue and were not offered at a fixed price (as is the case in public offers for retail investors).

In all likelihood this was the final fund-raise by the Treasury for this year. In fact, following the successful issuance of €341.9 million last week, the total issuance for this year now amounts to €1.394 billion. Although the original estimate for this year was for a maximum issuance of €1.6 billion, the Minister of Finance had indicated during the summer that the budget deficit for this year is anticipated to be lower than original expected on account of the slight reduction in the total cost of the energy subsidies. However, no precise figure was given at the time of the new borrowing requirement and further information in this respect will possibly be available during the Budget Speech which will take place in 10 days’ time.

It is interesting to analyse the results of last Friday’s MGS issue in view of the auction process to determine the prices and yields tendered given the sharp movements in yields across international financial markets over recent weeks.

The two new bonds on offer were both short-term in nature, one maturing in 3 years’ time, namely the 3.85% MGS 2026 (VI), and another in 5 years’ time, namely the 3.95% MGS 2028 (VII).

The total amount tendered at €351.9 million was just above the maximum issuance amount of €350 million. However, the total amount allotted was of €341.9 million nominal split as follows: €177.5 million in the 3.85% MGS 2026 (VI) and €164.4 million in the 3.95% MGS 2028 (VII).

In the 3.85% MGS 2026 (VI), the weighted average price of the tenders was of 99.4686% which translates into a yield to maturity of 4.0508%. All tenders submitted by the various institutions were accepted with the highest accepted bid at 100.31% (YTM: 3.7308%) and the lowest accepted bid at 98.82% (YTM: 4.2997%).

In the 3.95% MGS 2028 (VII), the weighted average price of the tenders was of 99.0976% which translates into a yield to maturity of 4.1578%. With the exception of 2 tenders totalling €10 million, all other tenders were accepted with the highest accepted bid at 100.43% (YTM: 3.8502%) and the lowest accepted bid at 98.17% (YTM: 4.3749%).

A comparison of the yields that were tendered during the auction with the prevailing yields for similar MGS’s also maturing in 2026 and 2028 is important given recent developments.

There are almost €690 million in MGS’s already in issue which mature in 2026. As at last Friday, the yield on the 3-year MGS’s based on the indicative price quoted by the Central Bank of Malta was of 3.76%. As such, by using the weighted average yield of all the tenders in the 2026 issue of 4.0508%, the bids in the auction were placed at a premium of 29 basis points compared to the prevailing yield for similar bonds maturing in 3 years. This is a sizeable discrepancy.

Similarly, in the 5-year MGS, the yield demanded in the auction last week was at an even larger premium to the prevailing yield in the market. There are 5 other MGS’s maturing in 2028 totalling €815 million. As at last Friday, the yield based on the indicative price quoted by the Central Bank of Malta for 5-year MGS’s was of 3.82%. Meanwhile, the weighted average yield of the tenders in the 2028 issue was of 4.1578% translating into a yield differential of 35 basis points.

The significant discrepancy between the yields in the auction and the secondary market yields is not surprising as institutional investors are demanding higher yields in the prevailing environment.

Local credit institutions were the dominant buyers in last week’s auction. The statistical analysis published by the Treasury reveals that total allotments to Maltese credit institutions amounted to €228 million split as follows: €129 million in the 3-year MGS and €99 million in the 5-year MGS.

This is not surprising given the high levels of liquidity across the banking system and the clear strategy by the major banks to lock-in yields of above 4% on their treasury portfolio so as to reduce dependency on interest rate decisions by the European Central Bank going forward as rates are close to peaking.

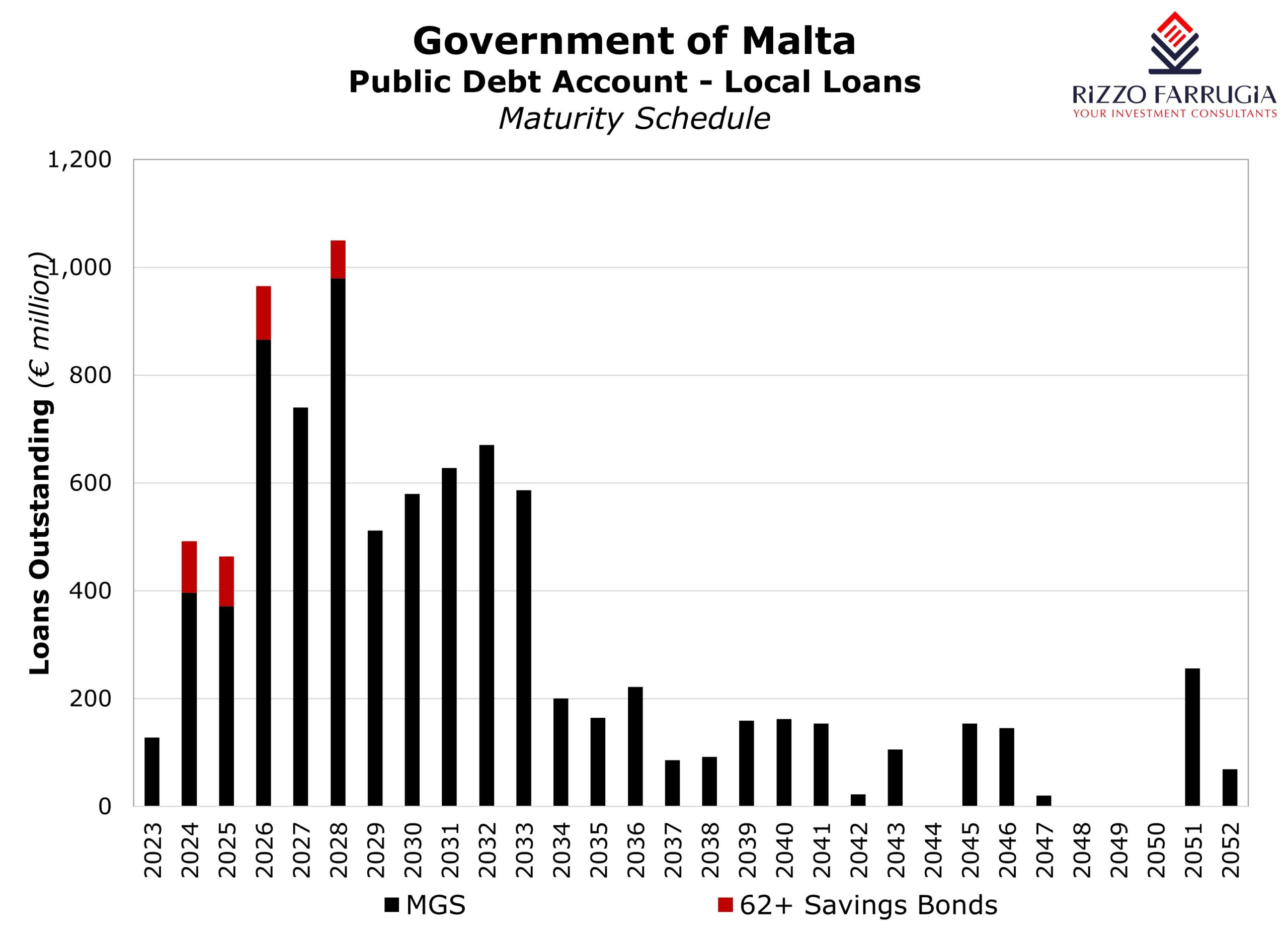

Following last week’s auction, it is good to visualise the updated amounts of MGS’s up for redemption in the coming years as it continues to indicate the sheer size of the issuance required in the next 5 years. A total of €3.84 billion matures by the end of 2028. In 2026, a total of €965 million is maturing while the total debt maturing in 2028 now exceeds the €1 billion figure.

The updated financial estimates being published as part of the Budget Speech on 30 October will provide more precise information on the new projections for Government debt issuance in the years ahead in view of the bonds up for redemption coupled with the projected budget deficit. This data is not only important for retail and institutional investors but also for issuers of corporate bonds as well as for all international credit rating agencies which regularly monitor sovereign debt dynamics.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.